Hiring in Indonesia? Understanding BPJS, the mandatory social security system, is crucial. It provides healthcare and employment benefits, protecting employees and ensuring legal compliance.

Managing BPJS Indonesia can be complex, but this guide explains the basics and shows how an EOR service can simplify the process.

Why BPJS Indonesia is important for employees and employers

BPJS, or Badan Penyelenggara Jaminan Sosial, has two core programs: healthcare (BPJS Kesehatan) and employment-related social security (BPJS Ketenagakerjaan). As the foundation of worker protection and business sustainability, it provides valuable benefits for both employees and employers.

For Employees: Financial and Health Security

- Affordable healthcare access: BPJS Kesehatan ensures that workers and their families receive essential medical services at no higher cost.

- Income protection: BPJS Ketenagakerjaan offers critical support through old-age savings, workplace accident coverage, and death benefits.

- Long-term benefits: Contributions build toward pensions, helping workers secure a more stable post-employment future.

For Employers: Compliance and Competitive Advantage

- Legal obligation: Indonesian law requires all employers to register and contribute to BPJS.

- Employee retention: Workers are more likely to stay with employers who provide comprehensive health and social security coverage.

- Business reputation: A firm BPJS policy demonstrates your commitment to employee welfare, enhancing your employer brand, and aiding recruitment.

Read more: A guide to benefits in kind tax in Indonesia.

Healthcare Program in Indonesia (BPJS Kesehatan)

BPJS Kesehatan aims to provide universal access to healthcare for all citizens and eligible residents, including employees in both formal and informal sectors of the economy.

BPJS Kesehatan covers a wide range of medical services, including:

- General practitioner and specialist consultations

- Hospitalization and surgery

- Maternal and child health services

- Prescribed medications

- Laboratory and diagnostic tests

BPJS Kesehatan: Contribution Rate

Under the BPJS Kesehatan program, contributions are calculated for both employers and employees as follows:

- Employer: 4% (maximum of IDR 480.000)

- Employee: 1% (maximum of IDR 120.000)

The contribution rate is capped at a maximum monthly salary of IDR 12 million. If the employee’s wage exceeds IDR 12 million, the employer and employee will contribute using the upper limit rate.

2025 Updates on BPJS Kesehatan Classifications

To standardize healthcare services for all BPJS Kesehatan members, the government will implement a new system, Kelas Rawat Inap Standar (KRIS), starting in December 2025. This change, mandated by Presidential Regulation No. 59/2024, will replace the current three-tiered class system.

While the updated contribution rates under KRIS have not yet been announced, the existing monthly rates for non-employees and dependents remain in effect until further notice:

- Class I: IDR 150,000

- Class II: IDR 100,000

- Class III: IDR 35,000 (after government subsidy)

Social security in Indonesia (BPJS Ketenagakerjaan)

BPJS Ketenagakerjaan provides financial protection for employees against risks related to work accidents, death, retirement, and pension. All employers are legally required to register eligible employees in this program.

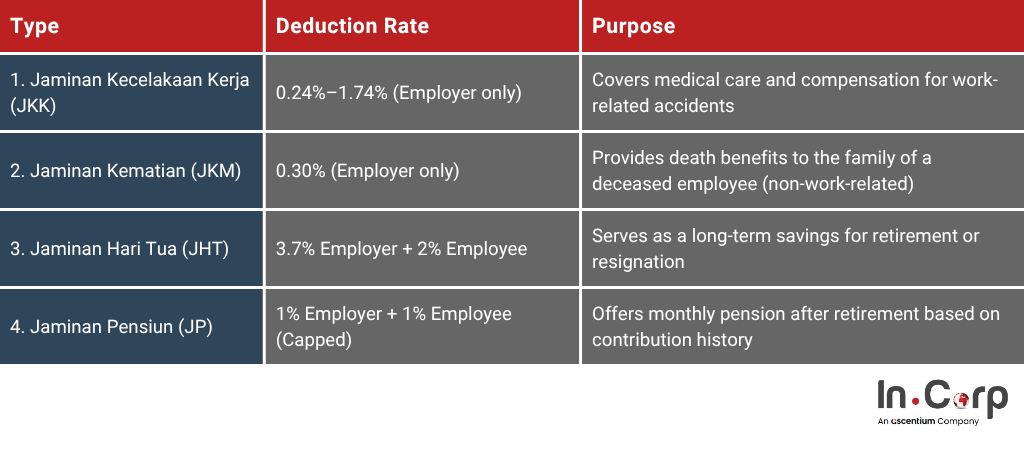

Below are the key components of BPJS Ketenagakerjaan:

1. Jaminan Kecelakaan Kerja (Work Accident Insurance/JKK)

This insurance provides coverage for medical care, rehabilitation, and compensation due to accidents at work or while commuting. JKK contribution is paid by employers ranging from 0.24% to 1.74% of workers’ monthly wage based on risk categories, such as:

| Risk Categories | Rate of Monthly Salary | Job Type |

| Low Risk (Class I) | 0.24% | Administrative and clerical jobs |

| Medium-Low Risk (Class II) | 0.54% | Retail and manufacturing with moderate risk |

| Medium Risk (Class III) | 0.89% | Various technical and service jobs |

| Medium-High Risk (Class IV) | 1.24% | Jobs with significant risk factors |

| High Risk (Class V) | 1.74% | Dangerous jobs, high injury risks |

2. Jaminan Kematian (Death Benefit/JKM)

JKM offers financial support to the deceased worker’s family when the death is not caused by a work accident or occupational disease. The employer pays all contributions at a rate of 0.3% of their monthly wage.

3. Jaminan Hari Tua (Old Age Protection/JHT)

JHT functions like a retirement savings plan, with benefits based on the contributions accumulated during the working period. JHT contribution is paid at 5.7% of the worker’s monthly wage, with details below:

- Employee Contribution: 2%

- Employer Contribution: 3,7%

4. Jaminan Pensiun (Pension Protection/JP)

JP is a social protection program that provides regular pension payments post-retirement based on years of service and contributions. This covers contributions amounting to 3% of the worker’s salary, with a maximum wage limit of IDR 10.547.400 (as of 2025). Contribution details are as follows:

- Employee Contribution: 1%

- Employer Contribution: 2%

Read more: Salary in Indonesia: A comprehensive guide for foreign businesses.

How EOR can help navigate BPJS implementation

implementing BPJS Indonesia can be challenging due to regulations and administrative tasks. An Employer of Record (EOR) simplifies this process so you can focus on business growth.

1. Contribution Management

EORs handle the calculation, reporting, and payment of BPJS Indonesia contributions, preventing errors and penalties.

2. Regulatory Compliance

They stay updated on regulatory changes and manage all reporting, keeping your business compliant effortlessly.

3. Foreign Worker Eligibility

EORs ensure proper BPJS enrollment for expatriates, avoiding legal issues and ensuring fair treatment.

4. Reduced Administration

By managing paperwork and system updates, EORs save time and lighten your HR team’s workload.

5. Employee Communication

They educate employees on their BPJS benefits, enhancing transparency and satisfaction.

Partnering with an EOR helps you meet BPJS Indonesia obligations, reduce risks, and streamline HR operations with ease.

Simplify your HR paperwork with InCorp

Managing BPJS Indonesia can be a complex and time-consuming process. As your trusted partner, InCorp Indonesia (an Ascentium Company) offers a seamless EoR solution—handling everything from BPJS registration to compliance so you can focus on growing your business.

- With our EOR solution, you can benefit from:

- Hassle-free BPJS Indonesia registration and contributions

- Timely updates and regulatory compliance

- Expert handling of foreign worker requirements

- Reduced administrative load with full legal assurance

Contact us today to simplify your HR tasks and stay focused on growing your business.

Frequently Asked Questions

What is an Employer of Record (EOR)?

An EOR is a third-party company that legally employs workers on behalf of another business, handling payroll, taxes, and compliance.

Who should use EOR services?

Companies expanding abroad or hiring remote workers without setting up a local entity benefit most from EOR services.

How does an EOR differ from a PEO

An EOR becomes the legal employer, while a PEO only co-manages HR functions with an existing local entity.

Is using an EOR legal in Indonesia?

Yes. EOR services comply with Indonesian labor laws, enabling foreign companies to hire employees legally without establishing a local company.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.