Indonesia’s property market is continuously evolving, along with the taxes related to purchasing, owning, or transferring land and buildings. At the same time, many property owners understand the necessity of paying taxes, but significantly fewer grasp the recent regulatory changes.

In recent years, new regulations, digital enforcement, and updated property values (NJOP) have significantly increased the real cost of owning or transferring property. Whether you’re selling, buying, building, or leasing, understanding the current tax obligations is crucial.

What’s new in Indonesia’s property tax system for 2026?

Understanding these updates can help property owners feel more confident and secure in managing their obligations. Here are key updates that every property stakeholder should be aware of:

- Final income tax (PPh Final) remains governed by PP No. 34/2016, but with broader digital enforcement through notaries and DJP systems.

- Inheritance-based transfers are now explicitly exempt from income tax, thanks to PMK No. 81/2024.

- BPHTB rules remain mostly unchanged, but regional thresholds and exemption categories vary, so property owners should pay close attention to local regulations to ensure compliance.

- VAT incentives for property buyers are extended through the end of 2027, offering cost relief on qualifying transactions.

Read more: How companies can avoid tax evasion allegations in Indonesia

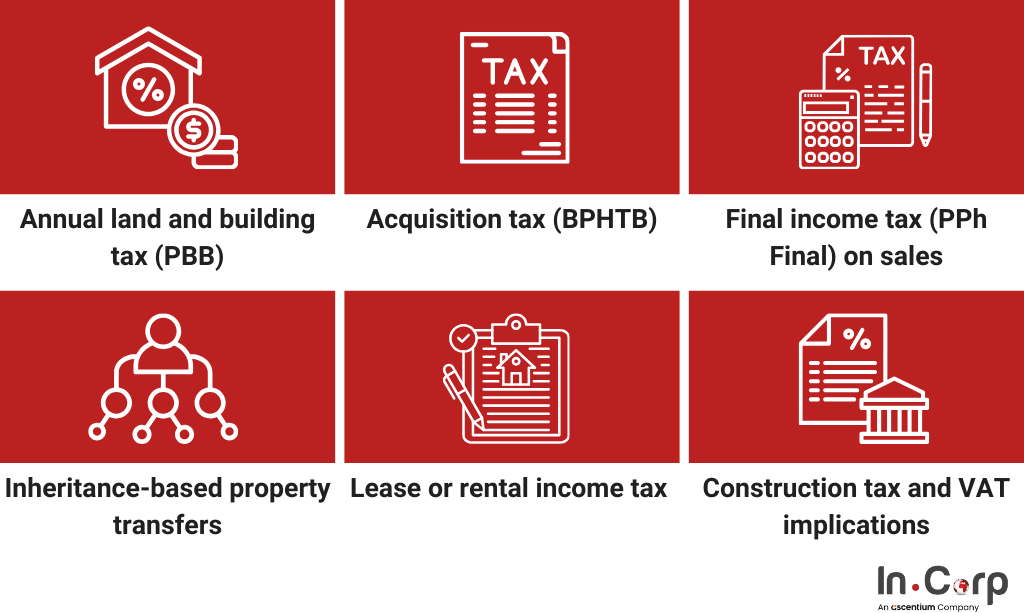

A closer look at current property taxes in 2026

To navigate these developments, here’s an updated breakdown of the central property-related taxes in Indonesia.

Annual land and building tax (PBB)

The foundational property tax (PBB) is levied annually on anyone who owns or benefits from land and buildings, such as:

- Tax base: NJOP (assessed value) minus NJOPTKP (non-taxable threshold)

- Taxable portion (NJKP): Usually 20%–40% of NJOP

- Rate: Up to 0.5% of NJKP

- Incentives: Vary by region (e.g., DKI Jakarta has capped annual increases through local policies)

Acquisition tax (BPHTB)

When property rights are transferred, buyers must pay the BPHTB (a one-time tax). This tax is calculated based on the property’s value.

- 5% × (Transaction value or NJOP, whichever is higher − NPOPTKP)

- NPOPTKP: Set locally; in Jakarta, it’s IDR 80 million

Exemptions from BPHTB apply to:

- Transfers to the state for public infrastructure

- Diplomatic representatives (reciprocal arrangements)

- International organizations operating non-commercially

Note: Providing proper documentation is essential to claim these exemptions and to ensure confident compliance with regulations.

Final income tax (PPh Final) on sales

Sellers are subject to income tax at the point of transfer. As of 2026, the rates are still governed by PP No. 34/2016:

- 2.5% for most properties

- 1% for modest housing (simple houses/flats)

- 0% if transferring to government or state-assigned use

The tax is based on the gross sale price or NJOP, whichever is higher, and must be paid before finalizing the ownership change at the land office.

Inheritance-based property transfers

As clarified by PMK No. 81/2024, transfers through inheritance are exempt from final income tax (PPh Final). This dispels previous confusion and ensures that heirs are not taxed when receiving property from deceased relatives.

However, if the inherited property is later sold, the seller (now the heir) must still pay PPh Final on that future sale.

Lease or rental income tax

Whether you’re renting out a house in Bali or a shoplot in Jakarta, the income from the lease is taxable.

- Tax residents: 10% of gross rental income

- Non-residents: 20% of gross rental income

These are withholding taxes. Tenants or agents often collect and remit the tax on behalf of landlords.

Construction tax and VAT implications

If you’re building a home or commercial unit, taxes apply to the construction phase:

- Construction tax: Usually 2% of the budgeted cost (RAB)

- VAT: Applies to building materials and contractor services (standard rate: 11%)

- VAT exemptions: For some developers or projects, VAT exemptions apply under the extended government program through 2027

Check with your contractor or architect whether their services include VAT and if you’re eligible for construction tax deductions.

How to stay compliant and minimize property tax risk

Property tax in Indonesia is manageable, but non-compliance can be costly. To fulfill your obligations:

- Monitor NJOP updates from your city’s tax office

- Ask for tax due diligence when buying/selling property

- Work with licensed notaries (PPAT) to ensure all taxes are filed correctly

- Use DJP Online or regional platforms to check your tax status and payment history

- Keep proof of inheritance transfers to claim rightful exemptions

Common mistakes to avoid when handling property tax in Indonesia

Even experienced property owners can slip up when navigating Indonesia’s layered tax system. Here are some of the most common and costly mistakes:

- Ignoring local NJOP updates: NJOP values are updated regularly and vary by region. Not tracking these changes can lead to underestimating your annual PBB.

- Overlooking BPHTB exemptions: Many buyers miss out on tax relief because they aren’t aware of the qualifying criteria or fail to apply in time.

- Mishandling rental tax obligations: Income from leasing property is taxable. Not withholding or declaring this properly can result in audits or penalties.

- Underestimating the importance of due diligence: Failing to verify ownership status, unpaid taxes, or land-use restrictions can derail acquisitions and increase legal risk.

- Not planning for inheritance transfers: While inheritance is now tax-exempt under PMK No. 81/2024, many heirs fail to register transfers, risking disputes or future tax complications properly.

Guide to Doing Business in Jakarta

Optimize your property tax strategy with InCorp

As regulations tighten and valuations rise, understanding your tax obligations is essential to making informed decisions. At InCorp (an Ascentium Company), we help individuals, investors, and businesses navigate Indonesia’s property tax system with confidence.

Here’s how we can assist:

- Tax consulting & compliance: We ensure you meet all legal obligations while optimizing your tax position.

- Land & property acquisition support: We guide you through the legal, tax, and regulatory steps for a smooth transaction.

Complete the form below to simplify every step of the process.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.