With its vast opportunities for foreign investors, Indonesia is an exciting prospect for Chinese businesses looking to expand. Understanding how to enter the Indonesia company registry and meet local business regulations is the key to unlocking these opportunities for a successful launch.

This guide walks you through the registration process, from obtaining your business registration number to understanding industry access, staffing, and long-term compliance.

Can Chinese businesses register a company in Indonesia?

Foreign businesses, including those from China, are allowed to register and entirely own companies in Indonesia, provided they follow the official framework set by the government.

Foreign investors must register under a PT PMA (Perseroan Terbatas Penanaman Modal Asing) structure, which allows up to 100% foreign ownership in approved sectors. Registration must comply with guidelines from the Indonesia Investment Coordinating Board (BKPM), including proper company formation steps and meeting capital requirements.

Once approved, your company can be listed in the Indonesia company registry, receive a valid registration number, and begin operations.

What industries are open to 100% Chinese foreign ownership

Indonesia’s Positive Investment List defines the business sectors where full foreign ownership is allowed. Before entering the Indonesia company registry, ensure your activity falls under these approved industries:

- Oil and gas construction

- Onshore/offshore drilling and distribution

- Electricity generation, including geothermal power

- Telecommunications and e-commerce

- Pharmaceutical manufacturing

- Hospital operations

- Port and airport support services

- Supermarkets under 1,200 sqm

- Department stores between 400–2,000 sqm

- Maritime cargo handling

However, some sectors remain off-limits to both local and foreign companies, including:

- Gambling and casino operations

- Production of narcotics and chemical weapons

- Fishing of endangered species

- Manufacturing of alcoholic beverages

- Use of natural coral for commercial purposes

Confirming your business activity early avoids registration delays or rejections.

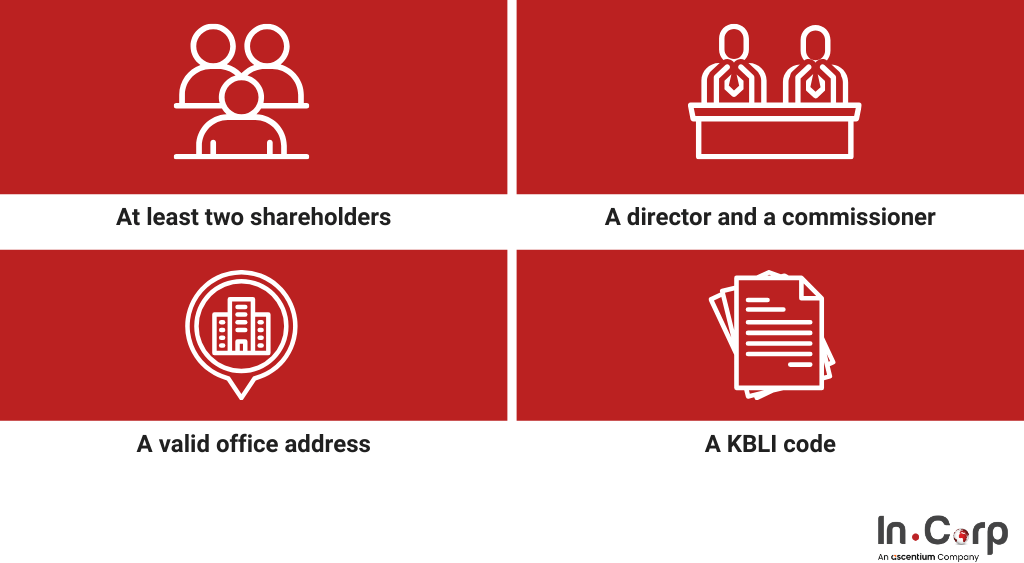

Key requirements for Indonesia company registry

To be listed in the Indonesia business registry, foreign investors must set up a PT PMA and meet the following core requirements:

- At least two shareholders (individuals or entities)

- A director and a commissioner

- A valid office address in a commercial zone

- A KBLI code that aligns with your business activity

These requirements form the legal foundation for Indonesia company registry and licensing.

Updated capital requirement for foreign companies

As of 2025, Indonesia has reduced the minimum paid-up capital for foreign-owned companies to IDR 2.5 billion (around USD 160,000). This capital must be declared during registration and can be used for operational needs. Failing to meet this minimum may lead to rejection.

Read more: PT PMA capital investment: Requirements and guidelines in Indonesia

Registering your business and securing a business license

Once your PT PMA is established, the next step is applying for your Business Identification Number (NIB) through the OSS system. This serves as your company’s official business registration number.

Depending on your activity, you may also need specific sectoral licenses. For example:

- Trade license for import/export or retail

- Environmental permits for manufacturing

- Industry-specific approvals for health, logistics, or tech sectors

Can you send staff to Indonesia after registration?

Yes, foreign-owned companies can sponsor and employ staff from their home country. However, the process requires proper permits:

- Your company must sponsor each foreign staff member

- Apply for a work permit (IMTA) from the Ministry of Manpower

- Follow up with a KITAS (Temporary Stay Permit)

- Submit all documentation via Indonesia’s online visa system (VITAS)

Some roles may be reserved for Indonesian workers, and foreign-to-local employee ratios must be respected.

7 common mistakes of registering a business in Indonesia

Entering the Indonesia company registry may seem straightforward, but many Chinese businesses encounter delays or legal issues due to avoidable mistakes. Here are the most common ones:

- Choosing the wrong KBLI code

- Underestimating minimum capital requirements

- Using an invalid or non-commercial office address

- Appointing ineligible directors or commissioners

- Submitting incomplete documentation

- Ignoring post-registration license requirements

- Starting operations before full approval is granted

Avoiding these errors ensures a faster, smoother path into the Indonesia business registry and prevents costly legal setbacks.

Benefits of proper business registration in Indonesia

Registering your company in Indonesia helps ensure legal operations, employee management, and smooth growth. Here’s what you gain:

Business registration and licensing

You’ll need an NIB and a business license based on your company’s activities. These documents make your operations legal and visible in the Indonesia company registry.

- PT PMA structure

- KBLI code selection

- OSS system registration

Tax compliance

A registered company must meet tax obligations to avoid penalties.

- NPWP (Tax ID)

- VAT and corporate tax setup

- Monthly and yearly tax filing

Hiring and employment compliance

Legal registration allows hiring workers and sponsorship of foreign staff, such as Chinese managers.

- Work contracts and BPJS registration

- IMTA and KITAS for foreign staff

Industry and environmental compliance

Specific sectors need extra approvals, especially in food, health, and manufacturing.

- BPOM or halal licenses

- Environmental (AMDAL) clearance

Intellectual property protection

Only registered businesses can protect their brand and products in Indonesia.

- Trademarks

- Patents

- Copyrights

Staying legally compliant

Proper registration makes updates, renewals, and expansions easier over time.

- License renewals

- Business updates

- Compliance reports

Guide to Doing Business in Jakarta

Simplify your Indonesia company registry with InCorp

Indonesia has potential, but foreign companies must carefully navigate local laws. InCorp Indonesia (an Ascentium Company) provides end-to-end support, helping your business enter and grow in Indonesia smoothly. Here’s how we can assist:

- Company registration and PT PMA setup in line with BKPM regulations

- Business licensing based on your selected KBLI activity

- Tax ID registration (NPWP) and monthly/annual tax reporting

- Work permit (IMTA) and KITAS processing for Chinese staff

- Registered office address services in major Indonesian cities

- Ongoing compliance and renewal support to keep your entity active

Fill out the form below to ensure your entry into the Indonesia business registry is smooth, fast, and fully compliant.

Frequently Asked Questions

Can Chinese businesses register a company in Indonesia?

Yes. Chinese investors can register a PT PMA and own up to 100% of the company in approved sectors under BKPM regulations.

Which industries allow 100% Chinese foreign ownership?

Sectors such as oil & gas services, telecom, e-commerce, pharma, hospitals, drilling, logistics, and retail (within size limits). Restricted sectors include gambling, narcotics, alcohol, and coral use.

What are the basic requirements to register a company?

You need two shareholders, a director, a commissioner, a commercial office address, and the correct KBLI code.

What is the minimum capital for a foreign-owned company?

As of 2025, the minimum paid-up capital is IDR 2.5 billion, which must be declared and used for operations.

Can Chinese companies send staff to Indonesia after registration?

Yes. Companies may sponsor foreign employees by securing IMTA (work permit) and KITAS, following Indonesia’s staffing and ratio rules.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.