Talking about the mining industry, nickel in Indonesia continues to dominate the global stage. Indonesia holds the title of the world’s largest producer of this crucial commodity.

As the world’s leading producer, the nation’s mining sector is brimming with exciting developments, promising a dynamic future. Let’s delve into the latest updates and explore the fascinating landscape of nickel mining in Indonesia.

Indonesia’s nickel mining potential

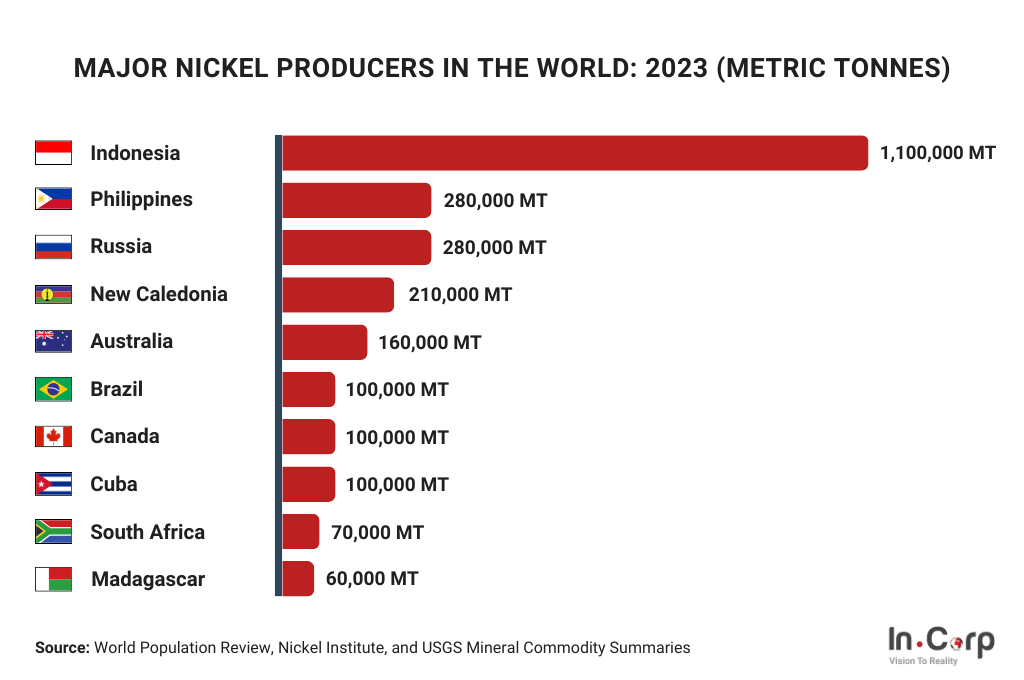

Indonesia has the largest nickel reserves globally, comprising 36% of the global supply. According to United States Geological Survey data, Indonesia is known as the leading producer.

Nickel production from Indonesia reached 1.6 million tonnes in 2022, significantly surpassing the Philippines, the second-largest producer with an output of 330,000 tonnes. Surpluses are projected to continue accumulating for the third consecutive year in 2023.

Read more: Investing in Indonesia: Promising sectors in 2024

Largest nickel mining projects in Indonesia

Indonesia has a significant potential for nickel-bearing formations that cover up to 2 million hectares, according to the Geological Agency of the Ministry of Energy and Mineral Resources (ESDM).

However, only 800,000 hectares of this area have been explored, and mining permits (IUP) have been granted. Below is a list of the largest nickel mines in Indonesia currently in operation:

1. Sorowako Block

The Sorowako Block is a nickel mining concession with open-pit mining operations managed by PT Vale Indonesia Tbk (INCO). Located in East Luwu, South Sulawesi, it covers an area of 70,566 hectares (ha).

In the Sorowako Block, Vale mines high-grade nickel ore or saprolite for its nickel matte plant in Sorowako. In the future, Vale will also mine low-grade nickel ore or limonite for further processing into MHP products.

As of November 2023, Vale Indonesia is controlled by the Brazilian company Vale S.A. through Vale Canada Limited, with a 43.79% stake, and Vale Japan Limited, with a 0.54% stake.

Vale Indonesia’s shares are also held by the State-Owned Mining Holding Company MIND ID at 20%, Sumitomo Metal Mining Co., Ltd at 15.03%, and the public at 20.64%.

2. Weda Bay Nickel Project

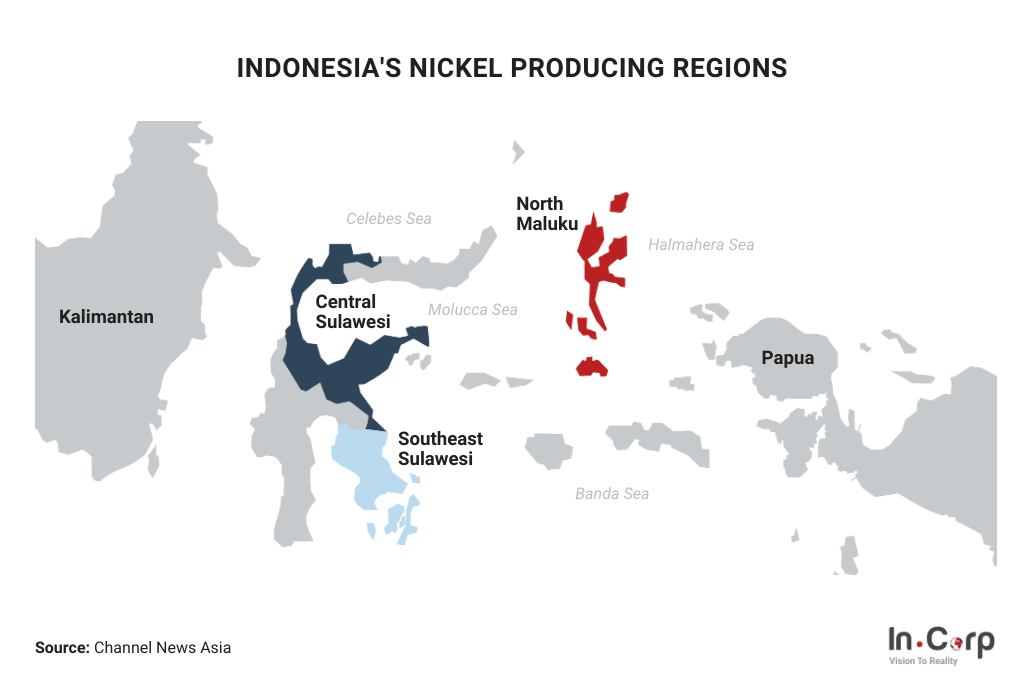

The Weda Bay Nickel mine, located in Central Halmahera and East Halmahera, North Maluku, has operated since 2019 This nickel mine is operated by PT Weda Bay Nickel (WBN), which is majority-owned by the Chinese company Tsingshan (51.3%) and the French company Eramet (37.8%).

The Indonesian government owns the remainder through PT Aneka Tambang Tbk. (Antam) at 10%. Eramet contributes its expertise in mining operations, while Tsingshan operates nickel processing and refining facilities.

3. Gag

Located on Gag Island, Raja Ampat, West Papua, this nickel mine has a Contract of Work area of 13,136 ha and an IPPKH area of 603.25 ha. PT Gag Nikel, a subsidiary of PT Antam Tbk, holds the mining operation production license (IUP OP) for this mine.

According to Antam’s 2022 Annual Report, the total nickel resources at the Gag mine reached 315.57 million wet metric tons (wmt), consisting of low-grade nickel ore at 154.61 million wmt and high-grade nickel at 160.96 million wmt.

4. Kawasi

PT Trimegah Bangun Persada Tbk holds the mining business license (IUP) for the Kawasi mine. This nickel mine, located on Obi Island, South Halmahera, North Maluku, covers an area of 4,247 ha.

According to Trimegah Bangun Persada’s 2022 Annual Report, the total mine reserves at Kawasi as of December 31, 2022, amount to 108.4 million wet metric tons (mt), with remaining reserves of 84.51 million mt.

5. Asera Project

The Asera deposit, covering an area of approximately 2,000 ha, is located in North Konawe, Southeast Sulawesi. Nickel ore mining at the Asera deposit uses open-pit mining methods.

According to the Joint Ore Reserves Committee (JORC), the Asera deposit has estimated resources of more than 16 million metric tons of nickel ore with an average nickel grade of 1.5%.

6. Bahoomoahi Mine

The Bahoomoahi deposit covers an area of approximately 1,400 ha and is located in Morowali, Central Sulawesi. The Solway Investment Group also owns this nickel mine through PT Sulawesi Resources.

According to Solway’s internal estimates, the Bahomoahi deposit has an estimated resource of 14 million metric tons, with an additional potential of 13 million metric tons of nickel ore with an average nickel grade of 1.9%.

The future of nickel mining in Indonesia

In 2023, the global nickel price experienced a downward trend, especially from the middle of the year.

According to Trading Economics data, on February 6, 2023, the international nickel price reached USD 27,563 per ton, but continued to decline to USD 16,366 per ton on December 25, 2023. It is estimated that by the end of the first quarter of 2024, the nickel price will be USD 15,900 per ton.

Industry and Regional Analyst at PT Bank Mandiri (Persero) Tbk Ahmad Zuhdi Dwi Kusuma stated that Indonesia’s aggressive nickel downstream program had affected the price.

In his notes, the smelter development plan for 2020-2024 has also expanded from 30 smelters to 111 smelters.

However, he also believes there are lucrative opportunities from the oversupply condition and the decline in nickel prices. The high nickel price, which has been high all this time, puts pressure on producers because production costs are high.

Therefore, the decline in nickel prices is believed to provide incentives to increase interest, especially for the electric vehicle (EV) battery raw material pathway.

Take advantage of Indonesia’s nickel potential

Nickel in Indonesia presents a promising opportunity, especially as the government continues to support downstream nickel, potentially boosting its prospects further. InCorp Indonesia is your trusted partner for navigating the complexities of business in the Indonesian nickel industry. We offer a comprehensive suite of services designed to streamline your entry and ensure your success:

- Investor KITAS: Our expert team guides you through obtaining the necessary visa to invest in Indonesia, ensuring a smooth and compliant process.

- Company Registration: We handle all aspects of company formation, saving you time and resources while ensuring adherence to local regulations.

- Industry Insights: We provide in-depth knowledge of the nickel sector, including regulatory updates, market trends, and key players.

- Network & Connections: We leverage our extensive network to connect you with relevant stakeholders, facilitating business partnerships and opportunities.

Contact InCorp Indonesia and let us help you navigate the exciting opportunities in this thriving sector.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.