Navigating personal income tax in Indonesia can feel overwhelming, especially with its unique brackets and potential deductions. Whether you’re a new resident or a seasoned taxpayer, this guide aims to demystify the process.

We’ll walk you through the basics of personal income tax, including who needs to pay, what types of taxable income, and how to navigate filing your return.

What is personal income tax in Indonesia?

Understanding the tax system in Indonesia is crucial for expatriate workers. Individual income in Indonesia is subject to progressive tax rates ranging from 5% to 35%.

The country employs a self-assessment scheme for personal income tax (PIT). Under Indonesia’s worldwide income taxation system, Indonesian tax residents must pay taxes on both their local and foreign income unless a double tax agreement is in place.

Non-residents, however, are only taxed on income earned within Indonesia, with potential reductions or exemptions if a tax treaty exists between their home country and Indonesia.

Who should pay personal income tax in Indonesia?

An individual can be considered a domestic tax subject in Indonesia if they stay there for more than 183 days within 12 months or if they intend to reside in Indonesia.

The government defines “residing in Indonesia” as living at a permanent address that can be accessed at any time, having vital interests in Indonesia, and maintaining a habitual abode there.

An “intention to stay in Indonesia” must be proven with documents such as:

- A permanent stay permit

- A limited-stay visa

- A limited-stay permit

- Other evidence supporting a stay of more than 183 days

Read more: A guide to benefits in kind tax in Indonesia

Tax obligations for foreigners in Indonesia

Foreigners who qualify as domestic tax subjects in Indonesia will only be taxed on income sourced within the country, provided they meet the expertise requirements outlined in Appendix II of PMK-18. To prove their expertise, they must have:

- A certificate from a government-authorized institution

- Applicants must have at least five years of experience in science, technology, or mathematics and demonstrate a commitment to transferring knowledge to an Indonesian citizen.

Foreigners must submit their applications to the Directorate General of Taxes (DGT) for territorial tax treatment. Additionally, individuals who were domestic tax subjects before the issuance of PMK-18/2021 are also eligible to apply for this tax treatment with the DGT.

Who is exempted from personal income tax?

Certain foreign expatriates are exempt from being considered Indonesian tax residents and thus do not have to pay personal income tax (PIT), despite staying in Indonesia for more than 183 days per year or intending to reside there. These exemptions apply to:

- Foreign diplomatic and consular staff

- Military and civilian personnel of foreign armed services

- Representatives of international organizations designated by the Government of Indonesia.

Individual tax rate in Indonesia

The table below outlines the progressive tax rates applied to individual taxable income in Indonesia. These rates range from 5% to 35% based on the income brackets specified.

| Taxable Income (IDR) | Tax Rate (%) |

|---|---|

| Up to IDR 60 million | 5% |

| Above IDR 60 million to IDR 250 million | 15% |

| Above IDR 250 million to IDR 500 million | 25% |

| Above IDR 500 million to IDR 5 billion | 30% |

| Above IDR 5 billion | 35% |

Deductions and allowances

In Indonesia, individuals can benefit from several deductions when calculating their taxable income. These deductions effectively lower the income subject to taxation, reducing the overall tax burden.

| Basis of Deduction | Deductible Amount Per Year |

|---|---|

| Individual taxpayer | IDR 54,000,000 |

| Spouse | IDR 4,500,000 (an additional 54,000,000 for a wife whose income is combined with her husband’s) |

| Dependents (maximum three) | IDR 4,500,000 each |

| Occupational support | 5% of gross income, with a maximum of IDR 6,000,000 |

| Pension costs | 5% of gross income, with a maximum of IDR 2,400,000 |

| Contribution to the approved pension fund | Amount of self-contribution |

| Compulsory tithe or religious contributions | The actual amount, provided that valid supporting evidence is available and all requirements are met. |

Filing tax returns

Taxes owed must be settled before submitting the tax return. The annual tax return, which covers the period from January 1 to December 31, must be filed with the Tax Office by March 31 of the following year.

For those with monthly tax obligations, payments must be made by the 15th of the following month. Once the payment is made, monthly submissions are considered complete.

Late payments incur a 2% interest penalty per month, and late filing of the tax return results in a fine of IDR 100,000.

What happens if you are unable to file the annual income tax return?

If you cannot submit the annual personal tax return by March 31, you can submit Form 1770-Y to request an extension to file until May 31.

However, this extension applies only to the filing deadline and does not extend the deadline for paying the taxes owed. Additionally, it requires income tax return verification.

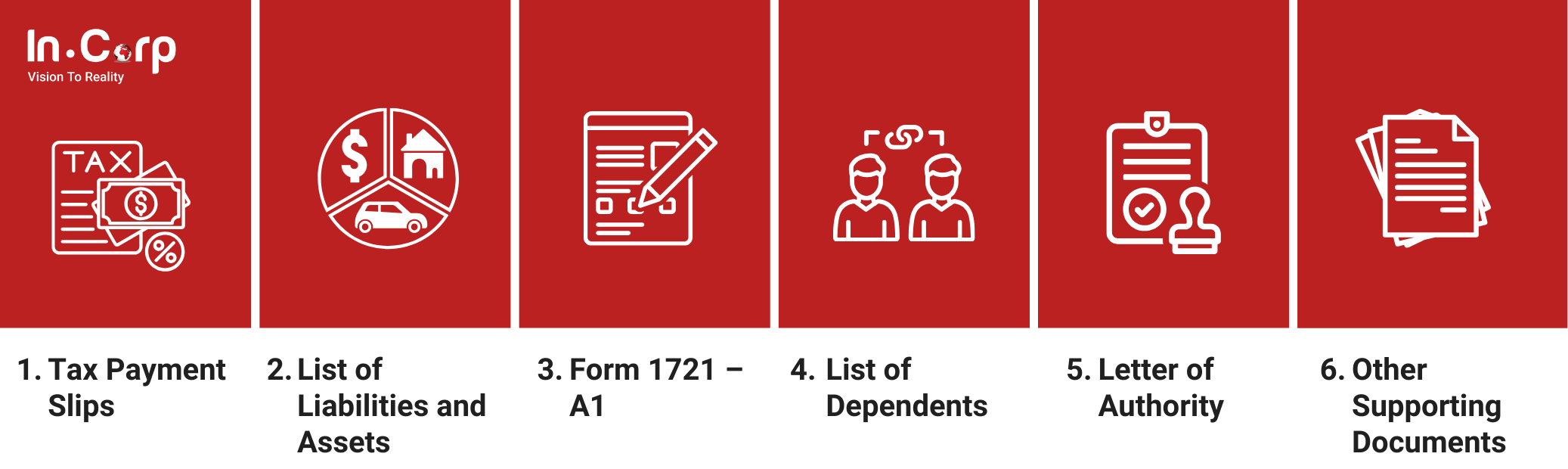

The documents needed for tax return

When submitting the annual personal income tax return (Forms 1770 and 1770S), you must include the following documents:

- Tax payment slips to prove that the calculated income tax balance has been settled

- A detailed list of liabilities and assets

- A copy of the Employer’s Certificate of Income Tax on Earnings (Form 1721 – A1)

- A list of the taxpayer’s dependents

- A letter of authority granting permission for a tax representative to file the return

- Supporting documents for any foreign taxes paid

The tax filing process

To file a tax return, you must register for a tax identification number (NPWP). The required documents for registration include:

- A copy of your passport

- A copy of your work permit (ITMA)

- A copy of your limited stay permit (ITAS)

- A completed registration form

- A letter of authority allowing a tax professional or representative to handle the registration

- A copy of the sponsoring company’s NPWP

Additionally, most tax offices recommend that taxpayers submit their returns electronically, which may necessitate registering for an Electronic Filing Identification Number (eFIN).

You can use the income tax calculator here to understand your tax obligations. This tool will help you estimate your tax liabilities based on your income and other relevant factors, ensuring you’re well-prepared when it’s time to file your return.

Tax deregistration when leaving Indonesia

Expatriates leaving Indonesia are advised to cancel their tax registration permanently to prevent ongoing tax residency status and avoid potential issues. To do this, they should apply to the local tax office, which will audit their returns and supporting documents before approving deregistration.

It is essential to have all relevant tax documents, such as bank statements, salary slips, foreign tax records (if applicable), and work contracts, readily available for the audit.

Streamline your tax reporting with InCorp

Navigating the Indonesian tax system can be challenging for foreigners due to its complexities. However, with over a decade of experience, InCorp has developed significant expertise in this area.

Here’s how InCorp can help you with your personal income tax in Indonesia:

- Tax reporting: Our experts will handle all aspects of your tax return, ensuring accuracy and compliance with Indonesian regulations.

- Accounting services: We can manage your income and expenses, making tax preparation a breeze.

Click the button below to simplify your personal income tax experience.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.