Indonesia’s employment landscape is undergoing rapid changes due to economic shifts and evolving labor market demands. One key support system is the Jaminan Kehilangan Pekerjaan (JKP), which offers financial relief, job training, and reemployment support during layoffs.

For both employers and employees, understanding available social security programs is essential. With new regulations now in place, employers must understand how the JKP program works.

This article covers everything you need to know about JKP and how to navigate recent updates to keep your business compliant.

Navigating Indonesia’s workforce challenges in 2025

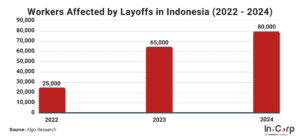

In 2025, Indonesia is expected to face a significant increase in job losses. By March, over 35,000 workers had claimed JKP benefits, marking a double rise compared to the same period in 2024. Sectors such as manufacturing, retail, and services have been hit the hardest by ongoing cost-cutting and restructuring.

This surge highlights growing reliance on job loss protection as companies adjust to shifting economic conditions. For employers in Indonesia, the JKP program becomes crucial in supporting the workforce’s transition from job loss to reemployment.

What is JKP in Indonesia?

Jaminan Kehilangan Pekerjaan is a government-mandated job loss program administered by BPJS Ketenagakerjaan. It is designed to support workers who have lost their jobs through no fault of their own. The program offers a safety net by providing the following:

- Cash benefits

- Access to labor market information

- Job training and career counseling

Objectives of the program

According to BPJS Ketenagakerjaan, the primary goals of Jaminan Kehilangan Pekerjaan are to:

- Maintain the welfare of laid-off workers

- Support job mobility and faster reemployment

- Improve worker skills through training and job placement support

This program does not replace severance pay or other legal benefits. Instead, it adds extra support to help workers during their transition. Employers contribute to this scheme indirectly through government subsidies without increasing company payroll expenses.

What are the benefits?

The JKP program offers several key benefits to eligible workers, helping them manage the transition after losing their jobs. These benefits include:

1. Cash Allowance

Based on the previous Government Regulations 37/2021, eligible workers receive a monthly allowance for up to six months. The amount is:

- 45% of the last reported wage for the first 3 months

- 25% of the salary for the next 3 months

2. Job Market Access

JKP provides access to an online platform managed by Indonesia’s Ministry of Manpower, SIAPKerja. Through this platform, job seekers can search for openings, register for recruitment events, and receive career advice.

3. Job Training and Upskilling

Laid-off workers can attend training programs organized by government-certified institutions. These programs focus on practical skills, helping individuals stay competitive in the labor market.

Who is eligible to receive JKP?

Not all workers are automatically eligible for JKP benefits. To qualify, employees must meet specific criteria set by BPJS Ketenagakerjaan and the Indonesian government.

- Indonesian citizen with a valid NIK; under 54 years old at registration.

- Formal sector employee registered with BPJS Ketenagakerjaan

- Minimum contributions: 12 months in the last 24, with 6 consecutive months before layoff

- Involuntary termination (not resignation, retirement, or misconduct)

- Proof of termination (termination letter, employment history, NPWP)

2025 updates on JKP policy

The Indonesian government has recently introduced key changes to JKP policy based on Government Regulation No. 6 of 2025. Effective February 7, 2025, this reform aims to support unemployed workers while balancing business sustainability.

The changes include cost adjustments and new responsibilities for companies operating in Indonesia. Here’s the update breakdown below:

Fixed 60% Salary Benefit

Under the previous regulation, JKP offered a tiered payout of 45% of wages for the first three months, followed by 25% for the next three. The updated policies replace this scheme with a flat 60% salary benefit for a period of six months.

However, benefits are capped based on a maximum salary of IDR 5 million, with a monthly payout limit of IDR 3 million.

Lower Employer Contributions

To ease the financial burden on businesses, the government has lowered the employer contribution rate to the job loss program fund from 0.46% to 0.36% of an employee’s monthly wage.

Protections from Bankruptcy

A new clause, Article 39A, ensures that laid-off employees remain eligible for JKP benefits even if their employer becomes insolvent or uncooperative.

How to claim it: A step-by-step guide

Claiming Jaminan Kehilangan Pekerjaan benefits involves several steps, but the process has been made more efficient with recent digital integration.

Workers who meet the eligibility criteria can apply through the Minister of Manpower’s online system or visit a service office. Below is the step-by-step process to follow:

1. Prepare Required Documents

Workers should claim their JKP benefits within 3 months after layoffs. Applicants must gather the following documents:

- Termination letter

- Updated ID (e-KTP)

- NPWP (Tax ID Number)

- Latest BPJS Ketenagakerjaan membership card

- Employment history or last payslip

2. Online Registration through SIAPKerja

After preparing the necessary documents, workers should register through the SIAPKerja platform using their national ID (NIK) and provide any additional personal information as required.

3. Report Employment Termination

If your employer hasn’t reported the layoff, submit it via SIAPKerja by entering job details, reason, company info, termination date, and uploading your termination letter.

4. JKP Claim Submission

Complete the online claim form, sign a readiness-to-work statement, and provide your active bank account details.

5. Verification and Self-Assessment

BPJS verifies your claim in 3 days. Meanwhile, complete the self-assessment on SIAPKerja to get job and training suggestions. Approved applicants get notifications on benefits and training options.

6. Training & Benefit Disbursement

Join training programs through SIAPKerja and receive monthly cash benefits directly to your bank account for up to 6 months.

Responsibilities for Foreign and Domestic Employers

The updated job loss program brings new responsibilities for both local and foreign businesses in Indonesia. Employers need to stay compliant while also actively supporting workforce transitions.

1. Data Reporting and Compliance

Regularly update employee data in BPJS to avoid delays and legal issues.

2. Cost Planning and Payroll Management

Include JKP contributions in payroll despite the lower rate.

3. Responsibility in Termination Scenarios

Provide termination documents to help workers claim JKP. Companies remain liable for unpaid contributions even if bankrupt.

4. Strategic Use of Employer of Record (EOR) Services

Read More: Why Choose HRO: A simple guide to HR outsourcing.

Stay compliant and support your workforce with InCorp

Indonesia’s evolving labor landscape presents both challenges and opportunities for employers. Whether you’re a foreign or local employer, understanding and complying with the JKP program is essential to protect your workforce and your business.

InCorp Indonesia (An Ascentium Company) can help navigate these changes seamlessly. Our services include:

- Employer of Record (EOR): We handle payroll, taxes, BPJS registration, and employee benefits, helping your business stay fully compliant with Indonesian labor regulations.

- Recruitment Agency: We manage comprehensive recruitment tasks to keep your operations smooth, efficient, and compliant.

Move forward with confidence. Let us manage your HR compliance, allowing you to focus on supporting your team effectively.

Frequently Ask Questions

What is an Employer of Record (EOR)?

An EOR is a third-party company that legally employs workers on behalf of another business, handling payroll, taxes, and compliance.

Who should use EOR services?

Companies expanding abroad or hiring remote workers without setting up a local entity benefit most from EOR services.

How does an EOR differ from a PEO

An EOR becomes the legal employer, while a PEO only co-manages HR functions with an existing local entity.

Is using an EOR legal in Indonesia?

Yes. EOR services comply with Indonesian labor laws, enabling foreign companies to hire employees legally without establishing a local company.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.