The smelter industry in Indonesia has evolved exponentially recently. The industry now aims to become a global leader in mineral processing, especially in nickel. This article delves into the current landscape of the smelter industry in Indonesia, exploring its operational capacity, key players, and the exciting prospects that lie ahead.

What is a nickel smelter?

The smelter industry in Indonesia will always be related to nickel production. A nickel smelter is an industrial facility that transforms nickel ore into usable products.

Nickel ore, typically containing just a low percentage of nickel itself, undergoes a smelting process at high temperatures to extract the valuable metal. This process separates the nickel from the waste materials present in the ore. Depending on the processing method, the end product of a nickel smelter can vary.

Still, standard outputs include nickel matte, an intermediate product high in nickel content, or ferronickel, a nickel-iron alloy. These products are refined further to produce pure nickel for various industrial applications.

Nickel potential in Indonesia

The government is promoting the downstream of mining products and intensifying efforts to develop smelter projects. Downstream of these mining commodities aims to enhance the country’s self-reliance in processing raw materials from mining products.

In 2024, Indonesia targets the construction of 53 smelter projects with an investment reaching USD 19.9 billion. The two largest copper producers in Indonesia, PT Freeport Indonesia and PT Amman Mineral Nusa Tenggara are also constructing smelters as a commitment to support the government’s mineral downstream policy.

Read more: The importance of B3 waste permit in Indonesia

Top Companies in the smelter industry

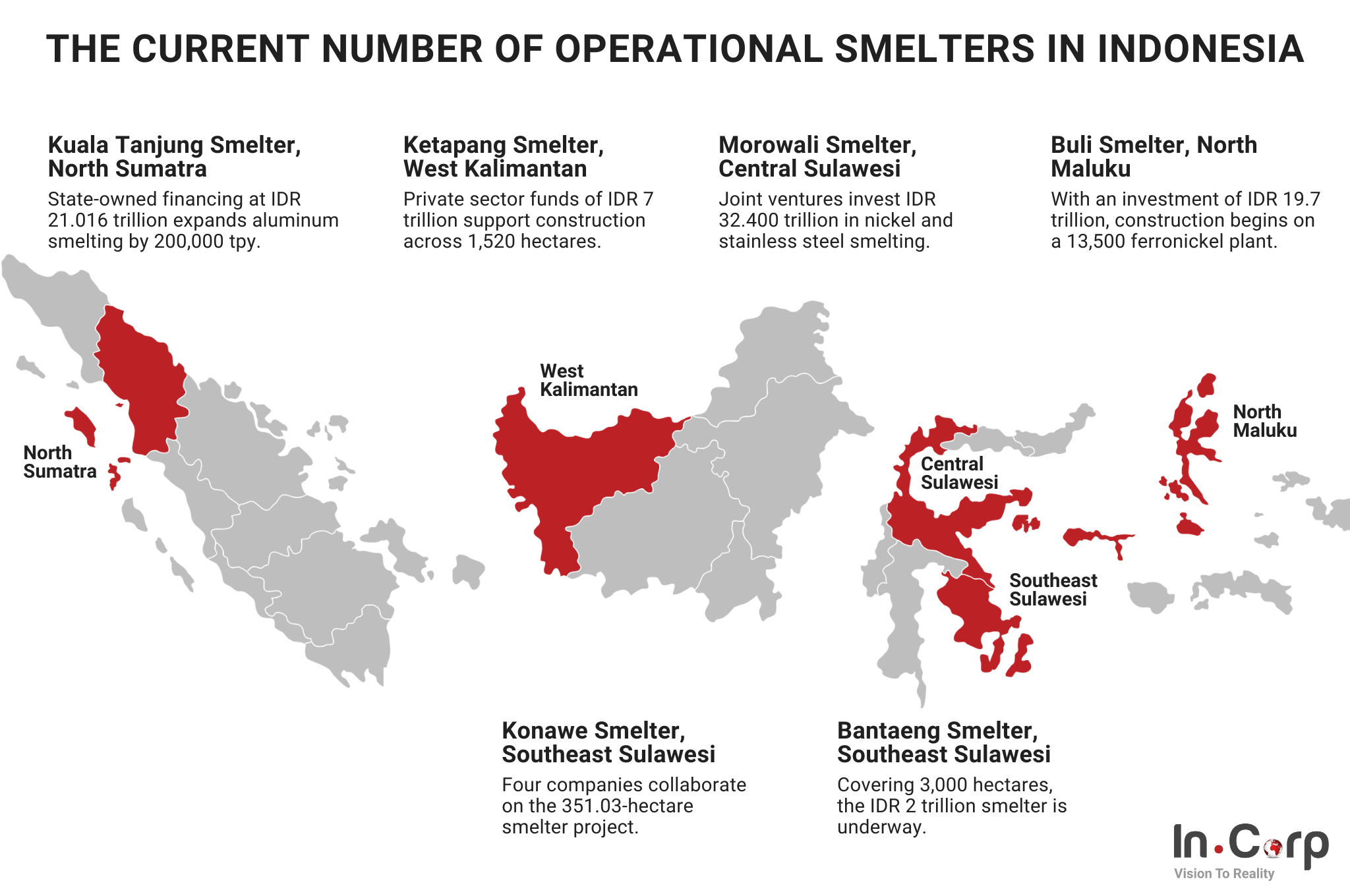

The construction of smelters is one of the most significant ambitions of the Indonesian government. Referring to the official website of the Committee for Acceleration of Priority Infrastructure Provision (KPPIP), here are some smelters in Indonesia:

Kuala Tanjung Smelter, North Sumatra

The Kuala Tanjung smelter costs IDR 21.016 trillion and is financed by state-owned enterprises. This project involves expanding aluminum smelting by 200,000 tpy.

Ketapang Smelter, West Kalimantan

The construction of the Ketapang smelter covers an area of 1,520 hectares. With an investment of IDR 7 trillion, the project funds come from the private sector.

Morowali Smelter, Central Sulawesi

PT Sulawesi Mining Investment, PT Indonesia Guang Ching Nickel, and the Stainless Steel Industry are building the Morowali smelter. The total investment for this project is IDR 32.400 trillion.

Buli Smelter, North Maluku

This project involves the construction of a 13,500 ferronickel plant with a total investment of IDR 19.7 trillion.

Konawe Smelter, Southeast Sulawesi

Four companies are building the Konawe smelter: PT Cahaya Modern Metal Industri, PT. Virtue Dragon Nickel Indonesia, PT COR Industri Indonesia, and PT. Karyatama Konawe Utara. The Smelter Indonesia covers an area of 351.03 hectares.

Bantaeng Smelter, Southeast Sulawesi

The Bantaeng smelter in Southeast Sulawesi, built on 3,000 hectares of land, will cost up to IDR 2 trillion.

Various minerals for the smelter industry

Some metal materials do not necessarily need to be processed using a smelter. These materials can be processed using alternative methods, which can be more cost-effective and energy-efficient. Here is a list of such materials, along with the recommended processing methods:

Iron

Iron is one of the most commonly smelted metals. Iron ore needs to be heated to separate it from oxygen. Processed iron ore can be used in various industrial sectors, from automotive to construction.

Gold

Gold ore must be heated to a high temperature to separate the metal from other minerals or impurities. Only then can the processed ore be used as pure gold metal or alloy.

Nickel

Nickel smelters are the most abundant so far, accumulating up to 116 smelters. Like iron and gold, nickel needs to undergo the smelting process to be processed into nickel alloy or pure nickel.

Tin

Many household items or equipment in daily life are made of tin. Before becoming versatile items, tin ore must be purified before forming into bars or coils.

Copper

Copper ore can be refined into pure copper or alloy. PT Freeport Indonesia is currently building a copper smelter in Indonesia.

Challenges and consideration

The Indonesian government’s endeavors to foster the smelting sector are evident, yet there remain certain obstacles:

Regulatory environment

Despite the government’s dedication to advancing the smelting industry, recent tax policies and procedures must be revised to these business-friendly investment initiatives.

Achieving a fully integrated domestic processing industry for mined minerals presents a multifaceted challenge for Indonesia’s government. It requires a delicate balance between short-term and long-term objectives from both regulatory and outcome perspectives.

This complexity is expected to persist until the envisioned transformation is realized.

Power availability and affordability

The availability and affordability of power infrastructure are critical requirements for smelting operations. Energy is a significant operational expense, typically accounting for up to one-third of the total smelting costs.

The actual expenses vary based on factors such as the metal being refined, furnace types, process methodologies, and energy sources, but they account for 15% to 60% of the overall smelting expenditures.

The benefit of investing in nickel Smelter Indonesia

President Joko Widodo inaugurated the expansion of PT Smelting in Gresik Regency, East Java, at the end of 2023. Copper anode and cathode production capacity have increased from 1 million tons annually to 1.3 million tons.

With the operation of internationally standardized smelters in Gresik, Indonesia is entering a new era as a critical player in the global mining industry, particularly in the precious metals sector, which holds high economic value.

By incorporating such significant infrastructure into the national economic ecosystem, Indonesia is deeply committed to innovation and growth. It is positioning itself as a regional leader in this highly competitive industry.

Start investing in Smelter Indonesia with InCorp

The Smelter industry in Indonesia presents a lucrative opportunity for investors. However, establishing a smelter facility requires careful planning and adherence to regulations.

Notably, obtaining a B3 License is crucial for operating a smelter facility in Indonesia. This license signifies compliance with environmental regulations for hazardous materials, a vital aspect of smelter operations.

For those considering establishing a smelter facility in this burgeoning market, InCorp Indonesia stands ready to assist.

Leveraging our expertise in incorporation and B3 License services, we provide full-scale support to guide you through the intricacies of launching a smelting operation in Indonesia’s ever-evolving business environment.

Click the button below to kickstart your smelting venture in Indonesia’s dynamic business landscape.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.