Navigating tax residency laws as a foreign expatriate in Indonesia can be challenging, as tax obligations differ based on residency status. Understanding tax residency rules is important because they give you control, ensure you follow the law, and help you avoid legal issues.

Many local firms offer Global Mobility Services (GMS), a trusted and experienced solution, to simplify the tax residency procedure for foreign expatriates in Indonesia.

This article will explain tax residency in simple terms and show how GMS can help you comply with Indonesia’s tax system. With our expertise, we can give you the confidence to navigate these rules successfully.

Insights into tax residency in Indonesia

Tax residency determines whether an individual is subject to taxation on worldwide income or only income sourced from Indonesia. Tax residency refers to a person’s obligation to pay taxes in a specific country, and Indonesia has its own criteria for defining it.

What are the tax residency criteria in Indonesia?

The Indonesian Directorate General of Taxes (DGT) has established several criteria to determine tax residency. Based on these criteria, tax obligations are divided into two groups:

- Individual Taxpayers: Stay in Indonesia for more than 183 days within 12 months and intend to reside in Indonesia (have obtained work permits, employment contracts, and permanent resident status).

- Companies: Companies should be registered and domiciled in Indonesia, established according to Indonesian laws, and have a head office in Indonesia.

Once classified as a tax resident, an individual must report global income and is subject to progressive tax rates. Nonresidents, on the other hand, are taxed only on Indonesian-sourced income at a flat rate.

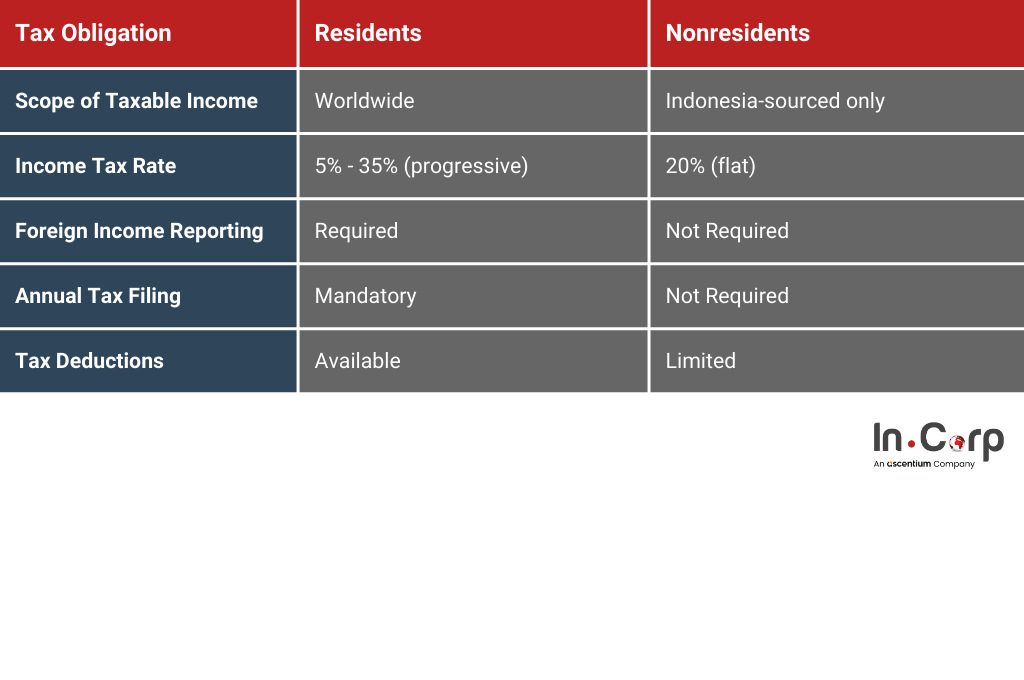

Tax obligations differences for residents and non-residents in Indonesia

Understanding the tax obligations of residents and non-residents in Indonesia is essential for foreign expatriates to ensure compliance with local tax laws. Here are the key differences:

Residents Taxation

Indonesia’s tax residents are subject to taxation on their worldwide income, which means foreigners should report and pay taxes from both Indonesian and foreign sources.

- Progressive Income Tax Rates: Tiered tax rates ranging from 5% to 35% based on total annual earnings.

- Obligation to Report Foreign Income: Any income abroad must be declared through foreign income tax exemptions or tax treaty benefits.

- Mandatory Annual Tax Filing: Residents must file an Annual Individual Tax Return (SPT) and disclose their global financial assets.

Nonresidents Taxation

Nonresidents in Indonesia are subject to taxation solely on income from Indonesian sources. Here are some important rules to keep in mind:

- Flat Tax Rate: Subject to a 20% withholding tax on Indonesian-sourced income unless reduced by a tax treaty.

- No Obligation to Report Foreign Income: Nonresidents must not declare income earned outside Indonesia.

- Limited Tax Deductions: Fewer opportunities to claim tax deductions or exemptions.

Personal income tax for foreign residents in Indonesia

Foreign expatriate residents in Indonesia must comply with personal income tax (PIT) regulations. The Indonesian tax system applies progressive tax rates to income earned both locally and, in some cases, abroad.

However, recent changes provide foreign income tax exemptions under specific conditions.

Progressive Individual Tax Rates

Indonesia imposes a tiered tax system on individual income:

| Annual Income (IDR) | Tax Rate |

| Up to 60 million | 5% |

| 60 million – 250 million | 15% |

| 250 million – 500 million | 25% |

| 500 million – 5 billion | 30% |

| Above 5 billion | 35% |

Tax on severance payments

Severance payments are taxed separately with the following rates:

| Taxable Income (IDR) | Tax Rate |

| Up to 50 million | 0% |

| Above 50 million – 100 million | 5% |

| Above 100 million – 500 million | 15% |

| Above 500 million | 25% |

Tax on lump-sum pension payments

The applicable tax rates for lump-sum pension payments from a government-recognized pension fund and old-age security savings disbursed by BPJS Ketenagakerjaan are as follows:

| Taxable Income (IDR) | Tax Rate |

| Up to 50 million | 0% |

| Above 50 million | 5% |

Foreign income tax exemptions

- Foreign income is not taxed if not remitted to Indonesia.

- Tax may still be exempt under specific conditions if foreign income is brought into Indonesia.

- Certain expatriates, such as foreign experts, investors, and researchers, may qualify for special tax incentives.

Read more: A guide to personal income tax in Indonesia

When should you file tax returns as a foreign expatriate in Indonesia?

Filing taxes on time is not just crucial. It’s your responsibility as an expatriate in Indonesia. It’s the key to avoiding penalties and legal issues. By filing your taxes on time, you demonstrate your responsibility and proactive approach to compliance.

- Monthly tax payment: This is due on the 15th of the following month, with the necessary reports submitted no later than the 20th.

- Annual tax filing: This is due in the 4th month after the tax year ends.

Late tax payments may result in penalties starting at 2% per month, potentially accumulating up to 48% in total monthly interest charges. Moreover, failure to file tax returns on time can lead to legal issues and may affect your residency status in Indonesia.

Read more: What to Expect in 2025 for the Core Tax Administration System

How Global Mobility Services Can Streamline Your Tax Residency Procedure?

Navigating tax residency in Indonesia can be challenging, but Global Mobility Services (GMS) at InCorp Indonesia (an Ascentium Company) makes it easier by ensuring full compliance while minimizing tax burdens.

Whether you’re an expatriate or an investor, GMS provides expert assistance to help you navigate Indonesia’s tax system efficiently.

How GMS can help ex-pats:

- Tax Advisory: Get expert guidance on tax residency rules, foreign income exemptions, and double tax treaties to ensure you make informed financial decisions.

- Tax Filing & Compliance: Stay compliant with Indonesian tax laws to ensure on-time tax filings, reduce tax liabilities, and avoid penalties.

Fill out the form below, and let us simplify your tax residency process now.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.