As the global climate crisis intensifies, the need for businesses to adopt sustainable practices while staying profitable becomes more urgent than ever. Green finance provides financial support to help companies invest in eco-friendly projects.

Green finance plays a significant role in reducing the carbon footprint of businesses, thereby fostering long-term business sustainability. In this article, we will explore the vital role of green finance in driving decarbonization and discuss how businesses can effectively harness it to create a more sustainable future.

What is green finance?

Green finance refers to financial products and services that support sustainable development and environmental conservation. It includes investments in renewable energy, energy efficiency projects, carbon offset initiatives, and other sustainability-focused activities.

This financial approach aims to balance economic growth with environmental responsibility. Green financing differs from traditional financing methods in several ways:

- Prioritizes environmental and social benefits alongside profitability.

- Focuses on the transparency of environmental and social impact.

- Involves higher risk and potentially lower returns due to limited data on environmental effects.

Essential benefits of green financing

Green financing offers businesses multiple advantages, including reducing their carbon footprint and ensuring long-term growth. Here are the key benefits:

1. Lowering Carbon Emissions

Green finance helps businesses fund renewable energy, energy-efficient systems, and sustainable operations, reducing their carbon footprint and supporting decarbonization.

2. Financial Incentives and Support

Governments and financial institutions offer subsidies, tax benefits, and low-interest green loans, making sustainable investments more affordable and financially rewarding.

3. Stronger Brand and Market Appeal

Companies prioritizing green finance improve their reputation, attract eco-conscious customers, and strengthen relationships with investors who value sustainability.

4. Protection Against Environmental Risks

Climate-related issues, like extreme weather and resource scarcity, can harm businesses. Green finance helps companies invest in climate resilience to reduce long-term risks.

5. Innovation and Competitive Edge

By adopting sustainable technologies, businesses can stay ahead of regulations and differentiate themselves in the market.

6. Attracting New Investors

With the rise of ESG (Environmental, Social, and Governance) investment, businesses that embrace green finance attract investors looking for sustainable and ethical opportunities.

Read more: Decarbonization 101: Strategies for measuring your carbon footprint.

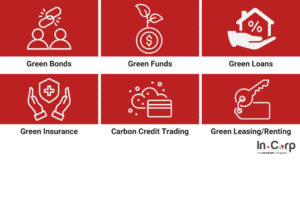

Green finance key products

Green financing offers a variety of funding options to help businesses invest in sustainable projects, lower their carbon footprint, and transition to environmentally friendly operations. These options include green bonds, green funds, green loans, green insurance, carbon credit trading, and green leasing/renting.

Here are the most common types of green financing:

Green Bonds

Green bonds are financial instruments issued by governments, corporations, and various organizations designed to raise capital for projects promoting environmental sustainability and social responsibility.

Green Funds

These financial instruments fund projects with positive environmental and social benefits. Investors can purchase shares in a green fund specializing in renewable companies.

Green Loans

These loans are like traditional business loans designated for environmentally friendly projects. Banks and financial institutions offer green loans to companies investing in solar power, waste management, clean transportation, and other sustainable efforts.

Green Insurance

This insurance coverage provides essential protection against losses or damage caused by natural disasters and the effects of climate change, ensuring that individuals and businesses can recover and rebuild after unforeseen events.

Carbon Credit Trading

Businesses can participate in carbon markets to buy or sell carbon credits, which helps offset their emissions. Companies that exceed their emission reduction targets can trade excess credits, while those struggling to reduce emissions can purchase credits to comply with regulations.

Green Leasing/Renting

A financing model where businesses lease energy-efficient equipment, vehicles, or buildings to reduce costs while promoting sustainability. Emerging areas where green leasing has been used include:

- Green property leases

- Green car leasing

- Energy efficiency

- Green mortgages.

How to implement green financing for your businesses

Transitioning to green financing can help enterprises to fund sustainable projects while lowering their carbon footprint. Here’s how companies can successfully integrate green financing into their operations:

1. Assess Your Sustainability Needs

Identify areas where eco-friendly investments are needed, such as energy efficiency, renewable energy adoption, or waste reduction. Conducting a carbon footprint assessment can also help set clear environmental goals.

2. Explore Available Green Financing Options

Based on business needs, choose from financing options like green bonds, loans, or ESG investments. Companies should also explore carbon credit trading if they aim to offset emissions.

3. Develop a Strong Business Case

Investors look for clear sustainability goals and measurable outcomes. Businesses should outline how the funding will reduce carbon emissions, improve efficiency, and align with sustainability regulations.

4. Partner With Financial Institutions and ESG Advisors

Working with banks, private investors, and ESG advisory firms helps businesses access suitable financing options and ensure compliance with green finance requirements.

5. Implement and Monitor Sustainable Projects

Once financing is secured, companies should track progress using key sustainability metrics. Many investors require regular updates on how funds are used to ensure compliance with green finance principles.

6. Communicate Sustainability Efforts

Businesses should be transparent by sharing sustainability reports, investor updates, and marketing campaigns to build trust with stakeholders and attract responsible investors.

Read more: Enhancing Green Financing in Indonesia with ESG Advisory.

Green financing trends in Indonesia

Indonesia is actively promoting green financing to support businesses in adopting sustainable practices. Several companies from various sectors in Indonesia have successfully implemented green financing into their operations, such as:

Bank Mandiri

Bank Mandiri has introduced various sustainable financial products, such as green and sustainability bonds, while publishing ESG reports. The bank funds environmental projects and provides consumer credit for solar panels and electric vehicle purchases.

Unilever

Unilever has committed €1 billion over the next 10 years to support environmental initiatives. Its Climate & Nature Fund finances landscape restoration, carbon capture, wildlife conservation, and water preservation projects.

Citi Indonesia

Citi Indonesia is strengthening its green financing portfolio, including a US$400 million green bond investment with PT Pertamina Geothermal Energy and US$700 million in green loans to PLN. Additionally, the bank prioritizes the social aspect of ESG, partnering with BTN and multinational firms to advance social financing initiatives.

Challenges of corporate green financing

One major challenge in green financing is the high initial costs of sustainable projects. Renewable energy, eco-friendly infrastructure, and carbon reduction technologies require significant upfront investment. Many businesses hesitate due to long payback periods and concerns about short-term profitability despite long-term benefits.

Another issue is the complex regulatory requirements, which demand strict ESG reporting and compliance. Many companies struggle with these rules due to a lack of expertise and additional administrative burdens.

Furthermore, the rising popularity of green finance has created a greenwashing practice in which businesses falsely claim their sustainability efforts. This reduces trust in the green finance market and makes it harder for genuinely sustainable firms to secure funding.

Unlock green financing opportunities with InCorp.

Managing green financing can be complex, but ESG advisory services simplify the process by helping businesses comply with sustainability regulations and attract ethical investors.

At InCorp Indonesia (An Ascentium Company), we provide expert guidance on ESG compliance and decarbonization strategies to help reduce your corporate carbon footprint. Our insights ensure your business stays aligned with sustainability goals and financial growth.

Ready to integrate sustainability into your financial strategy? Contact us today to unlock new opportunities in green business.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.