Claiming your tax refund in Indonesia can be straightforward if you understand the steps involved. Many taxpayers often wonder about their tax refund status, especially after filing their annual returns.

Knowing how to navigate the system effectively can help you receive your refund promptly. This guide will uncover the steps to claim your tax refund, from preparing the necessary documentation to checking your refund status online, ensuring you quickly get back what you are owed.

What is a tax refund in Indonesia?

A tax refund is a process where taxpayers request the return of excess taxes paid to the state. This overpayment represents the taxpayer’s entitlement, which arises when an excess payment is reported in the Tax Return (SPT) or an error in tax collection or withholding results in an overpayment.

Tax overpayments can occur for several reasons, including:

- Errors in tax collection or withholding: Mistakes in calculating the correct amount of tax that should have been collected or withheld.

- Tax credit exceeds tax payable: When the amount of tax credit exceeds the tax payable, as reported in the SPT.

- Unnecessary tax payments: Tax payments made that are optional from the taxpayer.

Why is a tax refund important?

Tax refunds promote transparency and fairness within the tax system. By providing refunds, the government demonstrates trust and respect for taxpayers’ compliance.

Additionally, refunds help maintain a balance between taxpayers’ rights and obligations, encouraging improved tax adherence. This process positively affects the country’s fiscal stability by ensuring that the taxes collected align with the applicable regulations.

Tax refund process in Indonesia

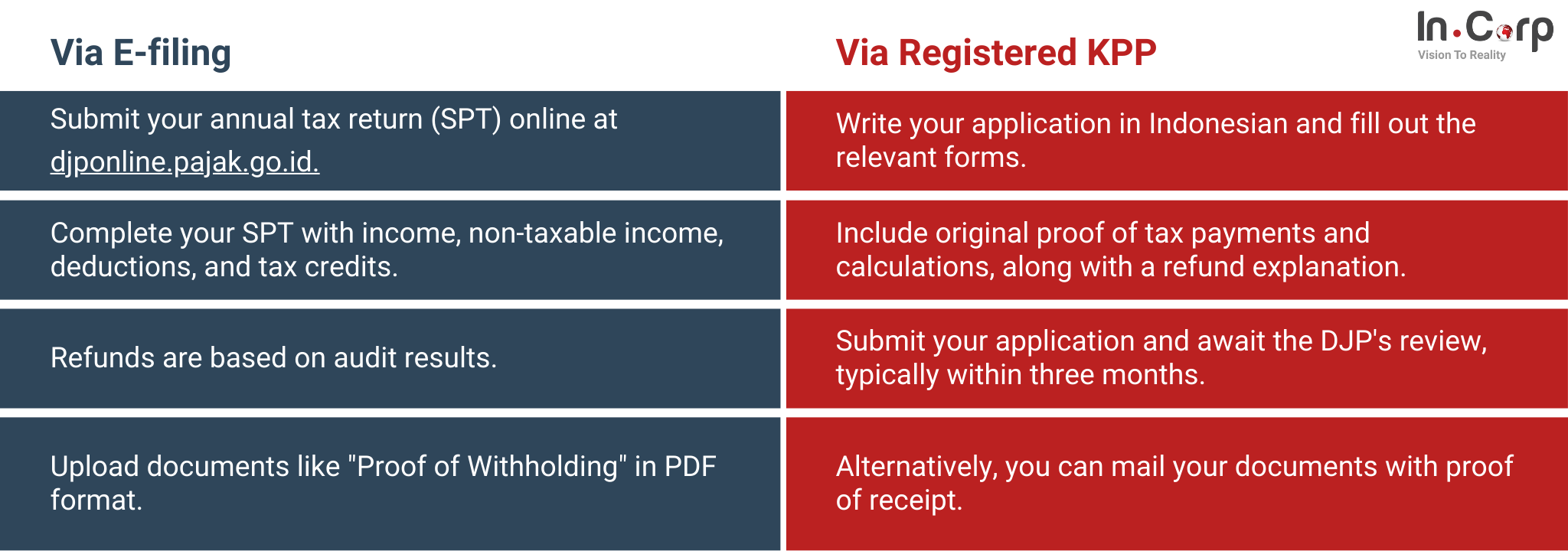

Tax refunds can generally be processed through various methods, such as e-filing or a registered Tax Service Office (KPP). These procedures are governed by law and managed by the Directorate General of Taxes (DJP), which holds the necessary authority.

Below is a complete guide on processing tax refunds by the applicable regulations.

Via e-filing

E-filing is an electronic system for submitting and reporting taxes, enabling taxpayers to file annual tax returns online. Taxpayers can submit their applications directly through the official website https://djponline.pajak.go.id, following these steps:

- Taxpayers must fully complete their tax return (SPT), including details on income, non-taxable income (PTKP), deductions from other parties, and tax credits.

- After the SPT is submitted via e-filing, the excess tax payment will be refunded according to the audit results.

- Taxpayers should prepare documents like “Proof of Withholding,” which can be uploaded in PDF format as part of the tax return archive.

Read more: Understanding the duties of the Directorate General of Taxes in Indonesia

Through a registered KPP

In addition to e-filing, tax refunds can be processed by applying directly to the KPP (Tax Services Office). Taxpayers can follow these steps:

- Applications must be written in Indonesian, and taxpayers must fill out the relevant forms, whether for individuals or companies, and include a power of attorney if needed.

- Taxpayers must also provide original proof of tax payments, tax calculations, and explanations for the refund request.

- After submission, taxpayers typically wait for the DJP to review the application, and a decision is generally made within three months.

- Tax refunds can also be processed by mailing the necessary documents through postal or courier services, ensuring that all submissions are securely delivered and verified with proof of receipt.

Tax refund types and filing requirements

There are two types of tax refunds based on the conditions for submission, which are important to understand during the tax refund filing process.

Understanding the differences can help you decide the appropriate approach for your situation and ensure a smoother refund experience.

Overpayment of taxes that should not be payable

This occurs when a taxpayer pays taxes they didn’t owe. For example, Mr. Andi paid IDR 45 million in income tax but had no tax payable for 2024. He can apply for a refund in 2025.

Terms for submitting overpayment refunds

Understanding the terms is important for a smooth process when handling overpayment refunds. If you have overpaid your taxes, you may be eligible for an income tax refund.

Tax refund for payments by the payer

- Written in Indonesian, signed by the payer or representative, and includes proof of payment (SSP) and reasons for the refund.

- Submit directly to the Tax Office or by mail with proof of receipt.

Tax refund in import contexts

- Written in Indonesian, signed by the taxpayer or representative, and attached to customs and import-related documents.

- Submit it to the tax office or via mail with proof of receipt.

Tax refund for withholding or collection errors

- Written in Indonesian, signed by the taxpayer or authorized representative.

Overpayment of income tax, VAT, or sales of luxury goods (PPnBM)

This occurs when more tax is paid than owed, such as PT. Alpa has an IDR 100 million VAT overpayment, which can be refunded or carried forward.

Terms for submitting refunds

- The overpaid tax must be deposited, uncredited in the VAT annual tax return (SPT), and uncapitalized.

- Taxable entrepreneurs (PKP) must report collected tax in the VAT SPT.

- The tax cannot be under dispute.

Simplify your tax process with InCorp

Navigating the taxation process in Indonesia can be complicated, but InCorp is here to make it easy for you. With over a decade of experience in the industry, we offer a range of expert tax advisory and accounting services specifically tailored to your business needs:

- Tax advisory: Get personalized guidance to optimize your tax strategy and ensure compliance.

- Accounting services: Benefit from our meticulous accounting support to keep your financial records in order.

Let us handle your tax-related concerns so you can concentrate on growing your business. Click the button below to simplify and enhance your tax process.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.