As global business structures become increasingly complex, tax authorities are intensifying their focus on transfer pricing. In Indonesia, Transfer Pricing Documentation (TP Doc) is a vital compliance tool for companies involved in related-party transactions.

This article will help you properly understand and manage TP doc to avoid penalties and ensure transparent tax reporting for your business.

What is Transfer Pricing Documentation (TP Doc)?

TP Doc is a mandatory report used to determine transfer pricing prepared by taxpayers engaging in transactions with related parties. TP Doc helps prevent tax disputes by providing a transparent record of transfer pricing practices.

Why TP Doc is important

Maintaining a comprehensive TP Doc is not only a regulatory requirement but also a strategic tool to:

- Demonstrate compliance with tax laws.

- Mitigate risks of audits and penalties.

- Facilitate transparent and consistent transfer pricing practices.’

Read more: Financial statement reporting: A must-know for business

The legal framework of TP Doc in Indonesia

Transfer Pricing Documentation (TP Doc) in Indonesia is regulated by both national laws and international standards to ensure fair pricing in transactions with related parties.

Here are the key regulations governing TP Doc:

- Article 18 of the Income Tax Law (Law No. 36/2008): The Directorate General of Taxes (DGT) can adjust taxable income or deductible costs from related parties.

- Minister of Finance Regulation No.172/2023: Replaces PMK-213 and updates key rules, including expansion of related parties’ definition, deadlines, and CbC report requirement for turnover exceeding IDR 11 trillion.

Smarter Transfer Pricing

What is required for TP Doc?

Based on PMK 213/2016, TP Doc consists of three-tiered documents, such as:

1. Master File (Dokumen Induk)

The Master File provides a high-level overview of the multinational enterprise’s global operations and transfer pricing policies. It includes:

- Organizational structure and ownership details.

- Description of the business activities of the group.

- Information on intangible assets and intercompany financial activities.

- Consolidated financial statements for the group.

Master files should be prepared within four months after the fiscal year-end and submitted upon request by the tax authorities.

2. Local File (Dokumen Lokal)

The Local File contains detailed information on the local entity’s intercompany transactions. It encompasses:

- Overview of the local entity’s business operations.

- Detailed descriptions of material intercompany transactions.

- Financial information specific to the local entity.

- Comparability analysis and selection of the most appropriate transfer pricing method.

This file should be prepared within four months after the fiscal year-end and submitted upon request by the tax authorities.

3. Country-by-Country Report (CbCR)

The CbCR provides a breakdown of the multinational enterprise’s global allocation of income, taxes paid, and specific indicators of economic activity. This includes:

- Revenue, profit before tax, and income tax paid and accrued.

- Number of employees, stated capital, retained earnings, and tangible assets in each jurisdiction.

CbCR must be submitted no later than 12 months after the end of the fiscal year.

Which businesses are required to prepare TP Doc?

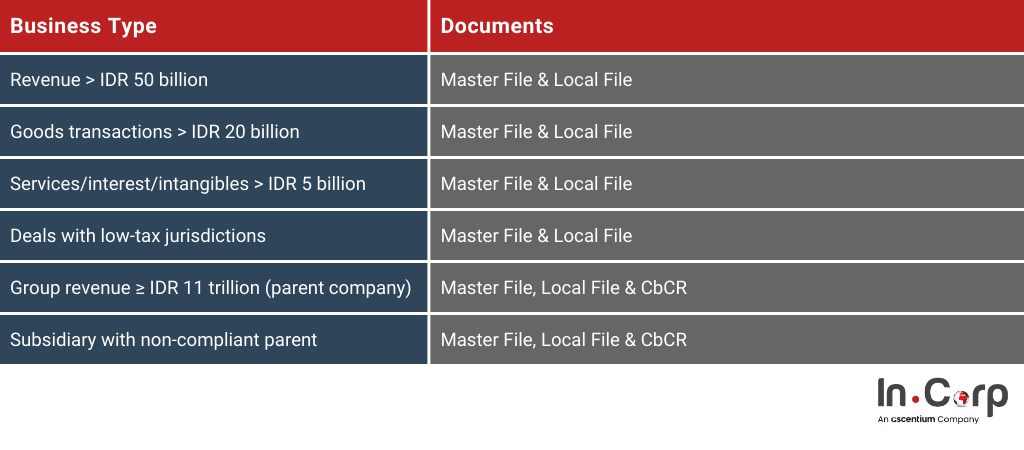

Not all companies in Indonesia need to prepare Transfer Pricing Documentation (TP Doc). The requirement depends on their income and the size of their related-party transactions.

Master File & Local File

Companies must prepare a Master File and Local File if they meet any of these conditions:

- The annual revenue exceeds IDR 50 billion.

- Related-party transactions exceed: IDR 20 billion for goods and IDR 5 billion for services, interest, or intangible assets.

- Transactions with related parties in low-tax countries.

Country-by-Country Report (CbCR)

Different from the master file and local file, companies should prepare the CbCR if:

- The company is the parent of a group with a total revenue of at least IDR 11 trillion.

- The company is a subsidiary, and:

- The parent doesn’t need to file a CbCR.

- The parents’ country doesn’t exchange tax info with Indonesia.

- The parent fails to file the CbCR.

What are the five methods of transfer pricing?

Indonesia follows five primary methods to determine fair prices in transactions between related parties, such as:

1. Comparable Uncontrolled Price (CUP) Method

This method compares the price charged in a related-party transaction to a similar deal between independent parties.

Example: A company sells a product to its parent at the same price it charges outside customers.

2. Resale Price Method (RPM)

It starts with the price of a product sold to an outside buyer and then subtracts a standard profit margin to find the right transfer price.

Example: A distributor buys from its parent and sells to customers. The profit margin is removed to set the transfer price.

3. Cost Plus Method (C+)

The C+ method begins with the cost of making a product or service and adds a standard markup.

Example: A factory sells to its parent company. It calculates its cost, adds a markup, and that’s the transfer price.

4. Profit Split Method (PSM)

Used when both parties contribute significantly. It splits the total profit based on each party’s role and contribution.

Example: Two companies co-develop a product and split the profit based on how much they each did.

5. Transactional Net Margin Method (TNMM)

This method looks at the net profit margin from a transaction and compares it to what similar independent companies earn.

Example: A service company charges its parent and verifies if its profit margin aligns with industry norms.

How to create a proper TP Documentation

Creating accurate Transfer Pricing Documentation (TP Doc) is essential for compliance with Indonesian tax regulations. Here’s the breakdown of the key steps to prepare TP Doc for your business:

1. Identify Related-Party Transactions

Begin by identifying all transactions with related parties. These may include:

- Sales or purchases of goods and services.

- Licensing of intangible assets.

- Intercompany financing arrangements.

2. Select the Appropriate Transfer Pricing Method

Choose the most suitable transfer pricing method based on the transaction type and available data.

3. Prepare the Required Documentation

Once the method is selected, compile the TP Documentation (Master File, Local File, and CbCR, where applicable). You also need to ensure these when preparing the documentation:

- Keep the documentation consistent with your business structure and actual transaction flows.

- Focus on quality analysis, not just descriptions.

- Avoid copy-paste content across files

- Ensure that benchmarks and comparables are updated and relevant.

4. Ensure Compliance with Language and Currency Requirements

All TP Documentation must be prepared in Bahasa Indonesia. If the original documents are in a language other than English, a translation must be provided upon request by the tax authorities.

5. Maintain and Update Documentation

Regularly review and update the TP Documentation to reflect any changes in business operations or intercompany transactions.

Read more: Due diligence checklist in Indonesia: Essential guide for corporations

Ensure compliance with expert TP Doc support.

Navigating Indonesia’s complex transfer pricing landscape requires expertise and a deep understanding of both local regulations and international standards.

InCorp Indonesia (An Ascentium Company) offers comprehensive transfer pricing solutions to ensure compliance, minimize tax risks, and support your business’s cross-border operations.

Why trust InCorp as your transfer pricing partner?

- Listed in TP Catalyst: InCorp’s TP Doc service is recognized and listed in TP Catalyst, a global platform for quality transfer pricing documentation providers.

- Trusted Tax Knowledge: Our team understands both Indonesian tax regulations and international guidelines to keep your business fully compliant.

- Tailored Strategies: We create industry-specific solutions, offering insights that align with your company’s operations and sector.

- Complete Support: From data collection to final review, we manage every step of your TP Doc with precision.

- Fast Delivery: Our efficient process ensures your documentation is ready on time, allowing you to focus on growing your business.

Complete the form below and optimize your transfer pricing strategies today with us.

Frequently Asked Questions

What is the principle of transfer pricing?

The principle requires that transactions between related parties be priced as if they were between independent entities. This ensures fairness and prevents profit shifting between jurisdictions.

Can a company use multiple transfer pricing methods?

Yes. A company may use more than one method, especially when no single method clearly establishes an arm’s length price.

How often should transfer pricing documentation be updated?

TP Documentation should be reviewed and updated annually, especially if there are changes in business structure, transaction types, or tax regulations.

What are the risks of non-compliance?

Non-compliance can lead to tax adjustments, penalties, double taxation, and a higher risk of audits. It may also damage a company’s reputation with tax authorities.

How can out transfer pricing service help streamline the process?

We handle the full TP process—strategy, documentation, and compliance—making it faster, easier, and audit-ready so you can focus on running your business.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.