Business compliance is the key to achieving success in Indonesia. Therefore, you must know well about the value added tax imposed in the country.

This guide is designed to equip you with the necessary tools and knowledge to navigate the intricate VAT regulations effectively. By ensuring your compliance in everything, tax included, you’ll be able to streamline any opportunities for improved business performance and growth.

What is a value added tax in Indonesia?

If you do business in Indonesia, you must pay value-added tax (VAT) when providing services or transferring taxable goods. If you make at least IDR 4.8 billion (USD 321,677) in revenue annually, you must register for VAT. But if you make less than that, you can register voluntarily.

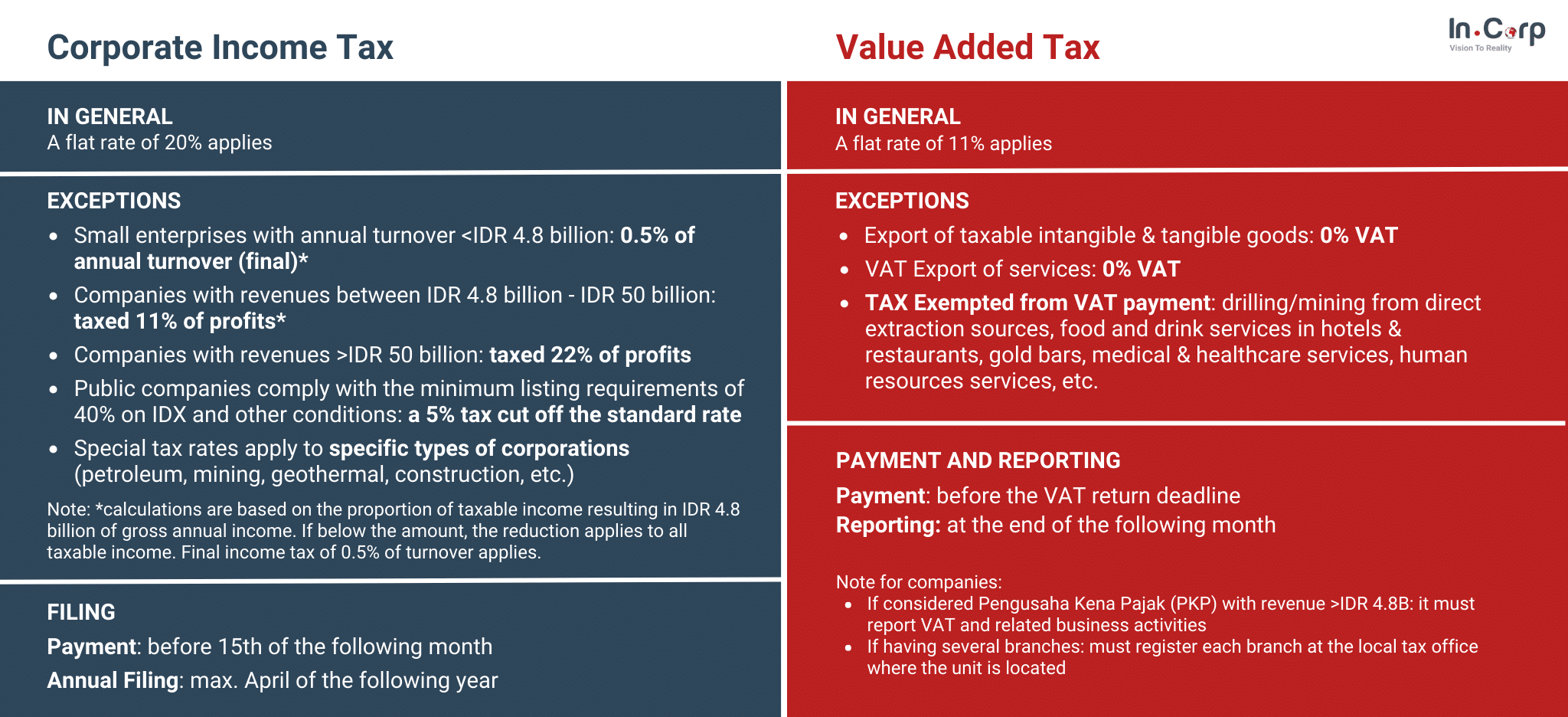

Indonesia is undergoing tax reform to maximize tax revenue and improve tax collection. The Value Added Tax (VAT) rates, presently set at 11%, will be enforced on most manufacturers, retailers, wholesalers, and importers from April 2022. A plan is also to increase the VAT rate to 12% by 2025.

Transporting tangible and intangible goods and services is subject to a zero percent VAT rate. Taxable goods and services encompass various transactions, such as:

- Importation of taxable goods.

- Provision of taxable services or importation of goods into a customs area.

- Utilization of taxable goods within the customs area.

- Utilization of taxable services within the customs area.

- Exportation of taxable goods by a VAT-registered entity.

Read more: Guide to withholding tax in Indonesia

VAT rates in Indonesia

In Indonesia, there’s a tax called value-added tax (VAT). Usually, this tax is 11% of your purchase price. But there are some cases where this tax might be different.

1. Exports

When you send or sell goods from one country to another, taxes are usually applied to them. However, no taxes may be charged for some types of goods that are not physical, like software or music. This means you don’t have to pay extra fees for sending or selling these items across borders.

2. Export of services

If you provide a service to someone in another country, you don’t have to pay any extra tax for your work. This is because the tax rate for exporting services is 0%.

3. Tax exemptions

Some VAT-exempt activities include drilling and mining, food and drink services in hotels and restaurants, gold bars, medical and healthcare services, and human resources services. VAT payments must be settled before the deadline, and reporting is done after the following month.

In cases where a company qualifies as a “Pengusaha Kena Pajak” (PKP) with revenue exceeding IDR 4.8 billion, it is obligated to report VAT and related business activities. Furthermore, companies with multiple branches must register each branch individually at the local tax office corresponding to the unit’s location.

This registration process ensures compliance with the tax regulations applicable to each branch.

What kind of goods or services is not subjected to VAT?

The Indonesian government has defined the specific goods and services exempted from taxation. These items fall under the non-taxable category, and businesses and consumers alike need to be aware of the delineation to avoid legal or financial repercussions.

Non-taxable goods

Goods that are not subject to tax include:

- Meals and drinks are provided in restaurants and hotels.

- Extracted or mined products like natural gas, crude oil, coal, gold ore, iron ore, and copper ores.

- Essential commodities like rice, eggs, milk, fruits, tubers, meat, sugar, soybeans, and salt.

- Gold bars are allocated for inclusion in government foreign exchange reserves.

Non-taxable services

Services exempt from taxation encompass:

- Religious services;

- Entertainment, hotel, parking, catering, and art services;

- Educational services;

- Medical and health services;

- Public transportation services;

- Financial services, and

- Labor services.

Procedures for VAT-related compliance in Indonesia

Here is a step-by-step roadmap to secure your VAT registration efficiently and confidently in Indonesia.

1. VAT refund

Refunds for value-added tax (VAT) can be requested after the fiscal year. Approval for VAT Refund The determination of VAT refund eligibility is carried out by the Directorate General of Taxes (DGT) and triggers a tax audit within 12 months of the VAT refund request.

If the DGT does not decide within the 12-month, VAT refund applications may still be granted. In such cases, companies must submit the necessary documents to the DGT within one month after the application.

Certain taxpayers, such as exporting goods or services, suppliers to VAT collectors, companies in the pre-production phase, and providers of goods or services exempt from VAT collection, may qualify for monthly refunds by meeting specified criteria.

2. Reporting VAT

Entrepreneurs subject to value-added tax (VAT) obligations, called VATable entrepreneurs or PKP, must report their VAT and business activities monthly. The report must be filed by the end of the next month, and any VAT owed must be paid before submitting the report.

Late returns and payments incur penalties, including a fine of IDR 500,000 and a monthly charge of 2% on the outstanding VAT amount. If VATable entrepreneurs have multiple branches, they must register each branch with the tax service office (Kantor Pelayanan Pajak or KPP).

However, they can simplify things by centralizing their VAT reporting by providing written notification to the Directorate General of Taxes (DGT).

3. VAT exemption

Certain imports and acquisitions qualify for VAT exemption under government-provided incentives. These include:

- Strategic goods, such as machinery and factory equipment

- Raw materials destined for processing by companies within a Bonded Zone

- Imports and services delivery, as well as equipment and other supplies necessary for projects funded by foreign aid

- Imports and purchases conducted by companies in specific industries like national shipping or airline companies

- Delivery and/or import of taxable goods into a Free Trade Zone

4. VAT invoice contents

The VAT invoices issued in Indonesia must contain the following details:

- A distinctive VAT invoice number assigned by the tax authority

- Seller’s name, tax identification number (TIN), and address

- Customer’s name, address, and their TIN

- Invoice date

- Comprehensive description of taxable supplies, including quantities, unit prices, etc.

- Net, VAT, and gross amounts

- For foreign currency invoices, the rates applied should align with the Ministry of Finance’s published rates.

Failure to generate a timely invoice meeting the specified criteria may result in a penalty of 2% of the tax base. It is mandatory to retain invoices for a minimum of ten years.

Navigating the complexities of VAT compliance may present challenges for businesses. InCorp Indonesia provides comprehensive tax reporting and accounting services to alleviate this burden.

Our dedicated support enables businesses to navigate the complexities of VAT regulations seamlessly, allowing your business to concentrate on fostering growth and achieving their business objectives.

Get expert guidance on ensuring your business compliance by clicking the button below.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.