Indonesia’s golden visa offers an attractive opportunity for foreign investors and skilled professionals who want to live and invest in the country. With nine distinct categories, the Golden Visa Indonesia caters to various investors, entrepreneurs, and highly skilled workers.

This article explores the categories available under Indonesia’s golden visa program, helping you determine which is best for your goals and investment plans.

What is Indonesia’s golden visa?

The golden visa is an immigration program that allows foreign nationals to reside in Indonesia for 5 to 10 years.

Various types of golden visas are available, catering to individual investors, such as company founders, non-founding investors, former Indonesian citizens now holding foreign nationalities, global talents, and digital nomads.

Applications for the program began on August 30, 2023, following the introduction of the golden visa policy through the Law and Human Rights Ministry Regulation No. 22/2023.

The Directorate General of Immigration reported that nearly 500 people had applied for the golden visa since its official launch in July 2024.

At the official launch event on July 25, 2024, it was announced that 300 foreign nationals had already been granted the golden visa, securing at least IDR 2 trillion (approximately USD 128.3 million) in investments for Indonesia.

Former President Joko Widodo launched the Golden Visa Indonesia program to boost the economy by attracting wealthy individuals, global talent, and former Indonesian citizens. The program offered five—or ten-year stays in exchange for investments or expertise.

Types of investments eligible for Indonesia’s golden visa

Indonesia’s golden visa program is designed to attract high-net-worth individuals, entrepreneurs, and skilled professionals by offering residency rights in exchange for specific investments.

The following types of investments typically qualify for a golden visa in Indonesia:

- Direct investments in companies: Establish or invest in an Indonesian company, including joint ventures or wholly foreign-owned enterprises (PT PMA).

- Government bonds: Invest in Indonesian government bonds for a specified period. These bonds support national development projects and are considered a secure investment option.

- Real estate investments: Invest in luxury or high-value real estate developments. Approved projects and foreign ownership regulations may apply.

- Venture capital or startups: Fund Indonesian startups or ventures aligned with national priorities, such as technology, renewable energy, or infrastructure development.

- Business operations in strategic sectors: Operate businesses in industries designated as strategic by the Indonesian government, including education, healthcare, and renewable energy.

- Job creation: Generate significant employment opportunities for Indonesian workers through business activities or large-scale investments.

Read more: The economic impact of foreign investment in Indonesia

9 categories of Golden Visa

Indonesia’s golden visa program offers nine categories with specific requirements and benefits. These categories include:

| Category | Investment Requirements | Living Expense Proof |

|---|---|---|

| Individual Investors (Business Owners) | USD 2.5M (5 years), USD 5M (10 years); turnover: USD 25M (5 years), USD 50M (10 years) | USD 5,000/month |

| Individual Investors (Non-Business) | USD 350K in bonds/shares (5 years), USD 700K (10 years), or USD 1M in property | Required |

| Corporate Investors | Company investment: USD 25M (5 years), USD 50M (10 years) | Required |

| Indonesian Diaspora (Former Citizens) | USD 35K in bonds, shares, or mutual funds | Required |

| Indonesian Diaspora (Descendants) | USD 50K in approved financial instruments | Required |

| Second Home Seekers | Deposit USD 130K in an Indonesian bank or purchase USD 1M property | Required |

| Global Talent | Expertise with certification or degree from top 100 universities, invited by the government | USD 2,000/month |

| Public Figures | Sponsored by the government, recognized achievements | USD 5,000/month |

| Retirees | Deposit USD 50K in a state-owned Indonesian bank | N/A |

How to apply for a golden visa in Indonesia

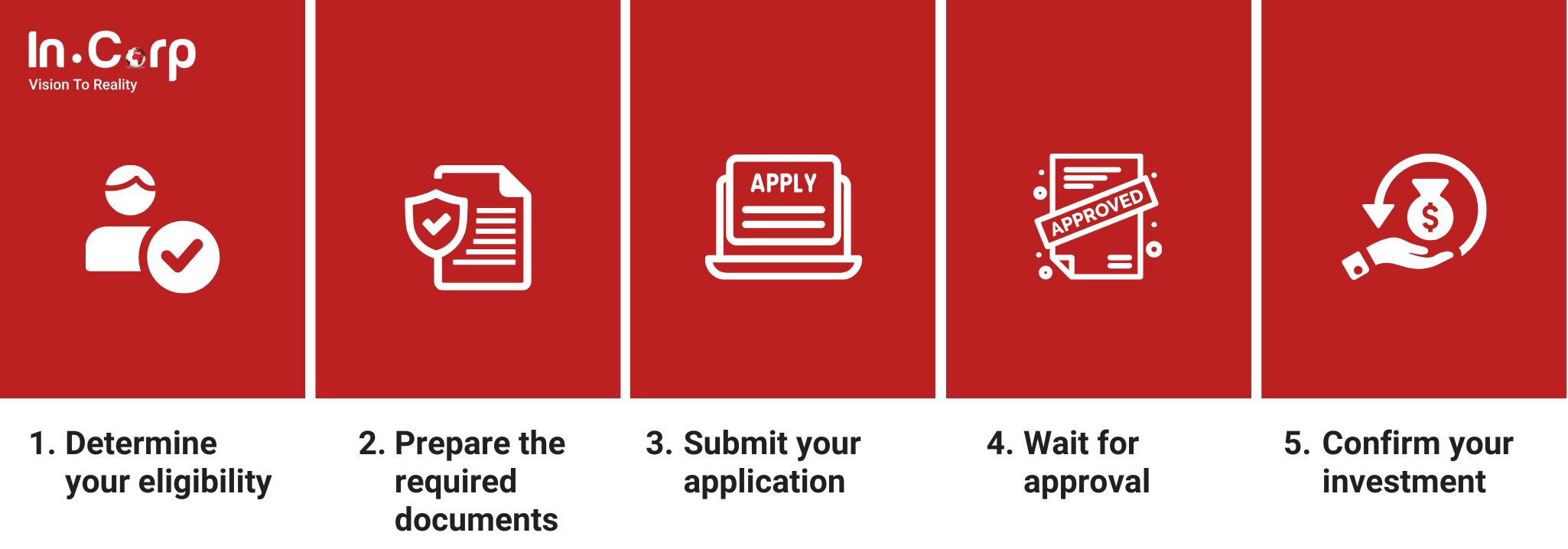

Applying for Indonesia’s golden visa can be rewarding but involves a detailed process. To ensure a smooth application, follow these key steps:

Immigration authorities generally process applications within four working days. Once approved, you must confirm your investment within 90 days of receiving your Limited Stay Permit. Afterward, your golden visa documents will be sent to you via email in PDF format.

Why should you use a visa agent for a Golden Visa Indonesia?

Navigating the golden visa application process can be overwhelming due to its detailed requirements and strict deadlines. A consultant like InCorp Indonesia provides:

- Expertise in selecting the best visa category based on your goals.

- Assistance with document preparation and compliance checks.

- Streamlined application submissions to avoid errors or delays.

- Professional guidance to ensure your investment confirmation meets regulations.

The immigration authorities typically process applications within four working days. Once approved, you must confirm your investment within 90 days of receiving the Limited Stay Permit. After approval, your golden visa documents will be emailed in PDF format.

Apply for a golden visa with InCorp

Applying for a Golden Visa Indonesia is easy and hassle-free with InCorp’s expert assistance. Our team ensures a smooth application process, helping you easily navigate complexities.

In addition to golden visas, we provide a range of immigration services, including business visas and Investor KITAS, offering a one-stop solution to simplify your business journey in Indonesia.

Click the button below to start and make your move to Indonesia seamless.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.