Free Trade Zones (FTZs) in Indonesia are gateways to significant benefits, including customs duty exemptions, tax incentives, and simplified procedures. However, these advantages can only be fully realized if businesses comply with the updated customs notification rules.

The key to this process is PPFTZ 01, 02, and 03, documents used to declare the movement of goods in and out of FTZs. Under the latest regulation, PER-4/BC/2025, their use is more structured and must follow electronic submission standards.

Understanding a Free Trade Zone in Indonesia

A Free Trade Zone (FTZ) in Indonesia is a designated area where businesses can import, store, process, and re-export goods without being subject to customs duties and taxes. These zones are designed to welcome international trade and investment through operational and fiscal advantages.

Key characteristics of FTZs

- Goods can enter and remain duty-free if they stay within the zone or are re-exported.

- Simplified customs procedures make it easier to manage logistics and reduce clearance times.

- FTZs are ideal for manufacturing, repackaging, or assembling goods before export.

While similar to bonded zones and special economic zones (SEZs), FTZs are governed by their own regulatory bodies and offer broader incentives. Businesses operating in these zones must comply with specific customs documentation to legally move goods in and out of the FTZ.

Read more: Why should you invest in Batam Free Trade Zone

The legal framework of free trade zones in Indonesia

Free trade zones in Indonesia operate under a well-defined legal structure that promotes trade while maintaining regulatory oversight. This framework is based on ministerial and customs regulations governing goods moving in, out, and within FTZs. Key regulations include:

- PMK No. 48/PMK.04/2012: Initially established the guidelines for customs procedures in FTZs.

- PMK No. 42/PMK.04/2020: Amended and refined the earlier rules, introducing updated customs treatment and electronic systems.

- PER-4/BC/2025: The latest regulation, effective March 31, 2025, provides a more comprehensive structure for PPFTZ notifications and mandates integrated electronic submissions.

The Directorate General of Customs and Excise (DJBC) issued and enforced these regulations. They are supported by the Indonesia National Single Window (INSW) system, which facilitates real-time document processing and risk assessment.

While FTZs offer operational flexibility, this legal framework ensures transparency and accountability within Indonesia’s broader customs and taxation system.

Understanding PPFTZ notifications (2025 update)

Indonesia uses a system of customs notifications known as PPFTZ (Pemberitahuan Pabean Free Trade Zone) to manage the movement of goods in and out of free trade zones. These documents are essential for businesses to declare goods legally and avoid delays or penalties.

Under the updated PER-4/BC/2025 regulation, PPFTZ notifications are categorized by purpose and goods flow. They must now be submitted electronically through the Sistem Komputer Pelayanan (SKP) linked to the Indonesia National Single Window (INSW). Each PPFTZ type serves a specific function:

PPFTZ 01: For goods entering or exiting the FTZ and customs area

Used when:

- Importing goods into the FTZ from outside Indonesia’s customs area (e.g., international shipments).

- Exporting goods from the FTZ to overseas markets.

- Moving goods from the FTZ into Indonesia’s domestic market.

This is the most commonly used PPFTZ type, covering external trade and local market release.

PPFTZ 02: For goods moving between zones

Used when:

- Transferring goods from one FTZ to another.

- Moving goods between an FTZ and a bonded logistics center (TPB).

- Moving goods between an FTZ and a Special Economic Zone (KEK).

This type facilitates inter-zone logistics within the customs territory without triggering import duties.

PPFTZ 03: For goods entering the FTZ from within Indonesia

Used when:

- Importing goods from within Indonesia’s customs area into an FTZ.

- This applies to domestic suppliers sending raw materials or products into a free trade zone.

Each notification type must be prepared with accurate details of goods, origin, destination, and purpose. Mistakes in selection or documentation can lead to customs rejections or tax complications.

Document requirements for PPFTZ submissions

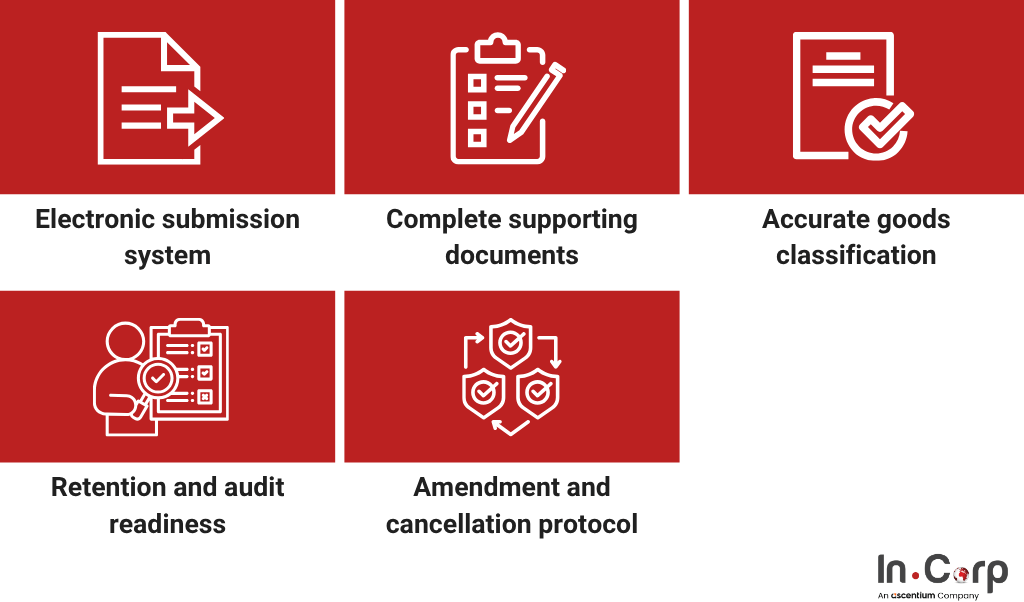

Managing PPFTZ documents is about ensuring accuracy, compliance, and traceability in line with PER-4/BC/2025. Key compliance requirements include:

- Electronic submission via SKP is integrated with the INSW system.

- Documents such as invoices, packing lists, and transport records.

- Correct classification of goods, using accurate HS Codes and declared values.

- Proper recordkeeping to meet audit and retention requirements.

- Clear protocols for amending or canceling declarations when needed.

Clear Paths to Product Registration in Indonesia

Easily manage documents in Free Trade Zones with InCorp

If you’re planning to operate in a free trade zone or need to regularize your current status, InCorp Indonesia (an Ascentium Company) can help streamline the process from start to finish. Our product registration and licensing services include:

- Business licensing with Free Trade Zone authorities

- Assistance with PPFTZ registration and customs system setup

- Regulatory compliance advisory

- Customs documentation support for import/export

- Ongoing reporting and amendment assistance for PPFTZ filings

- Import restructuring to optimize logistics and maximize FTZ incentives

Click the button below to license your business in Indonesia’s Free Trade Zones seamlessly.

Frequently Asked Questions

What is a Free Trade Zone (FTZ) in Indonesia?

A Free Trade Zone is a designated area where businesses can import, store, process, and re-export goods without paying customs duties or taxes, making it ideal for manufacturing and export operations.

What are the benefits of operating in a Free Trade Zone?

Companies enjoy duty exemptions, tax incentives, and simplified customs procedures, helping reduce costs and improve logistics efficiency.

What are PPFTZ 01, 02, and 03 documents?

These are customs notifications used to declare the movement of goods in and out of FTZs. Each type covers different transactions—imports, inter-zone transfers, and domestic supplies.

Why is PER-4/BC/2025 important for FTZ businesses?

This new regulation requires electronic submission of PPFTZ documents through the INSW system, ensuring transparency and faster customs processing.

What happens if PPFTZ notifications are incorrect or incomplete?

Errors in documentation can lead to customs rejections, delays, or loss of tax exemptions, so accuracy and compliance are essential.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.