The concept of the ASEAN Blue Economy revolves around sustainable ocean-based economic activities. Therefore, with its extensive coastline and maritime resources, Indonesia aims to become a leading force in this transformative movement. With a strategic position within the ASEAN region, Indonesia offers a wealth of investment opportunities for businesses eager to tap into the vast potential of the Blue Economy.

This article delves into Indonesia’s pivotal role in the ASEAN Blue Economy and explores its compelling prospects for forward-thinking investors and sustainable economic growth.

Blue economy’s potential in the ASEAN region

Suharto Manoarfa, the Minister of National Development Planning/Head of Bappenas, expressed his optimism that the blue economy could be a new driving force for ASEAN’s economic growth. The optimism is backed by over 66% of the ASEAN region being covered by water. Therefore, the potential for the blue economy is enormous.

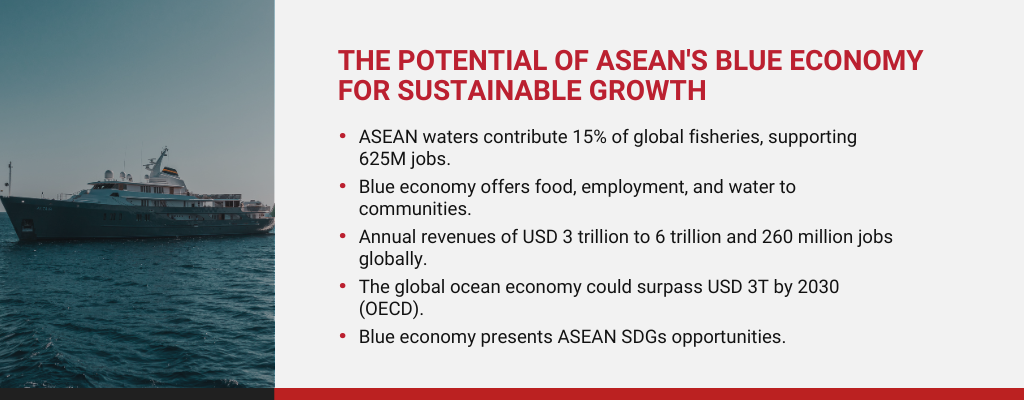

Bappenas reports that ASEAN waters contribute to 15% of global fisheries and support around 625 million jobs in related sectors. The potential of the blue economy lies in its capacity to generate annual revenues ranging from USD 3 trillion to 6 trillion and create approximately 260 million jobs globally.

As per the Organization for Economic Co-Operation and Development (OECD), the value-added output of the global ocean economy has the potential to increase twofold, from USD 1.5 trillion in 2010 to surpass USD 3 trillion by 2030. Moreover, transitioning to a blue economy presents opportunities to achieve sustainable development goals (SDGs) in ASEAN.

Key industries for blue economy development

According to the Partnerships in Environmental Management for the Seas of East Asia (PEMSEA), there are nine primary industries considered key for growing a blue economy, which are:

1. Fisheries and aquaculture

Good environmental management can support the long-term productivity of fisheries and generate new market opportunities for seafood products.

2. Ports, shipping, and marine transport

Improvement in environmental performance in this sector can present opportunities, such as cost savings from fuel efficiency and access to more customers from the reputation for meeting environmental requirements.

3. Tourism, resorts, and coastal development

A growing number of tourists are aware of the potentially negative impacts of their activities and are demanding more sustainable eco-tourism options that support local communities.

4. Oil and gas

While the oil and gas sector is expected to significant growth in East Asia, proper environmental management will be crucial to maintain its ability to operate effectively.

5. Coastal manufacturing

Consumers are now more mindful of their purchases, urging companies to be transparent about their environmental and social practices in the manufacturing supply chain.

6. Seabed mining

Utilizing the best available technology can minimize disturbance to surrounding ecosystems and cause less damage than terrestrial mining.

7. Renewable energy

The ocean presents several renewable forms of energy, including waves, tides, currents, thermal gradients, wind, and biomass.

8. Marine biotechnology

Marine species can be utilized as key ingredients for biofuel, cosmetic products, dietary supplements, painkillers, and even treatments for cancer, asthma, and arthritis.

9. Marine technology and environmental services

Applying environmental services and technology is essential to problems related to pollution and deteriorating water quality on the coasts.

Read more: Positive Investment List improves investment in Indonesia

Indonesia’s role and contributions to ASEAN blue economy

Indonesia successfully launched the Global Blended Finance Alliance (GBF) in 2022 as part of its G20 Presidency. The alliance plans to mobilize new sources of development financing from non-government actors. Minister Suharso emphasized that ASEAN member countries could benefit from the GBF Alliance to unlock the blue economy potential.

The GBF alliance can attract leading investors and experts in the blue economy sector to develop eco-tourism and ocean-coastal waste management. Therefore, the development will lead to sustainable marine manufacturing projects.

Indonesia already developed a comprehensive blue economy roadmap to promote a competitive, innovative, sustainable, and inclusive blue economy. The roadmap also serves as a signal of Indonesia’s readiness in this aspect to other ASEAN states.

With the contribution of Indonesia to ASEAN’s blue economy, Indonesia holds immense potential to be the champion for the blue economy, ranging from its geographical aspects to its policy instruments.

The prospective blue economy development in Indonesia

Bappenas’ Deputy for Economic Affairs, Amalia Adininggar Widyasanti, stated that Indonesia’s Chairmanship in ASEAN 2023 could play a crucial role in spearheading the development and implementation of the blue economy in the region.

Therefore, Indonesia holds significant potential for a blue economy for several reasons:

1. Unique geographical landscape

Indonesia has more than 17,500 islands, 108,000 kilometers of coastline, and three-quarters of its territory at sea. Oceans are central to Indonesia’s prosperity, supporting activities like capture fisheries, aquaculture, coastal tourism, marine construction, and transportation.

2. Enormous fishery & tourism sector

Indonesia is the world’s second-largest fishery sector, valued at approximately USD 27 billion, providing seven million jobs and fulfilling over 50 percent of the nation’s animal-based protein needs. Indonesia’s tourism industry heavily relies on its oceans, contributing around USD 21 billion to the GDP in 2019.

3. Clear political will

Indonesia’s commitment to a blue economy is evident through clear political will, as seen in President Joko Widodo’s blueprint known as Nawacita. The blueprint emphasizes the government’s determination to prioritize sustainable practices, including responsible utilization of marine resources.

4. Commitment to preserving natural capital

Indonesia has pledged to preserve natural capital, including marine resources, to mitigate climate change, as demonstrated by its participation in the Initiative Natural Capital Carbon Communities Super Power.

5. Promising economic outlook

The World Bank estimates the value of Indonesia’s blue economy at USD 1.338 billion, highlighting numerous opportunities for revenue, including coastal culture, capture fishery, treasure-laden shipwrecks, marine tourism, coral reefs, seagrass, and mangroves. Currently, the blue economy contributes 6% to Indonesia’s GDP, and this share is expected to grow to 12.5 to 15% by 2045.

Challenges for Indonesia’s blue economy

Albeit the huge potential, Indonesia faces three major challenges in developing the blue economy:

1. Lack of literacy

Lack of literacy and understanding among the public and businesses regarding the development of the blue economy.

2. Low utilization

The blue economy’s potential currently needs to be utilized, and it needs to be optimized.

3. Intergenerational commitment

The declining interest among the younger generation has become an issue in ensuring a long-term commitment to the blue economy’s growth.

Conclusion

Considering the current situation, the development of the blue economy is imminent. Indonesia’s leadership in ASEAN 2023 is also expected to trigger collaboration for the development of the blue economy in the region, which contributes to 15% of global fisheries.

Given the immense potential of Indonesia for a blue economy, businesses can consider exploring investment opportunities in this sector.

Investors that aim to capitalize on the opportunities of the blue economy and its related businesses can seek assistance from InCorp Indonesia by clicking the button below, particularly concerning company registration and obtaining business licenses.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.