Indonesia visa regulations were updated in 2025, simplifying applications and making entry into the country easier for travelers. Whether you’re visiting for tourism, business, or a long-term stay, understanding the correct visa type is crucial to avoid issues.

This guide provides detailed information on visa-free entry, long-term permits, and other options to help you choose the correct Indonesia visa and enjoy a hassle-free journey.

Why choosing the right visa is essential for foreigners

Applying for the correct Indonesia visa ensures a smooth entry and stay in Indonesia, preventing unnecessary delays or legal issues. Selecting the wrong visa could result in entry denial, penalties, deportation, or bans on future visits.

The Indonesian government has specific visa regulations for various purposes, such as tourism, business, employment, and long-term stays. Before applying for an Indonesia visa, foreigners must consider factors to comply with immigration laws:

- Duration of stay

- Purpose of visit

- Extension options

- Multiple-entry policies

- Sponsorship requirements

This helps travelers select the right visa and avoid potential legal complications.

Types of visas eligible to visit Indonesia

The government offers several Indonesia visa options based on travel purpose:

Diplomatic visa

A diplomatic visa is granted to foreigners with diplomatic passports, including their family members, to enter Indonesian territory. Based on international agreements, conventions, and courtesy, this visa can be used for any visitation purpose related to diplomatic duties.

Service visa

This visa is granted for official or service passport holders to enter Indonesia with non-diplomatic official duties from their government or an international organization. Foreign service officials at the Representative of the Republic of Indonesia, with the authority of the Minister of Foreign Affairs, issue diplomatic and service visas.

Visitor visa

This type of visa is granted to foreigners who will travel to Indonesia for government, education, socio-cultural, tourism, business, or family visits. A visitor visa is classified into three types:

1. Single-Entry Visa

A one-time entry visa designed for various short-term activities in Indonesia.

- Stay duration: Up to 60 days (extendable to 180 days).

- Purpose: Tourism, family visits, business and pre-investment, education and training, social or cultural activities.

- Application method: Apply online before arrival

This visa is also available for stateless individuals or those with non-national passports under the same categories.

2. Multiple-Entry Visa

A long-term visitor visa allows multiple visits within a 12-month validity period.

- Stay Duration: Up to 60 or 180 days per visit.

- Purpose: Business meetings, conferences, and trade negotiations.

3. Visa on Arrival (VOA)

VOA is a convenient short-term option for travelers who are not eligible for visa-free entry but want a simple process. This visa will be granted upon arrival at designated entry points.

- Stay Duration: 30 days (extendable once for another 30 days).

- Eligibility: Citizens of selected countries and unique administrative regions.

- Purpose: Tourism, business meetings, family visits.

Work and stay visa

This specific visa type is mandatory for foreigners who plan to work or reside in Indonesia for a long-term period. This visa includes:

- Limited Stay Visa (KITAS): For employees, investors, retirees, and spouses of Indonesian citizens.

- Permanent Stay Permit (KITAP): For those planning to live in Indonesia permanently after holding a KITAS.

Read more: An in-depth guide to extending your Bali visa

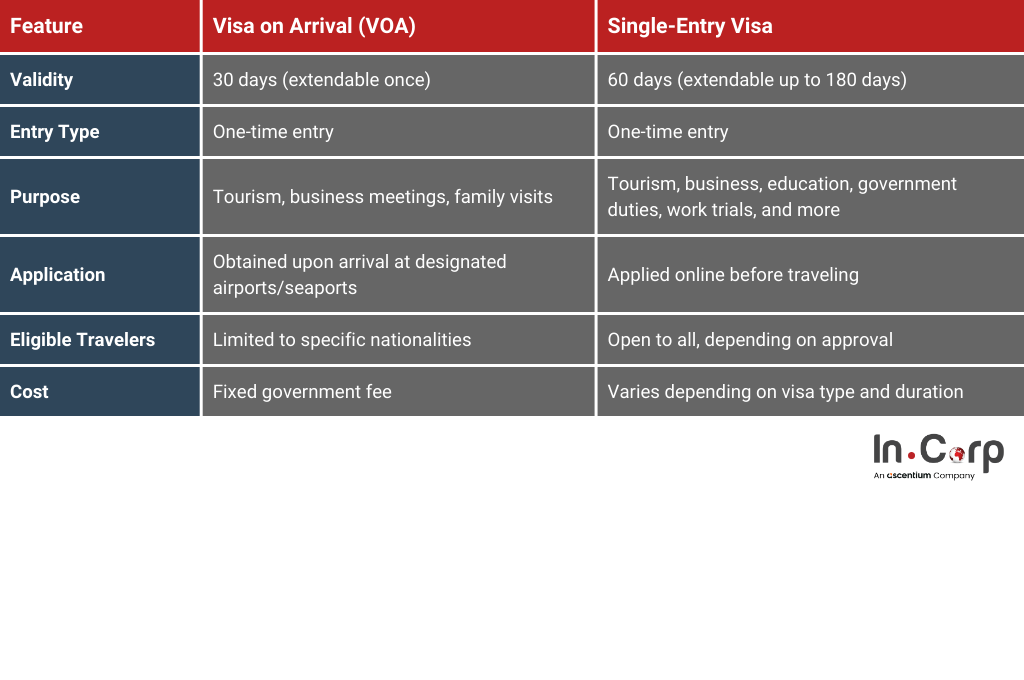

Visa on Arrival (VOA) vs. Single-Entry Visa: Key differences

Depending on your travel plans, you can choose between a Visa on Arrival (VOA) and a Single-Entry Visa when visiting Indonesia.

Here’s a complete breakdown of their differences:

1. Eligible countries

Visa on Arrival is eligible for foreigners from 97 specific countries. These include the ASEAN countries and several others, including the UAE, the United Kingdom, the United States, Australia, and most European nations.

If you are not eligible for VOA, a Single-Entry Visa is a suitable alternative because it is eligible for all countries without any restrictions.

2. Stay period

The duration of stay varies between the two visas. VOA allows for a stay of up to 30 days, which can be extended to an additional 30 days. The Single-Entry Visa, on the other hand, grants an initial stay of 60 days, which can be extended to a total stay of up to 180 days.

3. Entry requirements

Before traveling to Indonesia, ensure that you have a passport (valid for at least 6 months), a return or onward ticket, and an invitation letter from a relevant institution if you visit for government purposes.

4. Application method

Visa on Arrival can be obtained directly upon arrival at designated airports and seaports in Indonesia. Meanwhile, Single-Entry Visas can only be applied for in advance via an online immigration portal.

5. Renewal policy

Visa on Arrival can be renewed once for a total stay of up to 60 days, and can be done online or at any immigration office. A single-entry Visa offers more flexibility, with multiple extensions allowing up to a total stay of 180 days.

Read more: Indonesian Visa on Arrival: A simple how-to guide

Guide to Indonesia’s visa-free entry

Indonesia grants visa-free entry or visa exemption to citizens of certain countries for short-term visits without obtaining a visa in advance. Eligible travelers can receive this permit at immigration, valid for up to 30 days of stay in Indonesia.

However, the free visa is strictly non-extendable, meaning visitors must leave Indonesia before the 30-day stay period ends.

Who can apply for a visa exemption?

Under the visa-free framework, there are 169 countries eligible for visa-free entry into Indonesia, including:

- ASEAN Members are Singapore, Malaysia, Thailand, Vietnam, Cambodia, Laos, Myanmar, Brunei Darussalam, the Philippines, and Timor Leste.

- Other countries are Hong Kong, Colombia, and Suriname.

Requirements for Indonesia’s free visa

Unlike other types of visas, a visa exemption does not require an online application in advance. Upon arrival, eligible travelers can obtain this visa at designated border checkpoints in certain airports and seaports in Indonesia.

To get this visa, travelers must have a passport with a validity period of at least 6 months from the entry date and a return ticket to their home country.

Read more: How to Secure a Remote Worker Visa for Digital Nomad

Simplify your visa application process with InCorp

Navigating the Indonesia visa process can be complicated and time-consuming. To ensure a smooth and hassle-free experience, InCorp Indonesia (An Ascentium Company) offers comprehensive immigration services to help you efficiently manage Indonesia’s visa requirements.

Why Choose InCorp?

- We provide various visa options tailored to your needs, including Tourist Visas, Business Visas, Social Visas, and Visas on Arrival.

- Our expert assistance ensures faster visa processing, minimizing delays through our trusted immigration network.

- Avoid rejections with our thorough document preparation and review process.

- We guarantee that your visa application complies with Indonesia’s latest immigration regulations.

Complete the form below to make your travel experience stress-free.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.