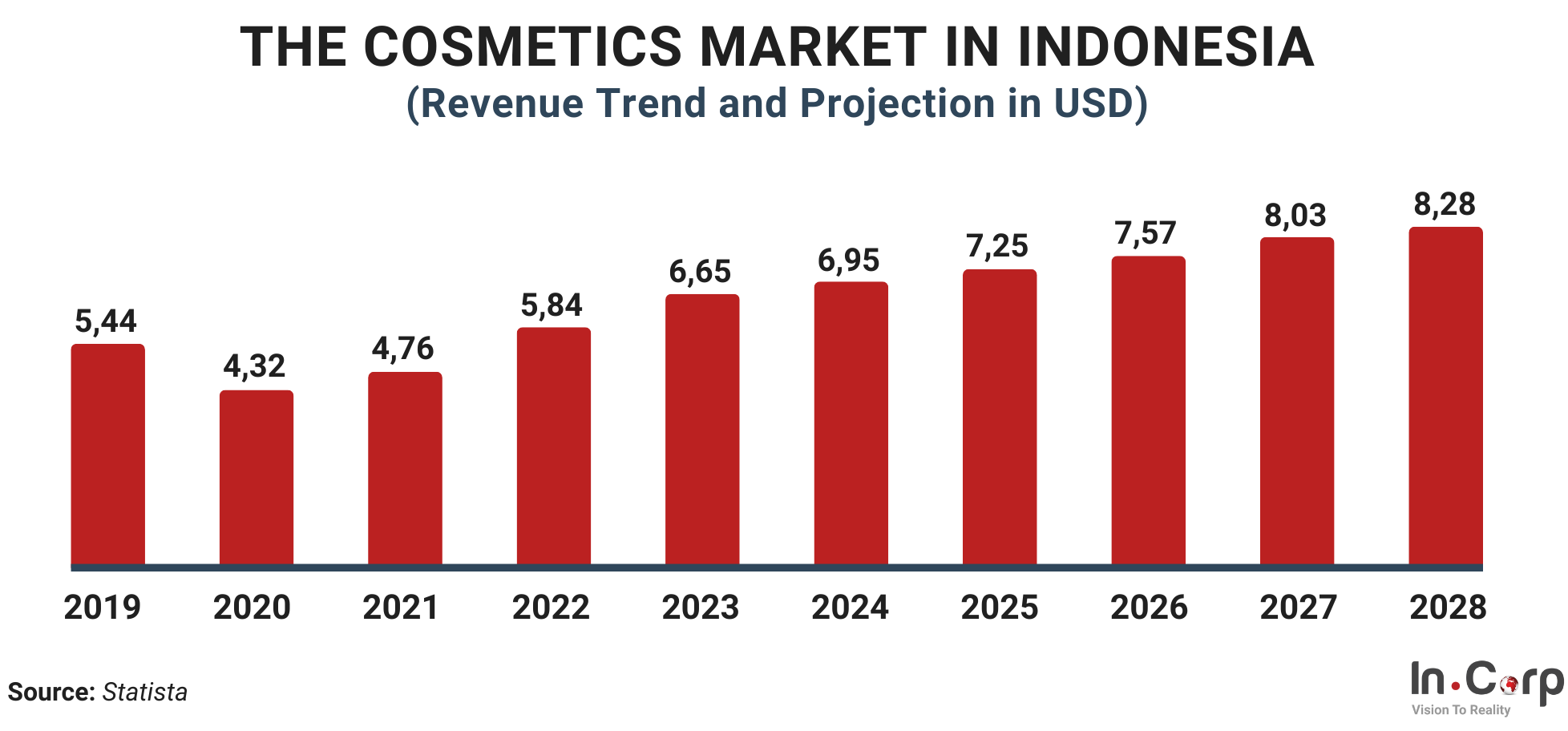

Indonesia’s cosmetic industry is a vibrant market brimming with potential for investors. With a rapidly growing population, rising disposable income, and a strong appetite for beauty products, Indonesia is projected to be one of the top five cosmetic markets globally within the next few years.

What is the cosmetic industry?

The cosmetic industry, also called the beauty industry, encompasses fragrances, skin, hair, personal care products, and color cosmetics such as facial makeup, nail care, lip care, and eye makeup products.

This sector experienced significant growth in the years before the pandemic. Allied Market Research said the global cosmetic market was valued at USD 380.2 billion in 2019.

The industry was projected to expand at a compound annual growth rate (CAGR) of 5.3%, reaching USD 463.5 billion by 2027.

Statista highlights that skincare products comprised 39% of the global market within the cosmetic industry, hair products constituted 21%, and makeup accounted for 19%.

The Asia Pacific region emerged as the industry leader in the same year, contributing around 40% to the world’s total revenue.

How big is the cosmetic industry in Indonesia?

The chemical raw materials industry group, which includes cosmetics, contributes a significant 6.8% to the GDP of the processing industry sector. This contribution ranks second after the food industry, which accounts for 17.2%.

This achievement is partly driven by the trend of natural and organic materials widely available domestically.

Indonesia is home to 40 out of 99 types of essential oil plants. Many domestically grown essential oil plants have been commercially cultivated and have become top export commodities in the global cosmetic industry market.

The Ministry of Industry (Kemenperin) recorded that by December 2023, Indonesia had exported around 9,500 tons of essential oil products, fragrances, and cosmetics.

Read more: Brand trademark registration guide for cosmetics & fashion industry in Bali

Trends and prospect in Indonesia’s cosmetic industry

The Indonesian cosmetics industry is highly competitive, and strong brand promotion is essential for success. As Indonesians become more image-conscious, many prefer natural-ingredient products, though foreign brands remain popular. Here are the key trends in this industry:

The rising demand for natural ingredient products

The cosmetics market in Indonesia is highly competitive, necessitating strong brand promotion for successful entry. Indonesian consumers have become more conscious of personal image and fashion, with 75% of women preferring beauty products made with natural ingredients.

Despite this preference, there is a general attraction towards foreign or foreign-like brands over local ones.

The rise of social media marketing

Personal care and cosmetics are available through various channels in Indonesia, including specialty stores, drug stores, department stores, supermarkets, direct marketing, skincare clinics, and beauty salons.

However, social media marketing is now capturing a significant market share that helps to grow the cosmetic industry.

The market spans various economic classes

The Indonesian cosmetics market caters to different economic classes. Imported products from Europe, Japan, South Korea, and the United States target the middle-to-upper class, while products from Thailand, South Korea, and Malaysia focus on the middle class.

Local brands like Mustika Ratu, Wardah, Sariayu Martha Tilaar, and international brands like Unilever and L’Oréal dominate the market. Smaller local brands have also shown promising sales, indicating domestic products can thrive.

Capitalizing on the halal cosmetic trends

The latest Indonesia Halal Economic Report estimates that the domestic halal cosmetics market will reach USD 4.19 billion in 2022, surpassing the overall economy with an annual growth rate of 8%.

The halal cosmetics industry has also experienced significant growth globally. The report from The State of the Global Islamic Economy (SGIE) estimated that Muslim spending on cosmetics was $84 billion in 2022, and it is forecast to increase to USD 129 billion by 2027.

Government regulation mandating halal certification for all domestically produced goods, including cosmetics, starting in October 2024, has further driven the growth of the halal industry in Indonesia, particularly in the halal cosmetics sector.

Challenges facing the cosmetic industry

The Indonesian cosmetics industry continues to grapple with several challenges that hinder its growth and development. Despite efforts to control the market, issues like illegal products, heavy dependence on imports, and a shortage of skilled talent persist, impacting the sector’s progress.

Mitigating the circulation of illegal products

Despite various efforts to minimize illegal cosmetic products in the country, the Indonesia National Agency of Drug and Food Control (BPOM) still finds such products in the domestic market.

Heavy dependence on imports

Approximately 90% of the raw materials used in cosmetics distributed in Indonesia are imported, leading to uncertainties in the country’s ability to verify the halal status of these products.

The complexity of raw material verification under the new local content regulation framework further complicates the development of the cosmetic industry.

Shortage of talents at a higher level

Another significant challenge is hiring more skilled talent in middle to top management positions. Companies must attract new talent and focus on training, developing, and retaining new and existing employees.

With increasing opportunities available to highly connected and agile local talents, a robust talent development strategy is essential for sustaining industry growth.

Register your cosmetics with InCorp

Indonesia’s booming beauty market offers excellent potential, but navigating regulations and legalities can take time and effort. Let InCorp be your guide.

We specialize in streamlining market entry for cosmetic businesses, tackling complexities head-on. Our comprehensive suite of services includes:

- Cosmetic Registration: We’ll handle the entire registration process with Indonesian authorities, ensuring your products meet all safety and compliance standards.

- Halal Certification: For brands targeting the lucrative halal market, we can guide you through the halal certification process, ensuring your products align with Islamic principles.

Don’t let market entry hurdles hinder your vision of success. Partner with InCorp and unlock the full potential of Indonesia’s thriving cosmetics industry.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.