Employee benefits in kind (BIK) are a common element of compensation packages. However, the tax implications of these benefits can be a source of confusion. This guide will assist you in the taxation of BIK, offering a clear explanation of the relevant regulations and how they are applied.

Understanding taxation on benefits in kind in Indonesia

Indonesia’s Minister of Finance Regulation 66 of 2023 (MoF 66/2023) came into effect on July 1, 2023, replacing Ministry of Finance Regulation 167/2018. This new regulation sets forth a revised framework for taxing BIK provided to employees.

The regulation categorizes BIKs into two main types:

| Compensation-in-kind | Facilities-based compensation |

|---|---|

| This category encompasses non-cash remuneration employers provide employees, such as meals and uniforms. | This category covers benefits delivered by providing facilities like housing, vehicles, and medical services. |

MoF 66/2023 clarifies the specific types of BIKs subject to taxation in Indonesia and the conditions under which certain benefits may be exempt. Additionally, the regulation outlines the methods used to calculate the taxable value of BIKs for tax purposes.

Exemptions and deductions for BIK

Ministry of Finance Regulation 66/2023 reaffirms excluding specific BIK categories from an employee’s taxable income. These exemptions include:

- Food and beverages are provided to all employees within the workplace.

- Specific BIKs are offered in designated areas stipulated by the Director General of Tax.

- BIKs are deemed essential for employees to fulfill their job duties.

- BIKs are funded by regional or state government budgets.

- BIKs of certain types or falling below-specified thresholds.

Furthermore, BIKs can be considered deductible expenses for employers if they meet the following criteria:

- The BIKs must be considered reimbursements or compensation directly tied to the employer-employee relationship.

- The BIKs must originate from service transactions between registered taxpayers.

The treatment of BIK expenses for tax purposes depends on their useful life:

- Expenses related to BIK costs with a useful life of less than one year can be recorded as an expense in the year they occur.

- Expenses associated with BIKs (kenikmatan) with a useful life exceeding one year must be recognized through depreciation or amortization.

Read more: Understanding the new income tax withholding system in Indonesia (2024 Update)

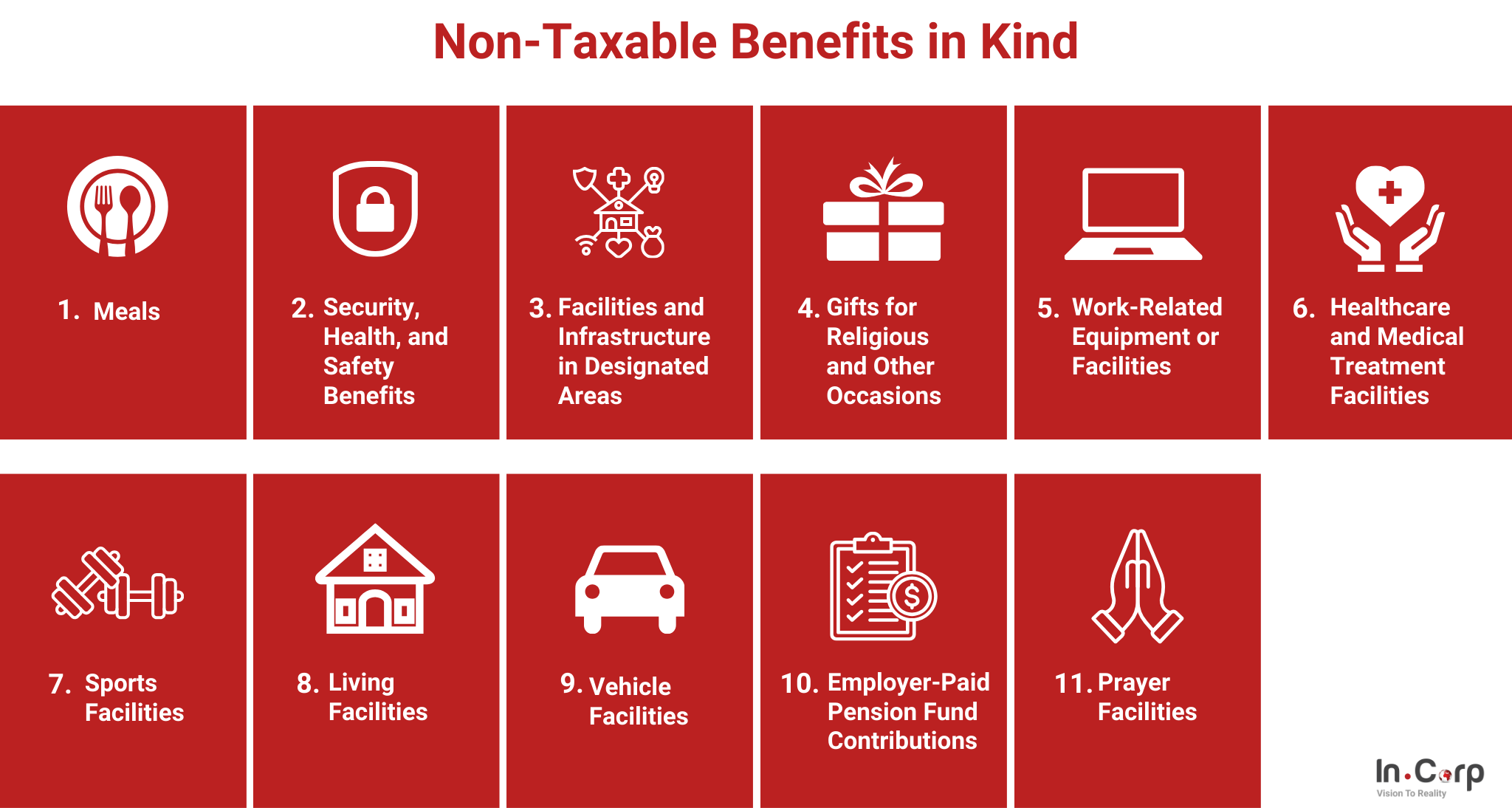

Non-taxable benefits in kind

Indonesia’s Ministry of Finance Regulation 66 of 2023 introduced exemptions for certain BIK traditionally considered employee taxable income.

Here’s a breakdown of these non-taxable categories:

1. Meals

Meals are provided for all employees within the workplace, with no value limit. Meal coupons or reimbursements for off-site duties must not exceed IDR 2 million per employee per month or the value of on-site meals, whichever is higher.

2. Security, health & safety benefits

These benefits are legally mandated by the government, with no value limit. Examples include uniforms, employee transportation, safety equipment, and essential medical supplies.

3. Facilities and infrastructure in designated areas

The Director General of Taxes must approve the specific location. The employer can provide the benefit directly or collaborate with another party to cover costs. Examples include housing, healthcare, education, transportation, and sports facilities within designated areas with no predefined value limit.

4. Gifts for religious and other occasions

Food, beverages, or meal ingredients can be offered to all employees for religious holidays (Eid Al-Fitr, Christmas, etc.) and other occasions, with no set value limit. Non-religious gifts are capped at IDR 3 million per employee per fiscal year.

5. Work-related equipment or facilities

Employees can receive necessary work-related equipment or facilities, such as laptops, computers, phones, phone credit, and internet access, with no predetermined value limit.

6. Healthcare and medical treatment facilities

Company-provided healthcare benefits should be available to all employees and cover work-related accidents, illnesses, emergencies, and follow-up treatments. There is no predefined value limit for this benefit.

7. Sports facilities

Sports facilities are available to employees, except for specific activities like golf, horseback riding, power boating, gliding, and automotive racing (capped at IDR 1.5 million per employee per fiscal year).

8. Living facilities

With limitations, employees can access communal or non-communal living facilities (dorms, apartments, houses). Communal facilities have no value limit, while non-communal living is capped at IDR 2 million per employee per month.

9. Vehicle facilities

This benefit applies to employees without equity participation in the company whose average gross income does not exceed IDR 100 million per tax year.

10. Employer-paid pension fund contributions

Employee contributions to a pension fund supervised by the Indonesian Financial Services Authority (OJK) are non-taxable.

11. Prayer facilities

Designated prayer rooms (mushalas, mosques, chapels, temples) are exempt from taxation.

Important note: Any in-kind benefit exceeding the mentioned thresholds after July 1, 2023, will be subject to taxation for employees and employers (withholding and management responsibilities).

Calculating and reporting tax on benefits in kind

Employers have two methods to determine the taxable value of BIKs provided to employees:

- Market value: This reflects the current market price to obtain the same benefit.

- Actual expenses: This represents the actual costs incurred or expected to be incurred by the employer for providing the BIK.

Withholding income tax

To comply with legal requirements, employers must withhold income tax on BIKs. The following table clarifies the withholding, remittance, and reporting process for different timeframes:

| Fiscal year | Employer responsibility | Employee (or service provider) responsibility |

|---|---|---|

| FY 2022 | No income tax withholding | Exempted from income tax |

| FY 2023 (January – June) | No income tax withholding | Employee calculates, pays, and reports the tax in their Annual Income Tax Return |

| FY 2023 (July 1 onwards) | Withhold, pay, and report tax in Article 21/23/4 (2) Monthly Tax Return | Declare the benefit in their Annual Income Tax Return |

Simplify HR and payroll processing with InCorp Indonesia

InCorp Indonesia understands the challenges of managing payroll and employee benefits. Our comprehensive payroll services free your HR team to focus on what matters most: your employees.

We also extend beyond payroll. We offer tailored accounting services to handle your financial and tax reporting, giving you peace of mind and the freedom to focus on expanding your operations.

Don’t let complex payroll tasks impede your business’s growth. Click the button below to empower your HR team and drive your business forward.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.