Indonesia’s tax audit rules will evolve in 2025. With the introduction of Minister of Finance Regulation No. 15 (PMK-15), the government aims to make tax audits faster and more transparent. These changes will affect how businesses are audited and how disputes are resolved.

This guide will explain everything you need to know about the new tax audit procedures and how to navigate them seamlessly for your business.

What changed in 2025?

Effective 14 February 2025, the Ministry of Finance issued PMK-15, replacing earlier audit regulations in PMK‑172, PMK‑256, and PMK‑184. The new rules align with Indonesia’s Core Tax system, focusing on efficiency and digital processes to streamline a uniform audit process.

Here are the key highlights of the legal update:

- Effective Scope: The regulation applies to any Tax Audit Notification Letter (SP2) issued on or after 14 February 2025.

- Digital Transition: Audit documents may be digitally signed and submitted electronically, a shift designed to integrate with the Core Tax system.

- Shorter Deadlines: The updated regulation imposes tighter timelines for audit closing and taxpayer responses.

Read more: Navigating Indonesia’s new Core Tax System.

Types of tax audit

Previously, the Directorate General of Taxes (DGT) differentiated compliance checking tax audits into field tax audits, office tax audits, and tax audits for concrete data. However, under PMK-15/2025, Indonesia now classifies tax audits into three types, each with a different focus and duration. This change helps streamline the audit process and improve efficiency.

1. Comprehensive Audit

Covers all tax aspects in detail, including multiple tax types and complete documentation. It applies to complex cases or routine checks. The audit can take up to 5 months.

2. Focused Audit

Targets specific tax items or issues flagged by the tax office. Taxpayers are informed in advance about what will be audited. The process lasts up to 3 months.

3. Specific Audit

It deals with minor or limited issues, like a single transaction. It’s the fastest type of audit, completed within one month, and doesn’t require preliminary meetings or discussions of findings.

Read more: Understanding the duties of the Directorate General of Taxes in Indonesia

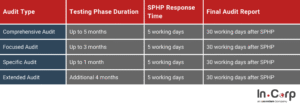

Tax audit new timeline

The 2025 update (PMK‑15/2025) overhauled the timelines for Indonesia’s tax audits, improving clarity, speed, and consistency based on the type of audit.

Testing Phase

- Comprehensive Audit: Now up to 5 months, down from the previous 6 months maximum.

- Focused Audit: Maximum of 3 months.

- Specific Audit: Completed within 1 month.

- Extended Audits: The testing phase can be extended to 4 additional months (previously up to 6 months) for group taxpayers or transfer-pricing cases.

Closing & Reporting Phase

Once the audit findings (SPHP) are issued, the tax office has 30 working days to finalize and submit the audit report (LHP). This is shorter than the previous 2-month window.

Taxpayer Response Time

After receiving SPHP, taxpayers have 5 working days to submit a written response. Previously, this window was 7 days, with a possible 3-day extension.

New procedure: Preliminary Audit Findings

Under PMK-15/2025, a new step called the Preliminary Audit Findings Discussion (PAHPS) is now required before finalizing most tax audits in Indonesia.

This formal discussion allows auditors to present early findings and enables taxpayers to clarify issues, respond, or provide additional documents. It increases transparency and helps prevent potential disputes before making the final audit decision.

One-month rule exception for document submission

PMK-15/2025 introduces an essential change to the timeline for submitting documents during a tax audit. Previously, taxpayers had a strict 1-month deadline to provide all requested documents. Under the new rules, this deadline is more flexible, with exceptions as follows:

- The tax office requests documents not listed in the original audit notice (SP2).

- The documents are requested after 1 month has passed.

In these cases, taxpayers must still comply, but the submission timeline is adjusted based on the situation to avoid unfair penalties due to late auditor requests.

Clear separation of tax audit and criminal procedure

Lastly, PMK-15/2025 separates regular tax audits from criminal investigations. If auditors find signs of a tax crime, the audit must stop, and the case is handed over to the Special Tax Investigator. Auditors cannot continue their review once the handover takes place.

This reinforcement helps protect taxpayers’ rights and ensure each process is handled appropriately.

How InCorp can help with tax audit

With all the 2025 tax audit changes, staying compliant is more important than ever. InCorp Indonesia (an Ascentium Company) offers reliable tax reporting services to help you keep up with new rules and avoid audit issues.

Why choose InCorp?

- Stay Compliant: We handle your tax filings accurately and on time.

- Avoid Risks: Proper reporting reduces the chance of being audited.

- Save Time: Focus on your business while experts manage your taxes.

- Get Expert Advice: We guide you through audits, tax incentives, and reporting best practices.

Fill out the form below to streamline your tax audit process with us, and we’ll help you grow your core business further.

Frequently Asked Questions

What triggers an audit by the tax office?

A tax review can be triggered by inconsistent filings, large refund claims, data mismatches, or unusual transactions. Some are also selected randomly.

How will I know if my tax being audited?

You’ll receive an Audit Notification Letter (SP2) from the tax office. It will tell you which tax periods are being reviewed.

Can I be reviewed without receiving a letter

No. According to Indonesian tax law, a formal notification must be issued before any audit or field examination begins. Unannounced reviews are not permitted.

What happens if businesses don't response the audit on time?

Delays in providing requested documents or responding to findings may result in a tax underpayment assessment, penalties, or even escalation to a tax crime investigation if non-compliance is suspected.

Is it possible to dispute the audit result?

Yes. If you disagree with the tax findings, you may file a formal objection within 3 months after the tax assessment letter is issued.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.