Launching a successful business in Indonesia requires navigating a dynamic legal landscape. One of the most crucial steps is securing your Business Registration Number (NIB), your company’s official stamp of legitimacy and key to unlocking efficient operations.

With an NIB, you can streamline administrative processes, access vital business licenses, and build trust with stakeholders, paving the way for efficient and sustainable operations.

Understanding the business registration number in Indonesia

The NIB is a unique identifier serving as your business’s official registration with the Indonesian government. It’s essential for several reasons:

Government recognition

The NIB proves your company’s legal existence, granting access to relevant laws and regulations for protection.

Compliance and legality

Without an NIB, businesses risk government sanctions, including freezing or dissolution, and can be reported by communities as unlawful.

Streamlined operations

The NIB acts as a primary permit, opening doors to obtaining other necessary licenses and facilitating efficient business activities.

State Recognition

Companies with NIBs are listed among Indonesia’s recognized corporates, building trust and credibility among the public.

Read more: Navigating business incorporation in Indonesia

Why should a company obtain a business registration number?

Getting a business registration number is essential when doing company incorporation Indonesia for a few important reasons:

- Any company, whether a local PT company or a foreign-owned company (PT PMA), can face government freezing and dissolution if it lacks a business registration number during an inspection.

- Communities can report companies without permits, considering them illegal and irresponsible.

- A business registration number means the government officially recognizes and protects the business according to applicable laws and regulations.

- Companies with a business registration number in Indonesia are included in the list of state-recognized companies.

- The recognition builds trust in the company’s performance and activities among the public.

The benefits of having a business registration number in Indonesia

The advantages of having a business registration number or Nomor Induk Berusaha (NIB) are:

| Benefits | Description |

| Conducting business activities | The NIB allows you to engage in various business operations, including import activities, as it functions as an Import Identification Number. |

| Visa application for foreign employees | Streamline international staff hiring and relocation by applying for visas on their behalf. |

| Customs access | Simplify customs-related processes and engage in efficient import and export activities. |

| Participation in business tenders | Participate in business tenders within Indonesia, expanding opportunities for contracts and projects. |

| Business visa sponsorship | Facilitate business visa acquisition for clients, enabling easier engagement with your company in Indonesia. |

| Social security program registration | Ensure compliance with regulations and provide employee benefits by registering for health and workforce social security programs. |

Read more: Work KITAS Indonesia: An Ultimate Guide to Foreign Workers

How to obtain a business registration number in Indonesia

It is crucial to understand that getting a business registration number is just one part of Indonesia’s complex business registration process. This number is a permit or legal certificate mandatory for acquiring other significant business licenses. With it, companies can conduct their business operations.

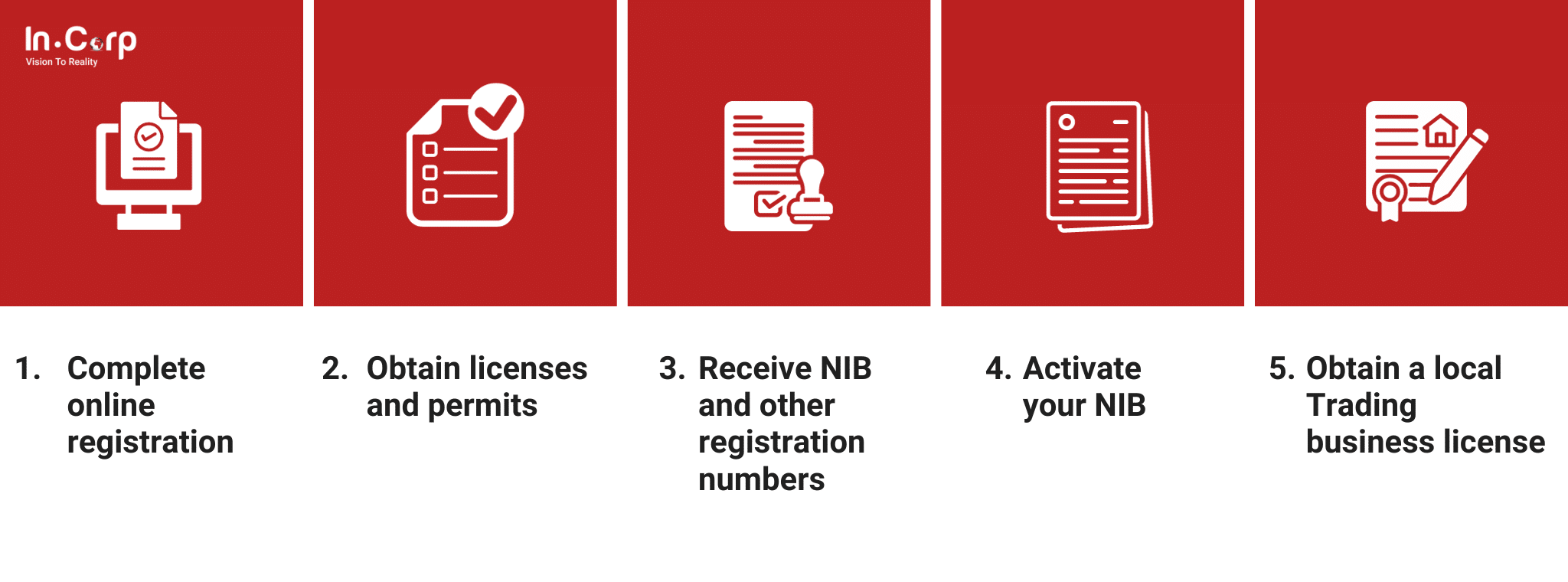

To obtain a business registration number in Indonesia, you can follow the procedures given below:

1. Complete online registration

- Access the Online Single Submission Risk-Based Approach (OSS-RBA) system at https://oss.go.id/.

- Create an account with your personal details and email address.

- Select “New Business Registration” and follow the prompts to fill in your company’s information, including company name, business activities, legal structure (PT, CV, etc.), location, capital investment, and directors and shareholders.

2. Obtain licenses and permits (if applicable)

- The OSS-RBA system will automatically assess your business type and generate a list of required licenses and permits.

- Apply for these licenses directly through the OSS-RBA system.

- Some licenses may require additional documentation or field inspections by relevant authorities.

3. Receive NIB and other registration numbers

Upon successful registration and license approval, you’ll receive:

- NIB (Business Registration Number)

- NPWP (Tax Identification Number)

- BPJS Ketenagakerjaan Number (Social Security Number)

- BPJS Kesehatan Number (Health Insurance Number)

Read more: How to Seamlessly Obtain an Industrial Business License (IUI) in Indonesia

4. Activate your NIB

Activate your NIB within ten working days by logging into the OSS-RBA system and completing the activation process.

5. Obtain a local Trading business license (Surat Izin Usaha Perdagangan – SIUP)

Apply for a SIUP through the OSS-RBA system or your local Investment Coordinating Board (BKPM).

6. Additional information

- Business Domicile Letter (SKDP): No longer required since 2023. NIB serves as proof of business domicile.

- OSS RBA Transition: Businesses with existing OSS accounts must have transitioned to OSS RBA by the end of 2023.

- Single Identity Number (SIN): From January 2024, taxpayers must integrate their NPWP with their NIK (National Identity Number) to form a SIN.

Obtain your business registration number with InCorp Indonesia

Securing a business registration number in Indonesia is essential for companies to engage in vital activities such as tax applications and return filings.

While the process may seem complex, seeking professional assistance can significantly streamline it. Consider consulting experienced business registration professionals to navigate the legalities and ensure you obtain all necessary permits with InCorp Indonesia for a smooth and successful journey for your company registration Indonesia.

With a proven track record, InCorp Indonesia can guide you through the complexities, ensuring your company obtains the necessary permits, including the crucial business registration number, to thrive legally in the Indonesian market.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.