Indonesia’s Tax Directorate General is the nation’s cornerstone for financial health. As the primary tax authority, it plays a pivotal role in collecting revenue, enforcing tax laws, and supporting economic stability.

This guide delves into the organization’s functions, responsibilities, and crucial impact on Indonesia’s economic landscape.

What is the Tax Directorate General?

The Directorate General of Taxes (DGT) is a division of Indonesia’s Ministry of Finance. It operates according to Minister of Finance Regulation No. 184/PMK/01/2010 guidelines.

The Tax Directorate General is instrumental in encouraging tax compliance among Indonesian citizens and businesses, highlighting the significance of timely and accurate tax payments for the country’s progress.

What does the DGT stand for?

The Directorate General of Taxes (DGT) is a critical policy-making body within Indonesia’s Ministry of Finance.

As a key driver of the national economy, the DGT is responsible for creating tax policies that adapt to the rapidly transforming digital landscape. Its role is crucial in harnessing emerging opportunities to optimize tax revenue and support economic growth.

Read more: A guide to benefits in kind tax in Indonesia

The history of the Tax Directorate General in Indonesia

The Directorate General of Taxes in Indonesia traces its origins to a merger of several tax-related entities.

These entities include the Tax Office, Auction Bureau, Tax Accountant Office, and the Agricultural Tax Office. The Agricultural Tax Office was initially under the Directorate of Regional Development Contribution (IPEDA).

A significant restructuring occurred in 1976. Under Presidential Decree No. 12/1976, IPEDA, previously part of the Directorate General of Monetary, was integrated into the DGT.

The DGT’s organizational structure comprises two main components: the head office and operational units. The head office oversees the DGT’s operations through various directorates and support functions.

Operational units, on the other hand, are responsible for direct taxpayer interactions and tax administration.

The operational offices include the Regional Office of the DGT (Kanwil DJP), the Tax Service Office (KPP), the Tax Service, the Counseling and Consulting Office (KP2KP), and the Tax Data and Document Processing Centre (PPDDP).

What does the Tax Directorate General do in Indonesia?

The Tax Directorate General is a cornerstone of Indonesia’s fiscal system. As a critical component of the Ministry of Finance, it is pivotal in driving economic growth.

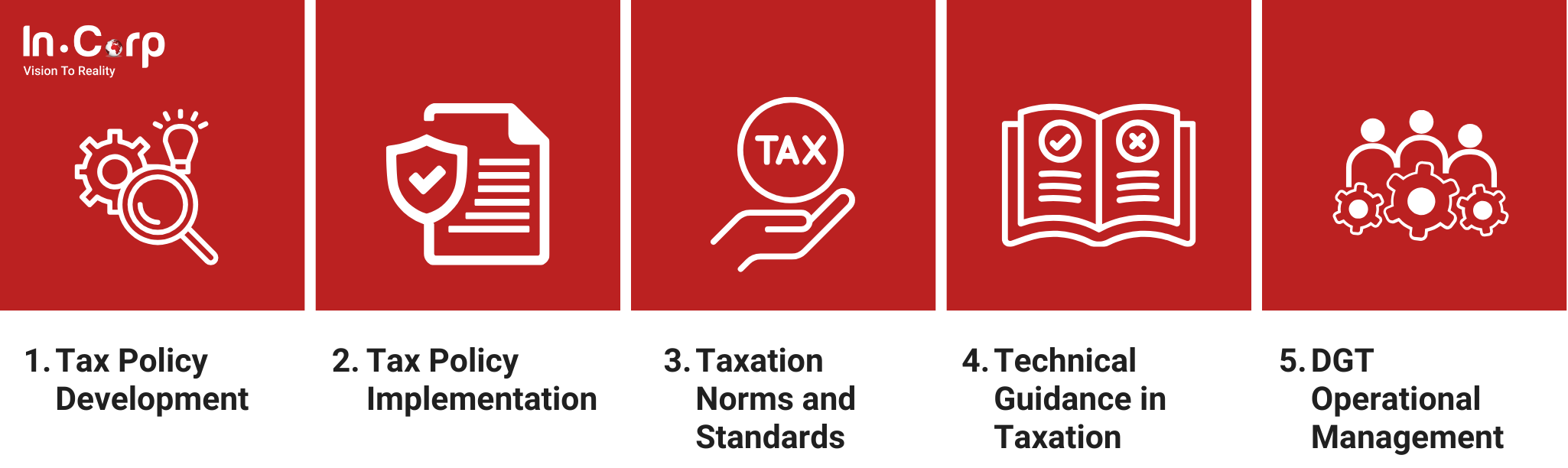

The DGT is mandated to:

- Develop and implement comprehensive tax policies.

- Establish standardized tax procedures, regulations, and criteria.

- Provide technical expertise and support related to taxation.

- Oversee the day-to-day operations of the tax administration.

By fulfilling these responsibilities, the DGT contributes significantly to Indonesia’s fiscal health and economic stability.

The role of the Tax Directorate General in Indonesia

The Tax Directorate General is pivotal in shaping Indonesia’s economic trajectory. Its multifaceted role extends beyond mere tax collection, encompassing a complex interplay of policy formulation, enforcement, and taxpayer service.

Revenue generation

As the state’s primary revenue-generating agency, the DGT funds essential public services, infrastructure development, and social programs.

Through the efficient and equitable collection of taxes, including income tax, value-added tax (VAT), and property tax, the DGT ensures a sustainable financial foundation for the nation.

Tax compliance

Beyond revenue generation, the DGT is critical in fostering a compliant tax environment.

By enforcing tax laws and regulations, the agency ensures a level playing field for businesses and individuals, deters tax evasion, and promotes fair competition. This ultimately supports a healthy and robust economy.

Policy innovation

Moreover, the DGT leads in tax policy innovation. The agency conducts in-depth research and analysis to uncover opportunities for optimizing the tax system. This helps stimulate economic growth and fosters a more favorable business climate.

This proactive approach ensures that Indonesia’s tax framework remains aligned with evolving economic realities and global best practices.

Taxpayer services

A cornerstone of the DGT’s mission is to provide exceptional taxpayer service. By simplifying tax procedures, offering clear guidance, and utilizing technology to enhance accessibility, the agency strives to build trust and confidence among taxpayers.

This taxpayer-centric approach is essential for fostering a cooperative tax culture.

International cooperation

Furthermore, the DGT plays a crucial role in international tax cooperation.

By actively participating in global tax initiatives and exchanging information with other tax authorities, Indonesia can effectively combat tax evasion and ensure that multinational corporations pay their fair share of taxes.

In conclusion, the Tax Directorate General is more than a tax collection agency. It is a strategic partner in Indonesia’s development, driving economic growth, enhancing public services, and promoting a fair and efficient tax system.

The DGT’s commitment to excellence and innovation is essential for securing Indonesia’s fiscal health and building a prosperous future for all citizens.

Simplify your tax compliance with InCorp

Tax reporting can be complex and time-consuming, fraught with potential errors and penalties. Let InCorp handle the complexities for you.

Our professional tax consultants deliver comprehensive tax advisory solutions tailored to your business. With a deep understanding of Indonesian tax regulations, we ensure accurate and timely tax filings.

Benefit from our expertise:

- Expert guidance: Our knowledgeable consultants navigate complex tax laws on your behalf.

- Accurate filings: Avoid costly penalties and disruptions with error-free tax reports.

- Streamlined process: We handle the entire tax reporting process, freeing up your time.

- Risk mitigation: Our comprehensive approach reduces the likelihood of audits.

Click the button below to simplify your tax compliance with InCorp.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.