In a rapidly evolving global economy, businesses are under increasing pressure to operate responsibly and transparently. Stakeholders want to know how companies impact the planet and society, not just financial performance. This is where sustainability reporting becomes crucial to disclose environmental, social, and governance (ESG) initiatives.

How can businesses leverage sustainability reporting correctly? This article will guide you through everything about sustainability reports and how a well-crafted report can enhance your company’s impact.

What is a sustainability report?

A sustainability report is a formal document that details a company’s performance and goals regarding ESG factors. It serves as a key communication tool between the organization and its stakeholders, offering transparency into non-financial performance areas such as carbon emissions, energy use, labor practices, waste management, and community engagement.

By articulating how resources are used and what impacts are generated, sustainability reports help businesses:

- Track and benchmark progress toward sustainability goals.

- Identify operational inefficiencies and areas for improvement.

- Build credibility with investors, regulators, and the public.

Legal Framework in Indonesia

Sustainability disclosures have become mandatory for businesses in Indonesia, governed by the Financial Services Authority of Indonesia (OJK) Regulation No. 51/2017. This regulation requires all financial service institutions, issuers, and publicly listed companies to submit an annual sustainability report by April 30 of the following year.

Supporting the OJK Regulation is the OJK Circular Letter No. 16/2021, which guides companies on how to execute sustainability reporting correctly.

Why sustainability reporting is important

Sustainability reports serve as a strategic asset that enhances a business’s reputation and fosters stakeholder loyalty. This is why the correct sustainability report can positively impact your company:

Building Trust and Transparency

Investors, customers, employees, and regulators are increasingly drawn to companies that are open about their environmental and social impacts. A comprehensive sustainability reporting:

- Enhances credibility through data-backed disclosures.

- Facilitates informed decision-making for stakeholders.

- Helps build brand loyalty by showcasing ethical and sustainable practices.

Driving Business Improvement

The reporting process often reveal inefficiencies and risk exposures. By tracking sustainability metrics, businesses can:

- Optimize resource utilization and minimize operational expenses.

- Anticipate regulatory changes and avoid penalties.

- Identify opportunities for innovation and market differentiation.

Aligning with Global Trends

As global attention to climate change, social equity, and ethical governance intensifies, sustainability reporting is becoming essential for market access. Companies that lead in sustainability reporting position favorably in ESG ratings and capital markets.

Sustainability reports vs ESG reports: What are the key differences?

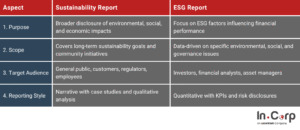

While the terms “sustainability reports” and “ESG reports” are often used interchangeably, they are not identical. Understanding their differences is crucial for creating accurate reports that meet the diverse expectations of various stakeholders.

Scope and Focus

Sustainability reporting offers a broader view of environmental, social, and economic impacts, while ESG reporting focuses on measurable factors tied to financial performances.

Target Audiences

Sustainability disclosures target a wide audience, including customers and regulators, whereas ESG reports primarily cater to investors and analysts.

Reporting Style and Metrics

The former is more narrative, often featuring case studies and stories, while the latter emphasizes KPIs, benchmarks, and risk data.

Read more: 7 ESG strategies for long-term business growth and impact

Key requirements for sustainability reporting

Producing a high-quality report requires several core components:

Materiality Assessment

The first step is to conduct a materiality assessment, which identifies the environmental, social, and governance topics most relevant to the company and its stakeholders. This ensures the report focuses on what truly matters rather than covering every possible issue.

Use of Standard Frameworks

Companies must follow recognized reporting frameworks such as GRI, SASB, TCFD, or ESRS. These frameworks provide structure, ensure data comparability, and help meet international best practices.

Governance and Accountability

The report should explain how company leaders, including managers and the board, are involved in guiding and overseeing sustainability efforts. This demonstrates that the company takes responsibility and incorporates sustainability into its key decisions.

Performance Metrics and KPIs

Quantitative performance indicators are essential, including carbon emissions, energy usage, water consumption, workforce diversity, and adherence to ethical practices. Metrics should be tracked consistently over time to demonstrate progress and credibility.

External Assurance and Verification

To enhance trust, many companies seek third-party assurance for their reports. This process verifies data accuracy and validates claims, particularly for investors and regulatory bodies.

Common challenges in preparing reports

Creating a strong sustainability disclosures often comes with key challenges, particularly in data preparation. Many companies struggle to gather complete and accurate information across departments. Without centralized systems, reports can be inconsistent and lack essential details.

Another issue is unclear communication. Some reports use complex language that’s hard to understand. Additionally, the entire reporting process is time-consuming, as it requires coordination among multiple departments. These hurdles often delay the publication of reports and make it harder for businesses to maintain transparency.

Read more: How carbon footprint reduction contributes to sustainable investment.

How InCorp can help

Navigating ESG integration can be challenging, but you don’t have to do it alone. InCorp Indonesia (an Ascentium Company) offers comprehensive ESG advisory services designed to elevate your sustainability performance. Our experts deliver tailored, high-impact support to help your business meet reporting standards and strategic goals.

Get in touch today and build sustainable success for your business.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.