Countries worldwide are working to reduce carbon emissions through decarbonization. Indonesia is no exception, targeting net zero emissions (NZE) by 2060, making carbon capture and storage (CCS) crucial for achieving this goal.

What is carbon capture and storage?

Carbon capture and storage help combat global warming and reduce carbon dioxide (CO2) emissions. They capture CO2 from power generation or industries like hydrogen, steel, or cement and store it underground.

In oil and gas, captured CO2 boosts the production of carbon capture, utilization, and storage (CCUS). CCS also aids the sector’s shift to low-emission energy.

What is the difference between carbon capture and carbon storage?

There is a distinct difference between carbon capture and carbon storage.

- Carbon capture refers to capturing CO2 emissions from industries such as power plants or factories.

- Carbon storage involves the safe and permanent geological storage of captured CO2 deep underground in depleted oil and gas reservoirs or saline formations.

The regulation of carbon capture and storage in Indonesia

Indonesia is developing a carbon capture and storage regulatory framework to support its net-zero emissions goals. Here’s a breakdown of the key points:

Presidential Regulation No. 14 of 2024

These regulations govern the implementation of carbon capture and storage (PR 14/2024). They establish the framework for CCS operations in the country and cover licensing, storage site selection, environmental monitoring, and liability.

Minister of Energy and Mineral Resources (ESDM) Regulation No. 2 of 2023

This regulation focuses on implementing CCS and CCUS for upstream oil and gas business activities, specifically on CCS activities within the oil and gas industry.

SKK Migas Working Guideline

This guideline (No. PTK-070/SKKIA0000/2024/S9 (PTK-070)) provides detailed technical requirements for CCS projects in the oil and gas sector.

Read more: Sustainable business models built on green infrastructure

Potential benefits of CCS in Indonesia

Indonesia has significant potential for implementing CCS and CCUS technologies, which provide substantial benefits for managing carbon emissions.

Strategic geographic and geological advantages

Indonesia’s strategic geographic and geological advantages in the Asia-Pacific region enhance this potential. Geologically, Indonesia is rich in saline aquifers, which are ideal for CO2 storage and have a capacity of 80 to 100 gigatons.

Projects and developments

Currently, 16 CCS/CCUS projects in Indonesia are in the study and preparation stages. When utilized optimally, CCS and CCUS applications extend beyond global emission reduction and can support sustainable energy production.

This includes improving access to affordable, sustainable, and modern energy for all and ensuring the well-being of all societal segments.

Indonesia embraces the CCS projects

Indonesia is actively investigating avenues to transform the nation into a regional CCS hub, leveraging its vast potential in depleted hydrocarbon reservoirs and saline aquifers.

Several significant investment milestones have been achieved in this pursuit. Some of these include:

Japanese investments in CCS projects in Papua

In Indonesia, Japan’s largest electric utility, Chubu Electric Power, signed a memorandum of understanding (MoU) on September 11, 2023, for a feasibility study on carbon capture, utilization, and storage and export through the Port of Nagoya, Japan.

This initiative aims to explore potential CO2 storage at the Tangguh field in Bintuni Bay, West Papua, where BP-owned BP Berau Ltd operates.

Additionally, on January 25, 2023, Nippon Steel, Mitsubishi Corporation, and ExxonMobil announced their plans to conduct carbon capture research at Nippon Steel’s domestic steelworks and establish related infrastructure in the Asia Pacific region.

This plan includes a detailed evaluation of storage opportunities in Malaysia, Indonesia, and Australia.

Singapore and Indonesia collaborate on CCS

Singapore is the first country to initiate a pioneering cross-border collaboration on carbon capture and storage with Indonesia.

On February 15, 2024, Singapore signed a letter of intent (LOI) with Indonesia, highlighting its commitment to establishing a working group to develop a legally binding bilateral agreement.

This agreement will facilitate the cross-border transportation and storage of carbon dioxide (CO2) between the two nations, representing a significant milestone in their efforts toward sustainable development and environmental stewardship.

The potential of CCS in Indonesia’s economy

CCS technology has the potential to significantly contribute to Indonesia’s economic development through large-scale carbon capture and storage projects, such as:

Running in a high-project activity

According to data from the Ministry of Energy and Mineral Resources (ESDM), there are at least 15 CCS/CCUS projects in Indonesia, most of which are still in the study phase.

These projects include BP Tangguh in West Papua, Pertamina Sukowati, Sakakemang CCS, and Arun CCS. Additionally, there is the Sunda-Asri CCS, a collaboration between Pertamina and ExxonMobil.

Offering massive storage capacity

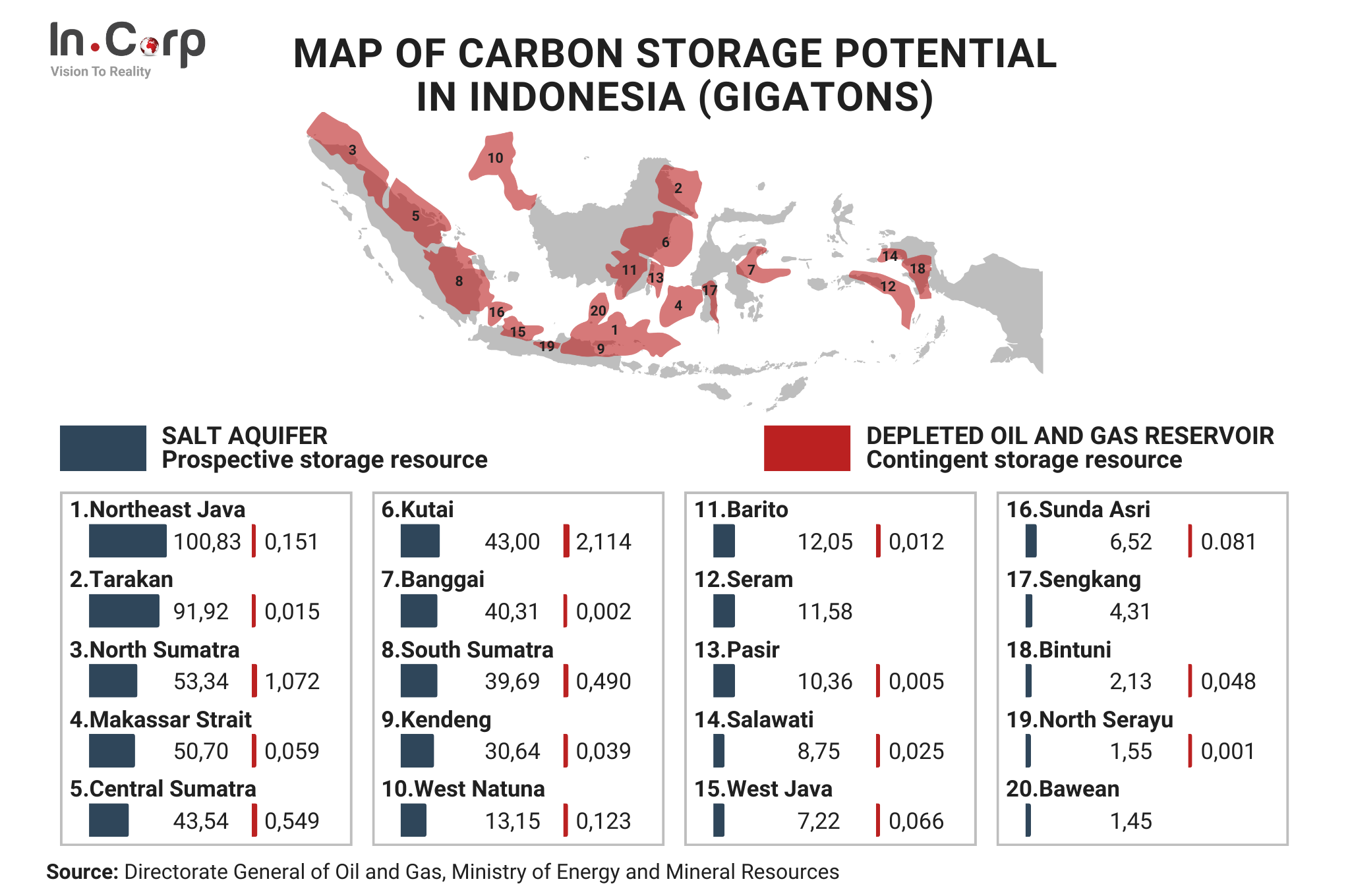

Based on calculations by the ESDM, Indonesia has a total CO2 storage potential of 577 gigatons, comprising depleted reservoirs (4.85 gigatons) and saline aquifers (572.77 gigatons).

This figure is derived from calculations of 20 basins spread across various regions in Indonesia, all of which are already in production.

Regulated distribution for many regions

The largest storage capacity is in the North East Java basin, located offshore in northern East Java. This basin is estimated to store 100.83 gigatons of carbon using the saline aquifer method and 0.151 gigatons using the depleted reservoir method.

Challenges of CCS in Indonesia

Despite significant progress, Indonesia faces several challenges in adopting carbon capture and storage technology.

Financial aspect

- Implementing CCS technologies requires significant investment.

- Balancing the economic viability with environmental benefits is a critical issue.

- The government must explore funding mechanisms, partnerships, and financial incentives to attract investors.

Suitable storage sites

- Developing safe and permanent storage sites for captured carbon is essential.

- Identifying and securing appropriate locations is a significant challenge.

- Ensuring public acceptance and addressing potential environmental and social impacts are crucial.

- Transparent communication and stakeholder engagement are essential for success.

Start your green transformation with InCorp

Indonesia aims to achieve net-zero emissions by 2060, demonstrating its dedication to a more environmentally friendly future. This effort strongly emphasizes promoting carbon capture and storage (CCS) technology. How can your company contribute to this shift toward sustainability?

At InCorp, every business, regardless of size, plays a crucial role. We offer comprehensive ESG Advisory services to support your sustainability journey.

Begin your green transformation and secure a sustainable future for your business and the environment by clicking the button below.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.