With a growing appetite for diversification, UAE investment in Indonesia is poised for significant growth. Indonesia, boasting a massive population and a strategic location in Southeast Asia, presents a compelling proposition for United Arab Emirates (UAE) investors seeking lucrative and stable returns.

Why should UAE businesses invest in Indonesia?

Indonesia is an attractive destination for investment due to its robust economic growth and expanding labor force. Indonesia demonstrated strong economic resilience as it concluded 2023 with a GDP growth rate of 5%.

This marks a return to pre-pandemic growth levels despite global challenges, positioning Indonesia alongside regional economies like Vietnam, Malaysia, and Thailand, which saw growth rates of 5%, 3.7%, and 2%, respectively.

From August 2022 to August 2023, Indonesia’s labor force expanded by 3.9 million, reaching 147.7 million people. The stable economic performance contributed to a slight decrease in the unemployment rate, from 5.5% to 5.3%.

Moreover, in 2023, Indonesia recorded a realized FDI inflow of USD 47.5 billion, a 13.7% year-on-year increase, following a 44.2% rise the previous year. This aligns with a regional trend where ASEAN economies are experiencing improved investor confidence and lower interest rates.

Given the context above, foreign investors, particularly those from the UAE, should consider investment opportunities in Indonesia.

Read more: Exploring investment potential in Indonesia

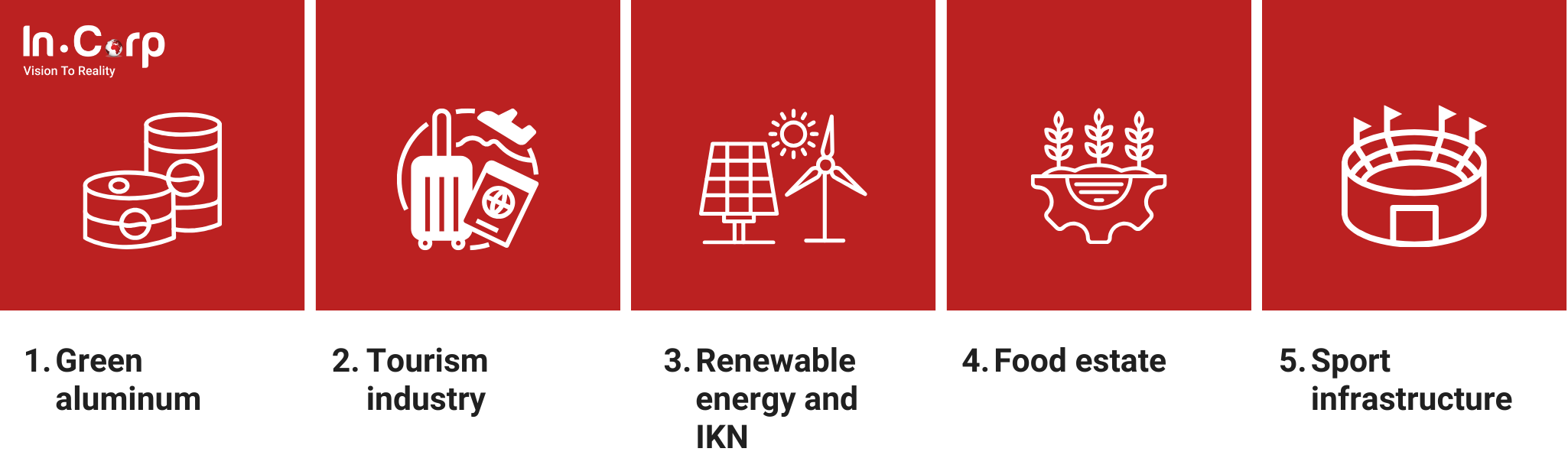

Best sectors in Indonesia for UAE investors

Several industry sectors in Indonesia offer UAE investment opportunities, allowing it to expand its portfolio and tap into new markets.

Additionally, the Indonesian government’s commitment to attracting foreign capital through favorable policies and incentives further enhances the appeal for UAE investment across various sectors.

Investing in green aluminum

Indonesia aims to collaborate with the UAE to become a prominent player in producing environmentally friendly aluminum, opening up new avenues for UAE investment in sustainable industries.

Pradana Indraputra, a special advisor at the Investment Ministry, mentioned during a Dubai Chambers event in Jakarta that Indonesia and the UAE aspire to dominate the global market with their joint production of green aluminum.

This partnership underscores both nations’ commitment to sustainable development and presents lucrative opportunities for UAE investment in Indonesia’s burgeoning green industries.

The development of tourism industry

The Ministry of Tourism and Creative Economy, Sandiaga Salahuddin Uno, has proposed investment opportunities in eight designated special economic zones (SEZs) to the UAE Entrepreneurship and Educator Team for Economic Zone Development, chaired by Adil Alzarooni.

Uno presented investment prospects in these SEZs, focusing on the tourism and creative economy sectors.

Opportunities in renewable energy and IKN

Commencing with the floating solar power plant (PLTS) in Cirata, the UAE has expressed keen interest in engaging in forthcoming phases of renewable energy initiatives stemming from the Cirata PLTS. Moreover, the UAE intends to actively advance renewable energy endeavors within the Capital City of the Archipelago (IKN), forging a partnership with PT Perusahaan Listrik Negara (PLN).

Exploring in food estate investment

State-owned enterprise Minister Erick Thohir recently announced that Elite Agro, a prominent agriculture company based in the United Arab Emirates, is considering investing in Indonesia’s food estate initiative.

This initiative is pivotal for the government’s goal of achieving self-sufficiency in food production and reducing import dependency.

Eyeing the potential of sport infrastructure development

During his visit to Abu Dhabi on Saturday, April 27, 2024, Indonesia’s Youth and Sports Minister, Dito Ariotedjo, met with representatives from the UAE government to discuss investment prospects in sports infrastructure development.

These talks took place during his working visit, where he met with officials from the Abu Dhabi Development Fund and the UAE Office of Development Affairs (ODA) on the second day.

Potential challenges of UAE investment in Indonesia

When contemplating establishing a business in Indonesia, businesses from the UAE will encounter various hurdles that could affect their success. Here are several key challenges they may need to address:

Restrictions on Foreign Ownership

Understanding Indonesia’s intricate business laws and restrictions on foreign ownership is essential. Foreign investors can engage through the Positive Investment List, while PT PMAs necessitate IDR 10 billion investment within five years. Representative Offices are feasible but cannot generate revenue.

Complex Government Regulations

Navigating Indonesia’s bureaucratic processes for business registration involves multiple documentation requirements and staying updated with frequently changing regulations.

Detailed Taxation System

Indonesia’s taxation system encompasses corporate income tax, employee withholding tax, value-added tax, and individual income tax, and it has strict compliance requirements.

Visa and Permit Procedures

Acquiring visas and permits can be daunting, with options including tourist visas, business visas, KITAS (employment), and KITAP (permanent residency for expats married to Indonesians).

Language Barriers

Indonesia’s diverse cultural landscape and numerous dialects pose language challenges. Effective marketing necessitates localization, and hiring local staff proficient in relevant dialects can facilitate communication.

Infrastructure Development

Certain regions encounter infrastructure deficiencies such as inadequate transportation, unreliable power, and limited internet access. Businesses may need to invest in infrastructure or adjust operations accordingly.

Cultural Sensitivity and Etiquette

Indonesian culture and etiquette are crucial. Proper greetings, gestures, and understanding of hierarchy are vital for fostering relationships.

Competition and Market Saturation

Indonesia’s burgeoning market attracts global enterprises, resulting in fierce competition. Thorough market research, unique value propositions, and forming local partnerships are imperative.

Labor Regulations and Disputes

Labor laws in Indonesia are intricate, leading to frequent disputes. Adhering to and comprehending labor regulations, including hiring and termination procedures, is indispensable. Implementing clear HR policies and seeking legal counsel can mitigate risks.

Intellectual Property Protection

Safeguarding intellectual property rights is paramount. Companies should register and enforce their IP rights to combat counterfeiting and unauthorized use. Legal guidance and IP registrations are recommended measures.

Unlock the potential for UAE investment in Indonesia with InCorp

Expanding your business into Indonesia can be lucrative, but navigating the country’s complex regulatory landscape can be daunting. That’s where InCorp comes in as your trusted partner.

InCorp can help you smoothly establish and expand your presence in Indonesia. From company incorporation to obtaining investor KITAS for your key personnel, we provide tailored solutions to your needs.

With InCorp as your partner, you can confidently navigate Indonesia’s regulatory landscape and pursue your business expansion endeavors with assurance, knowing that you have a steadfast partner supporting you at every stage of the process, focusing specifically on UAE investment.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.