In Indonesia, getting a tax identification number (TIN), or Nomor Pokok Wajib Pajak (NPWP), is important for anyone involved in the country’s tax system. Whether a business owner or an individual, having a TIN allows you to fulfill your tax obligations and comply with local regulations.

While obtaining one may seem daunting at first, a Tax Identification Number is necessary for people who earn income in Indonesia and are registered with the central financial system.

What is a Tax Identification Number (TIN)?

A tax identification number, often called a “TIN,” is a distinctive nine-digit number used to identify individuals or entities for tax purposes. This number is necessary for filing tax returns and is also required in various official transactions.

A tax identification number is vital for establishing your business as a legal entity for online companies, facilitating smooth transactions, and managing taxes from online sales. This becomes increasingly important as your business scales and handles more significant volumes of transactions and customers.

Read more: A guide to personal income tax in Indonesia

What is the Tax ID number in Indonesia?

In Indonesia, TIN is known as NPWP Indonesia. Obtaining your business license and handling all tax-related matters, including tax filing and eligibility for state services and benefits is crucial.

Where can I find my Tax Identification Number?

Knowing how to check your tax identification number (NPWP) will benefit your career and business. Tax Identification Number typically consists of 15 digits. Here’s an example format:

12.345.678.9-012.345

- The first nine digits represent the unique taxpayer code.

- The last six digits contain the tax office and branch location information.

For instance:

12.345.678.9-012.345 can be broken down as follows: the first nine digits are your personal or business tax ID, while the final digits indicate the region or branch handling your tax affairs.

The NPWP is required for tax reporting and financial transactions in Indonesia. Follow these steps to check your NPWP online.

Verify NPWP on the DJP website

Visit the Directorate General of Taxes (DJP) site (https://ereg.pajak.go.id), log in with your NPWP and password, and view your details on the dashboard.

Verify NPWP using M-Pajak app

Download the M-Pajak app, log in or create an account, and select “Cek NPWP.” Enter your NIK and view your NPWP on the dashboard.

Verify NPWP using ID card (KTP) and family card (KK)

Go to https://ereg.pajak.go.id/ceknpwp, input your NIK and KK numbers, complete the captcha, and view your NPWP details if found.

Verify NPWP using the QR code

Scan the QR code on your NPWP card with a scanner app, follow the link, enter the security code, and check your NPWP status.

How to check company Tax Identification Number

Checking a company’s NPWP number is essential for ensuring compliance with tax regulations. Various online and offline methods make this process easy and accessible for businesses.

Online methods

- M-Pajak DJP app: Download the app, log in, and check the NPWP number on the dashboard.

- Official DJP website: Visit https://pajak.go.id and select “Saluran Pengaduan” to check the NPWP.

- Kring Pajak hotline: Call 1500200 to inquire about the NPWP number.

- Fax: Send a fax to (021) 5251245, ext. 5 for NPWP verification.

- Email: Email pengaduan@pajak.go.id with the required tax documents for verification.

- Social media (X.com @Kring_Pajak): Post your inquiry on X.com and tag @Kring_Pajak for a response.

- Chat Pajak: Use the chat feature on the DJP website to request NPWP details.

Offline method

- Visit the nearest Tax Service Office (KPP) with relevant documents for in-person NPWP verification.

TIN registration process in Indonesia: Business vs. personal

Getting your Tax Identification Number Indonesia, or NPWP, is essential for managing a business or handling personal taxes. While individuals and businesses need a tax identification number for tax purposes, the registration process and requirements can differ.

Personal TIN application requirements

To apply for a personal TIN/NPWP, Indonesian citizens must meet specific criteria, such as being over 21 and earning above the non-taxable income threshold or planning transactions like opening a bank account. Key requirements include:

- NPWP application form.

- Copy of valid ID (KTP).

- Family card (KK) or domicile certificate.

- Salary slip or income statement.

- Declaration of information accuracy.

Company NPWP application requirements

For companies, having an NPWP is mandatory. Key requirements include:

- Recognized business entity (e.g., PT, CV).

- Business Identification Number (NIB).

- Clear business activities.

- The NPWP application letter, Articles of Association, NIB, and ID of the President Director are supporting documents.

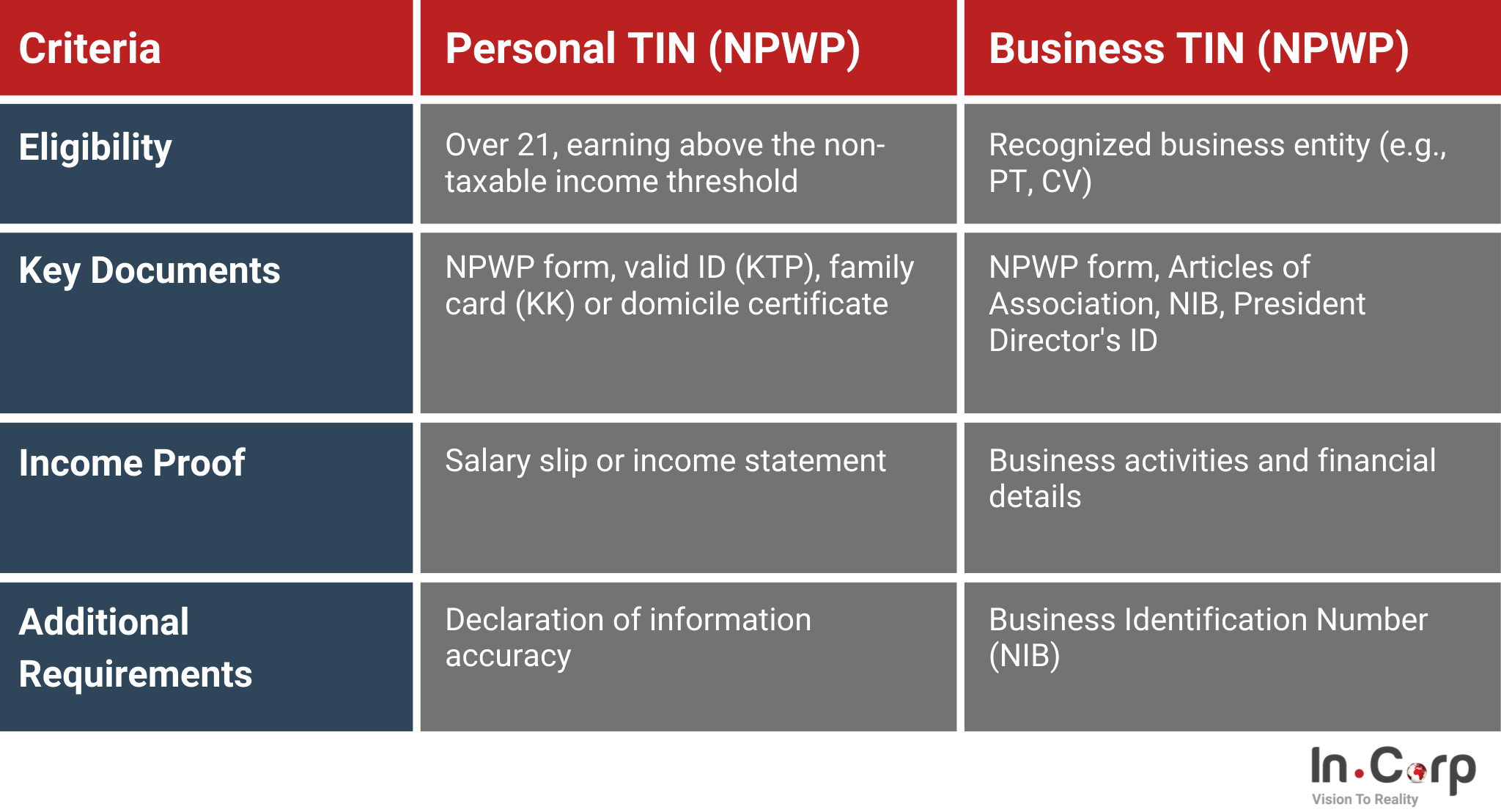

Personal TIN vs. business TIN: Key differences

A personal tax identification number is designated for individual tax responsibilities, while companies use a business TIN to meet corporate tax requirements. Here are the main differences between them:

| Aspects | Personal | Business |

|---|---|---|

| Purpose | A personal TIN is used for filing individual taxes, including employment income, personal investments, and other personal income taxes. | A business TIN is needed to handle taxes related to business activities, such as corporate income taxes and VAT. |

| Applicability | A personal TIN is required for all working individuals. | A business TIN is mandatory for commercial, professional, or vocational entities, reflecting their engagement in business operations. |

| Tax return | Personal tax returns typically cover salaries and individual earnings. | Business tax returns include reports on business profits, VAT, and other taxes associated with business operations. |

Obtain your Tax Identification Number with InCorp

Obtaining your tax identification number (NPWP) can be challenging, but it doesn’t have to be. With InCorp, we simplify the process, making tax management more accessible.

Our tax reporting and accounting services take the hassle out of taxation, ensuring your business stays compliant without the stress. Here’s how we can help:

- Tax Reporting: We handle all the necessary paperwork and filings to keep your business updated with Indonesia’s tax laws.

- Accounting: Our team ensures accurate financial records, so you don’t have to worry about errors or missed deadlines.

Click the button below to let InCorp simplify tax management so you can focus on growing your business.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.