The Indonesian government has officially introduced the Tabungan Perumahan Rakyat (Tapera), a mandatory housing savings program to increase access to affordable housing and foster national well-being.

Established through Government Regulation No. 21 of 2024, Tapera requires contributions from:

- Private sector employees

- State-owned enterprise (BUMN) and regional government-owned enterprise (BUMD) employees

- Indonesian National Armed Forces (TNI) personnel

- Indonesian National Police (Polri) personnel

These individuals will contribute a portion of their monthly salary to the program.

What is the purpose of the Tapera program?

The Tapera program is driven by two key objectives designed to improve access to affordable housing in Indonesia:

- Supporting individual homeownership: Tapera encourages regular savings from individuals, particularly those in low-income communities, and helps them own a decent home.

- Fueling sustainable housing development: Tapera aims to create a long-term, cost-effective funding source for housing development projects. This will help address the growing demand for affordable housing solutions nationwide.

What are the legal foundations of Tapera?

Several key legal documents establish the Tapera program’s foundation, ensuring its smooth operation and alignment with national housing goals. These include:

Law No. 4 of 2016 on People’s Housing Savings

This law defines the program’s objectives, guiding principles, and organizational structure.

Government Regulation No. 25 of 2020 on Tapera Implementation

This regulation provides operational details, outlining the roles of the Tapera Management Agency (BP Tapera), participant registration procedures, contribution methods, and investment strategies.

Government Regulation No. 21 of 2024

This recent amendment significantly expands the program’s reach. It includes private sector employees, BUMN/BUMD workers, TNI/Polri personnel, and even self-employed individuals. Additionally, it revises the contribution calculation method for freelancers.

Read more: Employment outsourcing in Jakarta: A complete guide

Who oversees the Tapera program?

A dedicated public entity, Badan Pengelola Tapera (BP Tapera), manages the Tapera program. This organization acts as the custodian of all participant savings, playing a vital role in ensuring the program’s success and achieving its housing goals.

To ensure responsible management and alignment with national housing priorities, BP Tapera is overseen by a Tapera Committee. This committee comprises distinguished individuals representing key stakeholders within the housing sector:

- Government representatives: The Minister of Public Works and Housing (PUPR), the Minister of Finance, and the Minister of Manpower.

- Financial regulatory authority: A representative from Otoritas Jasa Keuangan (OJK), Indonesia’s financial services authority.

- Housing experts: Professionals with relevant expertise in the field of housing.

This diverse composition ensures that BP Tapera’s decisions consider various perspectives and align with the broader national housing agenda.

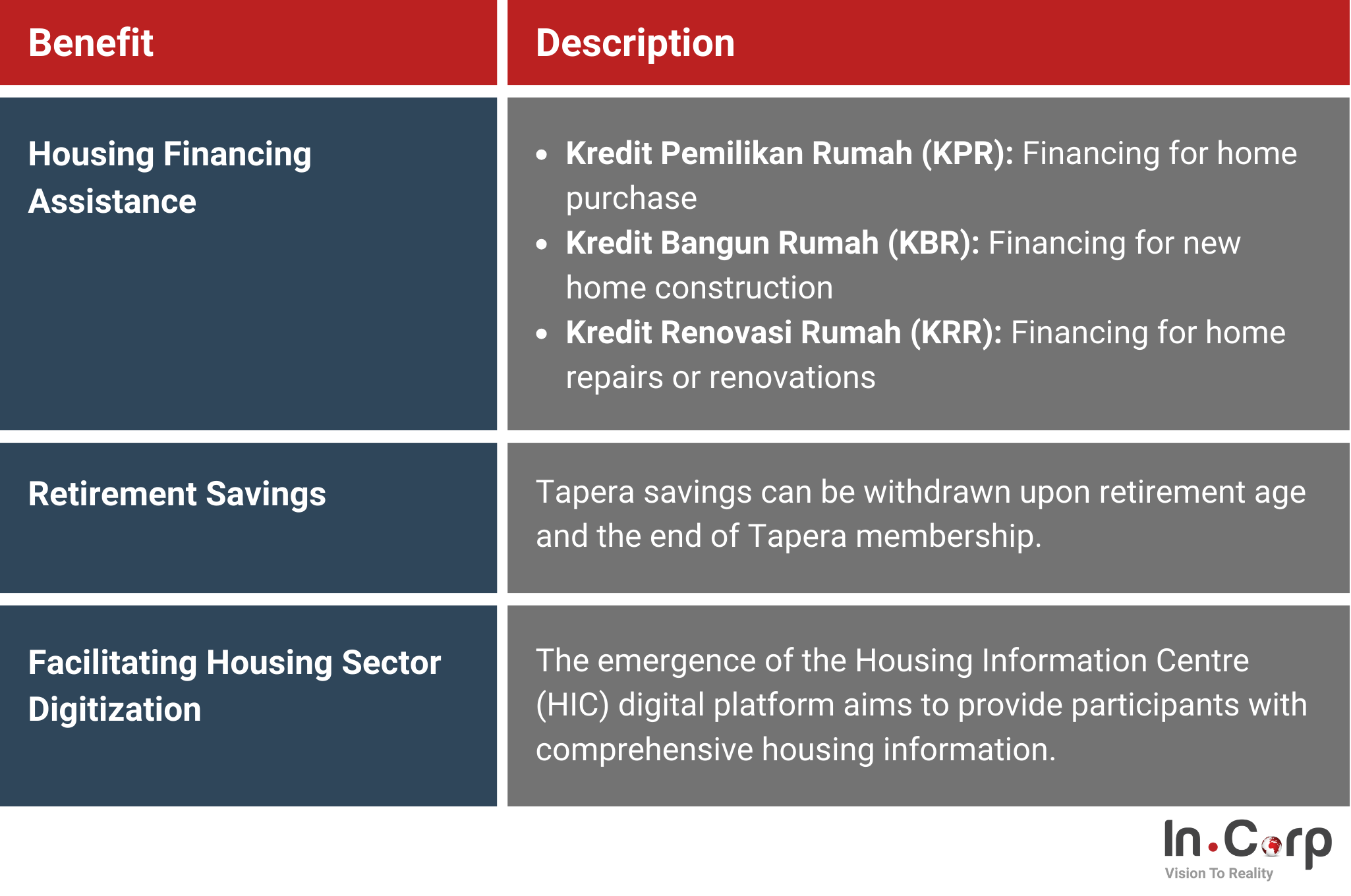

What are the advantages of the Tapera program?

Enrolling in the Tapera program comes with a multitude of benefits for participants. Here’s a breakdown of the key advantages:

Financing assistance

Tapera contributions open doors to various housing financing options, including:

- Kredit Pemilikan Rumah (KPR): Financing to purchase a home.

- Kredit Bangun Rumah (KBR): Financing to build a new home.

- Kredit Renovasi Rumah (KRR): Financing to renovate or repair your existing home.

Retirement savings

Tapera contributions become a form of long-term savings. These funds can be withdrawn upon retirement or when the membership ends.

Digital housing hub

The Housing Information Centre (HIC) ‘s digital platform offers participants easy access to comprehensive housing information, assisting participants in making informed decisions about their housing options.

Who is eligible for the Tapera program?

The Tapera program mandates individual participation, as outlined in Government Regulation No. 25 of 2020 and Law No. 4 of 2016. Here are the eligibility criteria:

- Registered citizen of Indonesia (WNI).

- At least 20 years old or married.

- Your monthly income must exceed the minimum wage requirement to qualify.

- Must fall into one of the following employment categories:

- Civil Service Applicant (CPNS)

- Civil Servant (ASN)

- Member of the TNI/Polri (military/police)

- State official

- BUMN/BUMD/BUMS employee (state-owned enterprises)

- Private employee

- Self-employed/Informal worker

When does the Tapera membership end?

The Tapera membership can terminate under specific circumstances:

- Upon retirement as a worker.

- Reaches the age of 58 (specifically for self-employed workers)

- Passes away.

- Not meeting the participation criteria for five consecutive years.

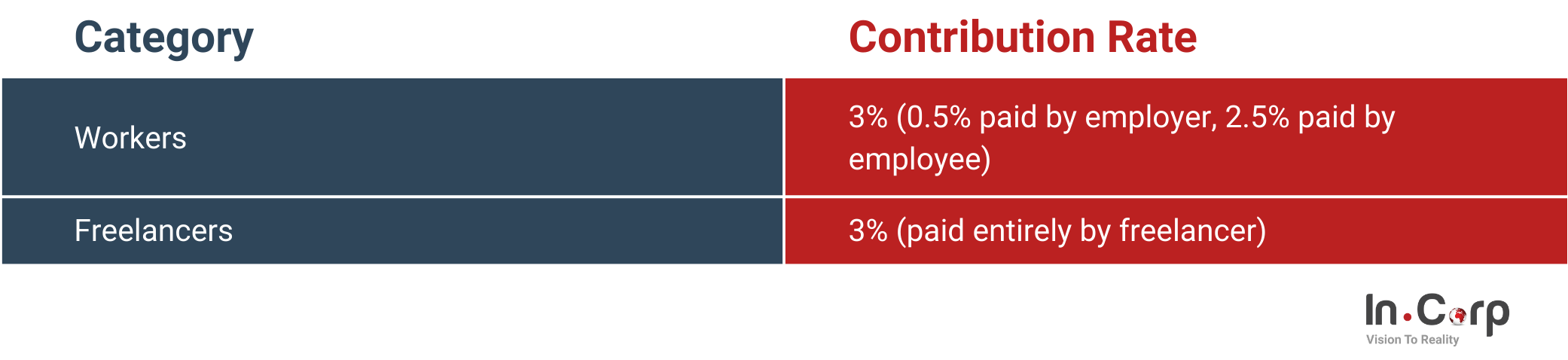

What is the amount for Tapera’s contribution?

The amount participants contribute to Tapera depends on their employment status:

- Workers (Employees): The total contribution is 3% of the wages. This is a shared responsibility:

- Employees contribute 2.5% of your salary.

- Employer contributes the remaining 0.5%.

- Freelancers (Self-employed): Responsible for a 3% contribution.

This information is based on the latest amendments introduced by Government Regulation No. 21 of 2024.

What are the requirements for housing financing with Tapera?

The following are the conditions for Tapera participants who wish to apply for home financing using their Tapera contributions:

- At least 12 months as a Tapera member.

- Classified as a Low-Income Household (MBR). Monthly income must be:

- Less than 8 million rupiah (except Papua and Papua Barat).

- Less than 10 million rupiah (Papua and Papua Barat).

- Not currently owning a home for the KPR/KBR program (purchase or construction).

- Tapera savings can be used to finance the purchase, construction, or repair of your first home.

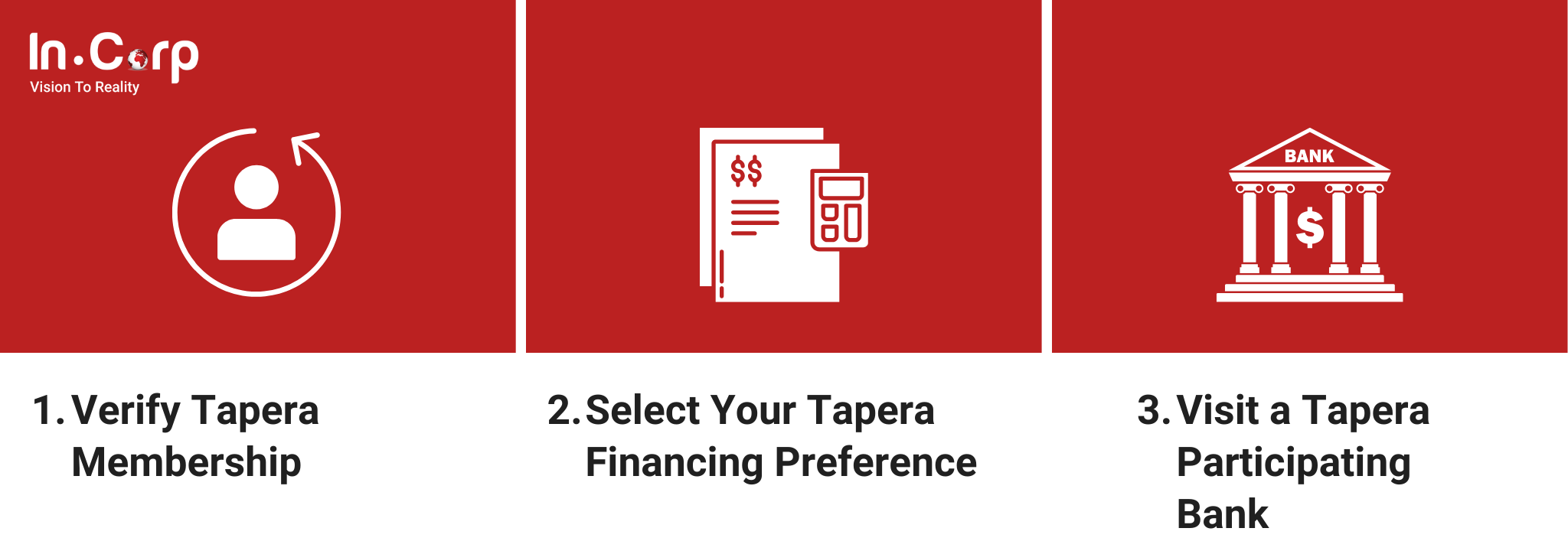

What are the steps in the Tapera housing financing process?

If you’re a Tapera participant who meets the eligibility criteria for housing financing, you can apply for financing options tailored to your needs. Here’s a step-by-step guide to the Tapera housing financing process:

1. Verify your membership

Before diving in, make sure you’re registered with Tapera. Head to their website to confirm your membership status and update any necessary information.

2. Choose your financing option

Tapera offers three programs:

- KPR: Purchase a pre-built house. Identify your desired location and gather documents like the KPR application form, proof of no home ownership, and a reservation letter from the developer.

- KBR: Construct a new house on your land. Prepare a detailed Bill of Quantities (RAB) outlining the project costs.

- KRR: Renovate your existing home. Prepare a Bill of Quantities for the renovation work.

3. Submit your application to a participating bank

Once you’ve chosen your financing option and gathered the required documents (ID card, Tapera membership ID, salary slip, tax return, bank statement), visit a Tapera participating bank to submit your application.

Streamline your payroll with InCorp’s Expertise

The new Tapera regulation introduces mandatory monthly deductions for employee housing funds, which can complicate payroll calculations.

InCorp Indonesia, with over a decade of experience, offers comprehensive payroll consulting services to simplify your business’s Tapera compliance.

Our experts can ensure your payroll system seamlessly integrates Tapera deductions, guaranteeing accurate and efficient processing. Click the button below to ensure a smooth transition for your business.