When investing in Indonesia, a clear understanding of the business registry process is crucial. You could face legal, financial, and operational risks without proper registration and valid licenses.

This article will guide you through the company registration framework in Indonesia and the common pitfalls to avoid. By the end, you will have a clear roadmap to start your business confidently in Indonesia.

Why businesses should comply with business registration requirements in Indonesia

Following the Indonesia business registry rules is the key to running your business legally and gaining trust. Here is why it matters:

Legal Status and Protection

Registering your company gives it official legal status. This enables:

- Legal protection of your company’s name and brand.

- The ability to sign contracts and enter into agreements.

- Legal standing in court (you can sue or be sued).

- Access to essential business permits and licenses.

Builds Trust and Credibility

Being listed in the Indonesia company registry shows customers, partners, and investors that your business is serious and trustworthy. It opens doors to more opportunities and partnerships.

Avoids Legal Trouble

Unregistered businesses risk operating illegally. This can lead to:

- Fines

- Business closure

- Reputational damage

- Deportation for foreign owners

Getting your company registration number through the OSS system ensures you are entirely legal and ready to grow in the Indonesian market.

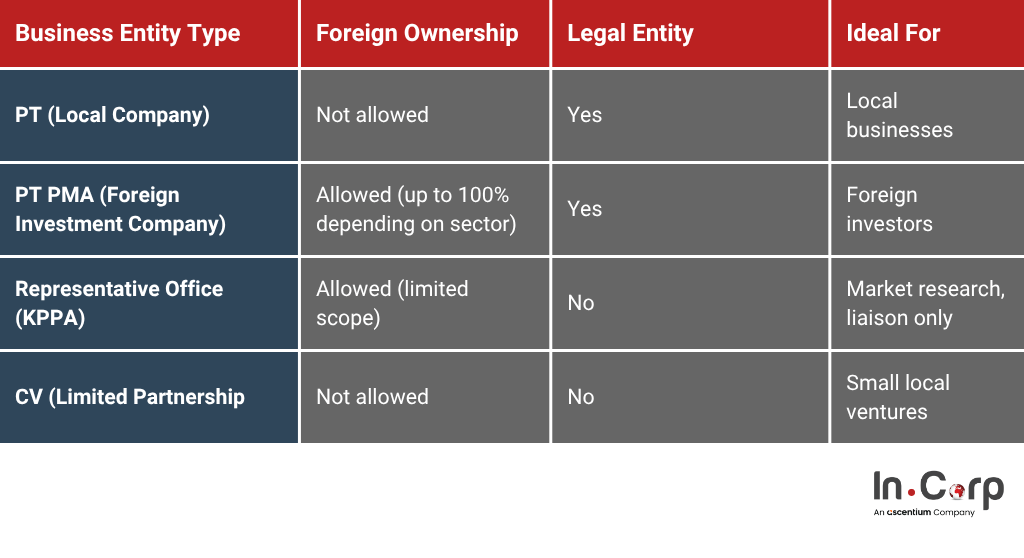

Types of business entities in Indonesia

Before you register your business, choosing the right type of business structure is crucial. Each entity type has its own set of rules, benefits, and restrictions, especially for foreign investors.

PT PMA: The Best Option for Foreign Investors

The most popular structure for investing in Indonesia is the PT PMA. It offers:

- Legal protection and full foreign ownership (in approved sectors).

- Eligibility to obtain business licenses.

- Access to Indonesia’s company registration and licensing systems.

The first step in company formation is choosing the proper structure. This structure affects your rights, tax obligations, and the speed at which you can begin operations.

Read more: Exploring PT PMA in Indonesia: How to establish a foreign-owned company

Key requirements to Indonesia business registry: NIB and OSS explained

To complete Indonesia business registry process, you must secure two core components: the NIB (Business Identification Number) and the OSS (Online Single Submission) system. These tools help simplify and centralize the Indonesia business registry process.

Business Identification Number (NIB)

The NIB (Nomor Induk Berusaha) is Indonesia’s official business registration number. This number is your company’s unique identity and acts as a company registration certificate, import-export license, customs registration, and tax identification number.

To apply for an NIB, you need to submit the following documents via the OSS platform:

- Deed of Establishment and its approval from the Ministry of Law and Human Rights.

- Taxpayer Identification Number (NPWP) of the company.

- Identity documents of shareholders and directors (passport or ID card).

- Business domicile letter or proof of company address.

- Company’s business activity classification (KBLI).

- Investment details (if applicable for PT PMA).

- Environmental and building permits (for specific sectors).

Read more: 7 ways company registration number benefits your business

Online Single Submission (OSS)

The OSS system is Indonesia’s official digital business licensing and registration platform. Through OSS, you can:

- Register and generate your NIB.

- Apply for additional licenses (e.g., commercial, location-based, sector-specific).

- Track application statuses in real time.

OSS makes the process more transparent and efficient for foreign investors doing business in Indonesia.

Common mistakes to avoid when registering businesses in Indonesia

Starting a business in Indonesia is easier with the OSS system, but many foreign investors still make mistakes that cause delays or legal problems. Here are the most common ones:

Choosing the Wrong Business Entity

Many investors rush into company formation without fully grasping the implications of the business entity structure. For instance, choosing a local PT (which does not allow foreign ownership) instead of a PT PMA can lead to significant setbacks. Choosing the proper structure that aligns with your business goals is crucial.

It’s essential to choose the right business structure that aligns with your business goals. This decision can significantly impact your business operations and ownership rights. Make sure you are well-informed and empowered to make the right choice.

Incomplete Documents

Missing or incorrect documents are a significant reason for company registration delays in Indonesia. This includes errors in:

- Identity documents

- Company address

- Shareholding structure

- KBLI classification codes

Missing Industry-Specific Licenses

Not all licenses are covered by NIB. Some sectors (e.g., education, healthcare, construction) require additional business licenses. Failing to secure these can lead to penalties or suspension of operations.

Using a Virtual Office Without Valid Domicile Proof

While virtual offices are common, many businesses fail to get the valid domicile letters required for OSS submission.

Read more: Choosing the best company registration consultant for startups

Streamline your business registration in Indonesia with InCorp

Indonesia business registry procedure can be complex—but you do not have to do it alone. InCorp Indonesia (an Ascentium Company) specializes in helping both local and foreign investors with:

- Company registration (including PT and PT PMA setup)

- NIB and OSS applications

- Business licensing across various sectors

- Ongoing compliance and legal support

Contact us today and let us help you streamline your business journey in Indonesia.

Frequently Asked Questions

What is the Indonesia business registry?

The Indonesia business registry is the official system for registering and licensing companies. It gives your business legal recognition to operate in Indonesia.

What type of entities can be registered

Common entities include PT (local company), CV (partnership), and PT PMA (foreign-owned company). For foreign investors, PT PMA is the most suitable option.

What is needed to complete the process?

You must obtain a Business Identification Number (NIB) and register through the OSS (Online Single Submission) system.

What documents are needed for NIB registration?

Key documents include the Deed of Establishment, NPWP, shareholder/board IDs, company address proof, KBLI (business classification), and permits if needed.

How does the OSS system support the company registration process?

The OSS platform allows businesses to apply for an NIB, request additional licenses, and track applications online, making the process faster and more transparent.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.