Suppose you run or plan to start a business in Bali. In that case, it is essential to familiarize yourself with the Regional Taxpayer Identification Number, also known as Nomor Pokok Wajib Pajak Daerah (NPWPD). It’s a key requirement for local tax compliance, especially for businesses like hotels, restaurants, and entertainment venues.

In this guide, we will provide comprehensive insights into this tax ID, its significance, and how to register seamlessly through NPWPD’s online services in Bali.

What is NPWPD

The regional tax office issues a Regional Taxpayer Identification Number to identify individuals or entities that are subject to local taxes in specific areas, such as Bali. This number differs from the national Tax Identification Number (TIN) or NPWP, which is used for tax purposes by the central government.

This registration allows local governments to monitor and collect taxes from businesses operating in their jurisdiction. If your business generates income in a region like Bali, you are required to have this local ID to report local taxes. Without it, companies could face penalties or even closure due to non-compliance with regulations.

Regional tax: Why it is essential for your businesses

Regional tax, as defined under Law No. 28 of 2009, is a mandatory contribution to the local government. While it doesn’t offer direct rewards to the taxpayer, it plays a crucial role in funding public services, such as road construction, job creation, and other community improvements.

Registering for the local taxpayer number not only fulfills a legal obligation but also brings key advantages, such as:

Legal Compliance

Without it, businesses are considered non-compliant with local tax laws and may face penalties or closure.

Funding Local Growth

Regional taxes help finance vital services and infrastructure that benefit residents and businesses.

Credibility and Transparency

A registered local taxpayer ID adds legitimacy to your business and makes financial reporting more transparent.

Simplified Online Services

With this local ID online, tax management becomes easier, faster, and more efficient.

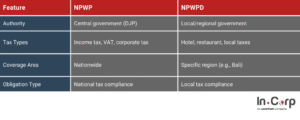

What are the differences between NPWP and NPWPD?

While both NPWP and the local tax ID are tax identification numbers in Indonesia, they serve different purposes and are handled by different authorities. Businesses in Bali often require both to ensure full compliance.

Here’s how they compare:

Authority

As part of the national tax administration system, NPWP is issued by the Directorate General of Taxes and operates under the Ministry of Finance. regional tax ID, on the other hand, is issued by the regional tax office of the local government

Tax Types

NPWP is used to report and pay national-level taxes for both individuals and businesses across Indonesia, including personal and corporate income tax (PPh) and value-added tax (VAT).

Meanwhile, regional ID only applies to local taxes, such as hotel, restaurant, and entertainment taxes. These are often linked to hospitality and tourism-related businesses.

Coverage Area

NPWP has a nationwide scope, meaning it is required for tax compliance across Indonesia, covering all business operations. Local ID only covers a specific region, such as Bali, and is limited to local tax obligations within that region.

Obligation Type

NPWP is mandatory for all individuals and companies earning income in Indonesia, including freelancers, SMEs, and large corporations.

In contrast, regional taxpayer identification is specifically required for businesses providing taxable services within a local area. Without it, they are not legally permitted to charge or pay regional taxes.

Read more: Understanding Indonesia’s tax identification number system

Who needs regional taxpayer identification?

Not everyone in Indonesia needs to register. However, if you run a business in Bali that earns income from taxable services, obtaining this number is essential.

Sectors that must register include:

- Hotels and villas

- Restaurants and cafes

- Entertainment venues (e.g., clubs, bars, spas)

- Parking services

- Businesses selling motor vehicle fuel

- Companies subject to lighting or advertisement taxes

How to obtain a Regional Taxpayer Number for businesses in Bali

To simplify registration, the government has introduced online platforms managed by local tax offices. This system enables faster applications and access from anywhere in Indonesia.

Key Requirements

Before initiating the registration, ensure you have the following documents ready:

- Personal Identification: Valid KTP for individuals.

- Business License: SIUP or SKU for business owners.

- Business Address Proof: Complete address of the business, supported by official documents such as a Surat Keterangan Domisili Usaha (SKDU) or proof of business premises ownership.

- Business Type Description: A brief description of the business type, e.g., restaurant, hotel, store.

- Personal Tax Identification Number: NPWP is required for individual entrepreneurs.

- Bank Account Number: The bank account used for business financial transactions.

- Active Email and Phone Number: For receiving confirmations and information related to NPWPD registration and local tax notifications.

Online Registration

For Bali, registration is done through the E-Palapa system operated by the Badung Regency Revenue Agency. Fill out the online form, upload documents, and wait for the local office to verify your application. Once approved, your registration certificate is ready for download.

Simplify your tax compliance in Bali with InCorp

Navigating Indonesia’s tax regulations can be complex, especially when managing both NPWP and NPWPD compliance in Bali.

InCorp Indonesia (An Ascentium Company) offers comprehensive tax reporting services to ensure full compliance with national and regional tax obligations in Bali. Our expert consultants assist with the following:

- NPWPD and NPWP registration

- Monthly and annual tax filings

- Local and central tax compliance

- Audit preparation and representation

Fill out the form below and let us handle the end-to-end tax paperwork seamlessly for you.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.