Bintan Island, part of Indonesia’s Riau Archipelago, is gaining recognition as a rising tourism destination in Southeast Asia. It offers pristine beaches, luxury resorts, and a growing infrastructure that appeals to leisure and business travelers.

How can the tourism investment potential in Bintan be effectively capitalized? This guide will walk you through the Bintan tourism outlook, opportunities, and challenges in 2025 and beyond.

Riau Islands tourism outlook in 2024

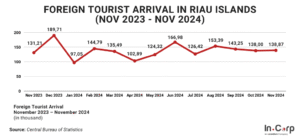

The Riau Islands, home to Bintan, saw a significant rise in international tourist arrivals in November 2024. Based on data from the Central Statistics Agency (BPS), the province received 138,873 foreign visitors, an increase of 5.8% compared to the previous year.

This trend highlights the region’s growing reputation as a tourist hotspot. Bintan was the second most visited destination after Batam, accounting for 10% of the international arrivals.

Singapore continued to dominate as the primary source of foreign tourists, contributing around 60% of total entries. Travelers from Malaysia, China, India, and the Philippines followed. The region’s strategic position to these countries and enhanced transport connectivity have driven this growth.

Read more: Best business in Batam: 7 promising sectors to start

Bintan: The rising tourist hub in the Riau Islands

Bintan, the largest island in the Riau Islands Province, spans 1,946 square kilometers. Its transformation into a key tourism destination is strongly tied to its strategic location within the Singapore-Johor-Riau (SIJORI) Growth Triangle.

Positioned near Singapore’s economic hub and Johor’s industrial zone, Bintan benefits from being a natural, scenic escape that complements its neighboring regions. Here’s why Bintan tourism is gaining attention as one of Indonesia’s thriving potentials:

Easy Access from Singapore

Bintan Island is quickly becoming a top tourist destination in Southeast Asia. A 60-minute ferry ride from Singapore attracts many international visitors looking for a quick and relaxing getaway.

A Variety of Attractions

Bintan offers various tourist spots, from beautiful beaches to luxury resorts, cultural landmarks, and outdoor activities. Key spots include Crystal Lagoon and Penyengat Island.

Growing Infrastructure

Bintan’s tourism infrastructure is expanding. Investments are being made in new resorts, better roads, and more tourist facilities. These improvements help support the rising number of visitors and enhance the travel experience.

Boost to the Local Economy

Tourism growth is driving Bintan’s economy. More jobs are being created, especially in hotels and restaurants, and local businesses benefit from increased visitor spending.

Government Support & Incentives

Bintan is part of Indonesia’s Special Economic Zone (SEZ) and Free Trade Zone (FTZ). This means investors get benefits like tax breaks, no import duties, and faster business permits. These policies help reduce costs and make setting up and growing a business easier.

Read more: Inside look at Indonesia’s tourism revival

Key investment opportunities in Bintan tourism

With its expanding economy, Bintan achieved an investment realization of IDR 7.1 trillion by 2024, surpassing its original target of IDR 3.5 trillion. The industrial sector led the way, accounting for over 50% of this amount, while the tourism sector contributed over IDR 990 billion.

This strong investment climate makes Bintan an attractive destination for foreign investors, especially in tourism. Key opportunities include:

1. Resorts and Hotels

Bintan’s beaches and tropical setting are perfect for building luxury resorts and beachfront hotels. Areas like Lagoi Bay are open for new developments aimed at tourists looking for relaxing, high-end stays.

2. Homes and Villas

Investors can build vacation homes, retirement villas, or residential communities. These are popular among long-term visitors, retirees, and people who want a second home near Singapore.

3. Shops and Restaurants

With more tourists coming to Bintan, there’s a growing demand for shopping centers, cafes, and entertainment. Business-ready spaces are available in busy tourist areas, ideal for retail and food businesses.

4. Large Tourism Projects

Places like Treasure Bay Bintan offer land for significant developments, such as water parks, hotels, wellness centers, and family attractions. These big projects are designed to serve many tourists and offer strong investment returns.

Challenges of investing in Bintan tourism

Bintan tourism offers tremendous opportunities, but some essential challenges need attention for long-term success.

Environmental Concerns

Tourism growth is putting pressure on Bintan’s nature. Issues like pollution, forest cutting, and damage to beaches and marine life can harm the island’s beauty. To keep Bintan attractive, businesses must focus on eco-friendly and responsible tourism.

Competing with Other Destinations

Bintan competes with well-known destinations like Bali and Phuket, which have attracted many tourists. To stay competitive, Bintan must highlight its unique strengths, such as its peaceful environment and easy access from Singapore.

Local Regulations

Starting a business in Bintan can be complicated due to slow and unclear regulations, which may discourage new investors. Working with a reliable local partner or agent simplifies the process and ensures a smooth business setup and operation.

Read more: How to Obtain a Tourism Business License in Indonesia

Unlock Bintan’s tourism potential with InCorp

As Bintan continues to grow as a key tourism hotspot, it presents many opportunities for forward-thinking investors. Yet, entering the Indonesian market requires careful attention to legal requirements and regulatory procedures.

InCorp Indonesia (An Ascentium Company) offers expert support in company setup and business licensing, helping you easily navigate the business landscape in Bintan’s tourism sector.

Fill out the form below and embark on your business journey in the thriving Bintan Island landscape.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.