A thorough understanding of transfer pricing methods is beneficial and crucial when conducting business in Indonesia. This article provides a comprehensive guide to two vital components of compliance: the Master File and the Local File. By the end, you will clearly grasp how these documents fit into your transfer pricing services and why they are of utmost importance.

What is a local file?

The Local File is a document that Indonesia’s tax authorities require to explain how a company sets prices for transactions with related parties.

It focuses on Indonesia-specific data and is part of the overall transfer pricing documentation.

What’s Inside a Local File?

- Company structure in Indonesia

- Description of business activities

- Details of related party transactions (who, what, and how much)

- Explanation of how prices are set (called a functional analysis)

- Methods used to set fair prices, such as Comparable Uncontrolled Price (CUP), Cost Plus Method, and Transactional Net Margin Method (TNMM)

Why It Matters

- Risk reduction: It helps avoid audits, fines, or penalties from unclear pricing.

- Transparency for tax authorities: It gives tax officers a clear view of your business operations in Indonesia.

- Support during audits: A well-prepared Local File can be strong evidence in transfer pricing disputes.

What Is a Master File?

The Master File gives a high-level overview of the companies involved in related party transactions, not just the Indonesian entity. It’s required under the transfer pricing methods in Indonesia for companies part of a multinational group.

What’s Inside a Master File?

- Global organizational structure

- Description of the business and industry across all countries

- Group’s intangible assets (such as patents, trademarks, or copyrights)

- Intercompany financial arrangements (including funding and loans)

- Consolidated financial and tax positions of the group

- Description of the group’s transfer pricing policies and the OECD transfer pricing methods used

Why It’s Important

- Group-level visibility: Gives a complete picture of how the multinational company operates globally.

- Cross-border pricing consistency: Shows how prices between group companies are set worldwide.

- Reduces risk of double taxation: Helps avoid tax issues across different countries.

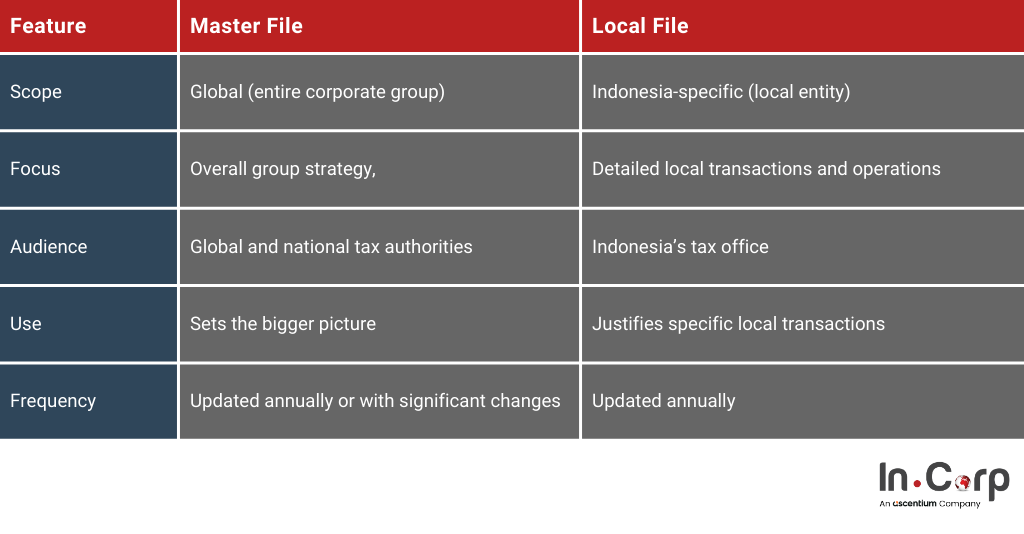

Master File vs Local File: Key Differences

Understanding the distinction between the Master File and Local File is essential for full compliance with transfer pricing rules in Indonesia. Both documents serve different purposes as follows:

Read more: Transfer Pricing Documentation (TP Doc): Key requirements and benefits

Which taxpayers should submit both documents?

Not all businesses are required to submit both files. The Directorate General of Taxes Indonesia requires a taxpayer to submit the transfer pricing documentation if they meet any of the following conditions:

- Annual gross revenue exceeds IDR 50 billion.

- Transactions with related parties exceed: Tangible Goods (IDR 20 billion) and Service, Royalties, and Interest Payments (IDR 5 billion)

- The company conducts transactions with related parties in countries with lower tax rates (i.e., countries with a tax rate lower than 25%)

Read more: How to tackle SP2DK for your business effectively.

How to properly prepare transfer pricing files

Preparing high-quality transfer pricing documentation is essential for any business investing in Indonesia or operating across borders. Here are the best practices to avoid penalties, audits, and reputational harm.

1. Start Early

Don’t wait until tax season. Prepare your documentation as part of your year-end reporting.

2. Use the Right OECD Method

Choose the most suitable method (CUP, Cost Plus, or TNMM) for your transactions.

3. Centralize Financial Data

Keep all related party transaction records in one place for easy access.

4. Conduct a Functional Analysis

Clearly define roles, risks, and assets involved in each transaction.

5. Benchmark Your Prices

Use reliable market data to justify the arm’s length nature of your pricing.

6. Engage Professionals

Work with specialized transfer pricing advisory services like TP Doc to ensure accuracy and compliance.

Smarter Transfer Pricing

How InCorp Can Help

Complying with transfer pricing rules in Indonesia doesn’t have to be overwhelming. However, as document preparation becomes increasingly complex, businesses need more than guidance—they need a partner.

That’s where InCorp Indonesia (an Ascentium Company) comes in. Through our dedicated Transfer Pricing service, we offer comprehensive support to help you:

- Simplify the entire documentation process

- Ensure compliance with Indonesia’s strict TP regulations

- Apply the proper OECD transfer pricing methods

- Stay prepared for audits and avoid penalties

- Save time and resources with expert handling

Contact us today and trust your transfer pricing methods with our expert support!

Frequently Asked Questions

What is a local file in transfer pricing methods?

A Local File is a document that explains how an Indonesian company sets prices for related party transactions. It focuses on Indonesia-specific data.

What information included in a Local File?

It includes company structure, business activities, details of related party transactions, functional analysis, and the pricing methods used (CUP, Cost Plus, TNMM).

What is a Master File?

A Master File provides a global overview of a multinational group’s operations, including structure, business activities, intangible assets, financial arrangements, and transfer pricing policies.

How is a Master File different from a Local File?

The Local File focuses on Indonesia-specific transactions, while the Master File shows the group-wide operations and policies across all countries.

Why are transfer pricing files important?

They reduce the risk of audits, fines, and double taxation, while providing transparency for tax authorities and support during disputes.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.