In January 2025, Indonesia launched the Core Tax System (CTS), a significant change to its tax system. This modernization effort, managed by the Directorate General of Taxes (DJP), aims to make tax reporting more manageable, faster, and transparent, bringing a wave of optimism for businesses.

What does this mean for businesses in Indonesia? This guide will help you understand the Core Tax Administration System (CTAS), covering key regulatory changes and how companies can adapt to this new system.

Understanding the Core Tax System

The Core Tax System is a digital platform designed to modernize tax administration by replacing outdated manual procedures. It streamlines essential tax operations, including taxpayer registration, tax return filing, payment processing, compliance tracking, and audits, ensuring a more efficient process.

In Indonesia, the introduction of the Core Tax Administration System (CTAS) aims to simplify tax management by integrating all tax-related data into a single system. This enhancement will simplify tax filing, reduce errors, and help businesses comply with regulations.

The key features of Indonesia’s new Core Tax System include:

- Online tax reporting and payment

- Real-time taxpayer database

- Automated compliance checks

- Better data security

- Integration with banks and financial institutions

Why the Core Tax System is important

Indonesia’s tax system has faced many challenges, including inefficiencies, outdated processes, and low tax collection. In 2022, the country’s tax-to-GDP ratio was only 12%, below global standards.

This made tax collection less effective and created difficulties for businesses. To solve these problems, Indonesia introduced a core tax system, a modern digital platform with key goals and benefits for businesses:

Greater efficiency

Automating the Core Tax system eliminates manual processes, significantly reducing errors and streamlining tax management. By integrating digital tools, businesses can accelerate tax processing and meet their obligations quickly and efficiently.

More transparency

Real-time tracking of tax payments fosters trust between businesses and regulatory authorities and enhances financial oversight and compliance by providing clear visibility into tax transactions.

Improved compliance

Automated reminders play a crucial role in ensuring timely tax filings, which minimizes the risk of missed deadlines and penalties. This allows businesses to maintain compliance effortlessly while directing their focus on growth and success.

Smarter tax policies

Accurate and reliable tax data is crucial for informed decision-making, fostering innovative and fairer tax policies. Ensuring a well-structured tax system creates a more predictable and equitable regulatory environment that ultimately benefits businesses.

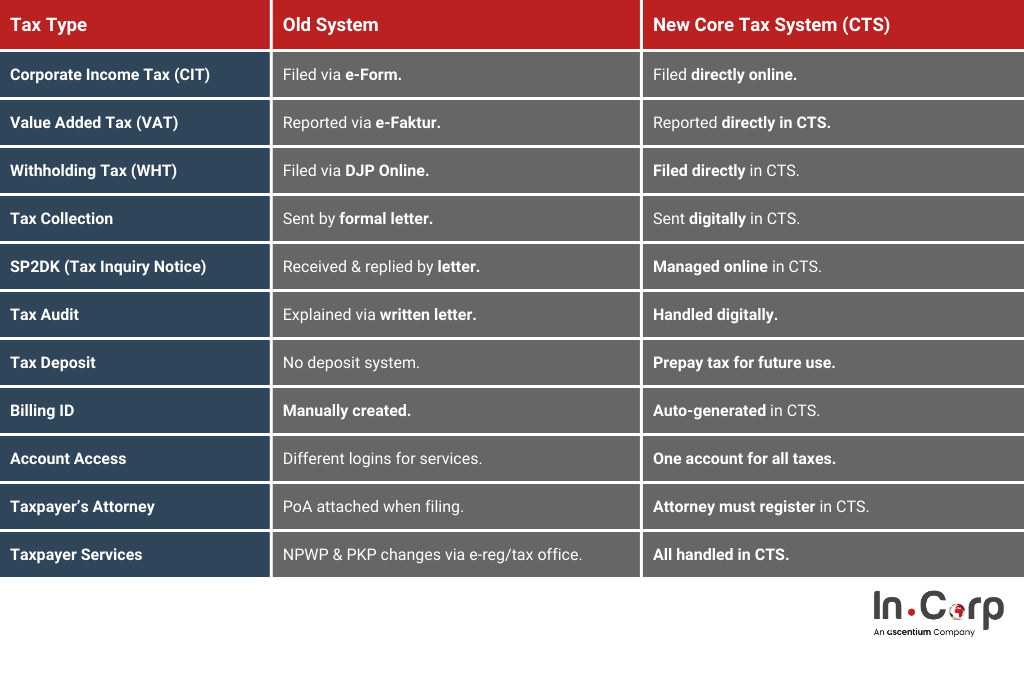

Key changes under the Core Tax System

On 18 October 2024, the Minister of Finance issued PMK-81 to streamline Core Tax System implementation regulations and will revoke the previous 42 PMKs. The new rules contain some alignments in terms of payment, reporting deadlines, and sanctions.

Below are the highlights of key changes under PMK-81 that taxpayers should pay attention to:

Digital tax processes

PMK-81 requires most tax transactions to be done electronically through online portals, official apps, or the tax office’s contact center. Manual filing is only allowed if technical issues or emergencies prevent electronic filing.

Taxpayer account system

Under the new Core Tax System, every taxpayer will receive a DGT-issued account to manage tax records and filings online.

Taxpayers must activate this account with the following steps:

- Email and phone number verification is done through the tax portal or by visiting a tax office.

- Obtain an Electronic Filing Identification Number (EFIN) to access DGT’s online platforms.

Without an activated taxpayer account and EFIN, businesses cannot file taxes or engage with Indonesia’s digital tax system.

Tax deposits & payments

A tax deposit is a pre-paid tax amount that has not yet been assigned to a specific tax payment. Businesses can use tax deposits for direct payment, transfer funds, and overpayments.

Tax overpayment

Under the new regulations, taxpayers can request a refund for overpaid taxes in the following cases:

- Cancellation of a Tax Assessment Letter (SKP) under tax law.

- Mutual Agreement Procedure (MAP) decisions that result in tax adjustments.

- Reduction or cancellation of Property Tax (PBB) Payable Notification Letters.

Tax refunds can be deposited into the taxpayer’s bank account, used to settle other tax debts, or stored as a tax deposit for future payments.

Tax returns and reporting

PMK-81 mainly revises outdated deadlines for tax returns across all major categories, such as:

- Monthly VAT Reporting: Foreign e-commerce businesses must file and pay VAT monthly.

- Annual Tax Return: Parent companies must digitally submit a consolidated financial report.

- Carbon Tax Return: Taxpayers can request a two-month extension for tax filing before the deadline.

Final income on Land & Building (L&B) transfers

Recent updates have changed the tax reporting process for final income tax on L&B transfers:

- If L&B is transferred to a government agency, the tax payment slip will be issued in the agency’s name.

- No payment slip is required if the tax rate is 0%.

- Tax payment is now based on the seller’s place of residence instead of the property’s location.

Read more: How to claim your tax refunds in Indonesia.

Tax compliance simplified

For businesses operating in Indonesia, tax compliance is a non-negotiable responsibility. However, navigating evolving regulations, deadlines, and digital tax systems can be challenging, especially for companies focused on growth.

With the implementation of the Core Tax Administration System (CTAS), tax filing and compliance have become more streamlined. However, businesses still need a strategy to ensure accuracy, minimize risks, and avoid disruptions.

The hidden costs of tax mismanagement

Many companies underestimate the impact of tax inefficiencies. Late filings, miscalculations, or improper reporting can lead to penalties, audits, and reputational damage. Even with digital advancements, businesses that lack a structured compliance approach often face unnecessary setbacks. This is why the new Core Tax System is so important.

A smarter approach to tax management

Instead of treating tax compliance as a routine administrative task, forward-thinking businesses are adopting a strategic approach:

- Automation & Integration: Utilizing digital tools to sync tax processes with financial systems reduces human error and improves efficiency.

- Proactive Compliance Monitoring: Real-time obligations tracking ensures businesses never miss deadlines or risk penalties.

- Expert-Led Tax Management: Relying on professional support alleviates the burden, allowing businesses to focus on core operations while maintaining compliance.

Read more: Guide to Obtaining a Tax Identification Number in Indonesia.

How businesses can adapt to the Core Tax System

The transition to the Core Tax System requires businesses to update their tax practices and ensure compliance with the new digital system. Here are the key steps companies should take to adapt smoothly:

Activate and learn the system

Register for a DGT-issued taxpayer account and get an EFIN for online access in advance. Understanding the platform early will also make tax filing and payments more manageable.

Train your finance team

Ensure your accounting team knows how to use the new digital tax system. Proper training will help prevent errors and keep tax filings accurate.

Automate tax processes

Use accounting software that integrates with CTS to simplify tax filing and payments. Automation reduces mistakes and ensures everything is done on time.

Stay updated on tax rules

To stay informed, check for updates from the Directorate General of Taxes (DGT). Knowing the latest tax regulations will help avoid compliance issues.

Navigate your tax transition seamlessly with InCorp

Indonesia’s new tax regulations require businesses to shift to a fully digital tax system. InCorp Indonesia (An Ascentium Company) simplifies this transition, helping businesses easily navigate tax digitalization.

Our expert tax advisory services ensure compliance while maximizing the new system’s benefits for business growth.

Fill out the form below and let us help you streamline your tax processes and stay compliant effortlessly.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.