Indonesia is rapidly gaining the attention of international investors and import-export businesses. The strategic advantage offered by the development of bonded zones is a key driver of this growth.

These zones, which extend beyond mere storage areas, catalyze economic transformation, empowering businesses with unique opportunities. This article explores how bonded zones in Indonesia are essential for companies seeking to tap into local and global markets.

What is a bonded zone in Indonesia?

A bonded zone is a specially designated area under customs control where imported goods can be stored, manufactured, or processed without import duties or taxes. These goods are considered outside the customs territory, meaning taxes and duties are suspended until the goods are officially released into the domestic market.

The true essence of bonded area zones lies in their ability to alleviate the burden on businesses by providing the flexibility to delay or avoid import taxes. Whether utilized as a warehouse, manufacturing hub, or logistics center, bonded zones offer flexibility and a range of economic incentives, instilling a sense of optimism and motivation in businesses.

Where are bonded zones located in Indonesia?

Bonded zones are typically placed near ports, airports, and industrial clusters to reduce logistics costs and speed up customs processes. In Indonesia, bonded zones are in these areas, including:

- Batam (Riau Islands Province)

- Cikarang (West Java)

- Tangerang (Banten)

- Surabaya (East Java)

- Semarang (Central Java)

- SEZ Mandalika (Lombok), SEZ Sei Mangkei (North Sumatera), and SEZ Kendal (Central Java)

Read more: Navigating the import landscape in Indonesia

Types of Indonesia’s bonded zones

Indonesia offers a variety of bonded zone facilities tailored to meet the needs of different business operations. These zones are strategically designed to optimize logistics, reduce costs, and attract investment.

Here are the major types of bonded areas found across Indonesia:

1. Bonded Zone

This zone is for export-focused manufacturers making or processing goods, including textiles, electronics, and automotive. Businesses can import materials and tools immediately without paying taxes if they use them inside the zone.

- Deferred tax and duty payments

- Simplified customs procedures

- Easier re-export processes

2. Bonded Warehouse

This facility stores imported goods before they are released into the domestic market or re-exported. This setup is ideal for businesses that need flexibility in inventory management and are not yet ready to sell or process the goods immediately.

Benefits include:

- Long-term storage with no tax burden

- Ability to repackage or relabel goods

- Tax payment is applied only when goods are taken out

3. Bonded Storage Facility

These facilities are designed for storing goods related to specific business purposes, such as exhibitions, repairs, or transit. They are perfect for logistics companies operating in time-sensitive supply chains.

4. Bonded Logistics Center

This zone is a significant warehouse hub for distribution, sorting, and logistics operations. It enables the integration of imports and exports, making it effective for e-commerce, retail, and fast-delivery businesses.

5. Special Economic Zones (SEZs)

Although broader in scope, SEZs often include bonded zone features. They are designed to boost economic development in certain regions by attracting high-value industries like technology, tourism, and manufacturing. Several benefits are provided from this area, including:

- Tax holidays

- Reduced regulations

- Priority infrastructure support

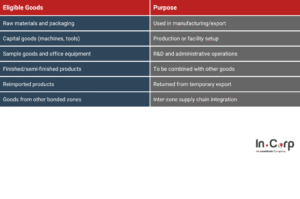

Goods that receive bonded zone facilities

Not all goods are eligible for bonded zone facilities. Typically, businesses can import and process the following under bonded arrangements:

How businesses can benefit from bonded zone facilities

Bonded zones in Indonesia offer significant advantages for companies that import, export or manufacture goods. These special areas allow companies, such as manufacturing companies, e-commerce businesses, and logistics providers, to grow faster and compete better in local and global markets.

Here’s the breakdown of why Indonesia’s bonded-free area can benefit your businesses:

1. Cash Flow Improvement

Bonded zone facilities offer the significant advantage of delaying import duties and taxes. This will allow companies to control their cash flow, which is especially helpful for startups and manufacturers with substantial upfront costs.

2. Tax and Duty Exemptions

Goods imported into bonded zones are exempt from:

- Value Added Tax (VAT) on imported goods

- Value Added Tax (VAT) on foreign-owned goods meant for export

- Import Duties

- Excise Tax (alcohol and tobacco products)

- Import-Related Tax (VAT and Income Tax) for goods outside the customs area.

These exemptions help businesses save millions in operational costs, especially when dealing with bulk raw materials or machinery imports.

Read more: Navigating import taxes and duties in Indonesia

3. Flexible Manufacturing and Storage

Companies can store, assemble, label, or manufacture products inside bonded areas. This flexibility makes it easier to adapt to dynamic market demands and process goods cost-effectively.

4. Competitive Export Advantages

Since many businesses in bonded zones are export-focused, the facilities help them stay globally competitive by:

- Cutting production and logistics costs

- Speeding up lead times

- Providing easy access to regional and international markets

Many global companies choose Indonesia’s bonded zones as a strategic export hub.

5. Inventory Control and Distribution Efficiency

Bonded zones allow businesses to store and distribute goods regionally without going through complicated tax and customs procedures for each shipment. This is a significant win for e-commerce, logistics providers, and multinational companies.

6. Risk Reduction for Unused Goods

If goods imported into a bonded zone are not sold or needed, they can be re-exported without taxes. This reduces the financial risk of holding unsold inventory and gives businesses more room to experiment or test market demand.

Guide to setting up your business in Indonesia’s bonded zones

Setting up your business in one of Indonesia’s bonded zones is a strategic way to enjoy tax benefits and simplify import-export operations. However, it requires careful preparation and compliance with customs regulations.

Here’s a step-by-step guide based on the requirements and practical insights on how to set up your business in Indonesia’s bonded zones.

1. Determine Your Eligibility

To operate in a bonded zone, your business should be involved in:

- Manufacturing or processing goods for export

- Importing materials or equipment for export-related production

- Logistics and distribution operations within or outside Indonesia

Businesses that want to use the bonded area must be directly or indirectly involved in exporting goods and demonstrate operational readiness to manage imported items under customs supervision.

2. Prepare the Required Documents

To begin the application, companies that intend to be bonded zone organizers should prepare several documents, including:

- Business license and company registration documents

- Business Identification Number (NIB)

- Confirmation of Taxpayer Status (KSPW)

- Importer Identification Number (API)

- Proof of land or building ownership/lease

- Detailed site layout and operational flow

Information on production processes and inventory systems

3. Apply for Bonded Zone Status

Companies must submit their prepared documents and application to the Directorate General of Customs and Excise (DJBC). Once submitted, DJBC will conduct on-site inspections, verify documents, and evaluate business readiness.

If approved, you will receive a Bonded Zone Operator License (PKB), which officially grants you the right to manage operations in the bonded area.

4. Operational Launch

Once your bonded zone license is approved, you can begin your bonded operations, including receiving tax exemptions, processing and manufacturing, and re-exporting activities.

Businesses should install a real-time inventory and custom monitoring system that integrates with the Indonesia National Single Window (INSW) to comply with the system’s setup.

Key strategies to seize bonded zones

Businesses should use innovative, simple strategies to succeed in a bonded zone facility. Here are the five most important ways to maximize the benefits.

Focus on Export

Bonded free zones offer the best tax benefits when you export goods. If your business mainly sells to international markets, you’ll save more on taxes and get faster customs clearance.

Use Simple Tracking Systems

Install basic software to track your goods and communicate with customs. This will help you avoid mistakes, stay compliant, and speed up import/export processes.

Add Value Within Bonded Zones

Instead of just storing goods, you can do activities like packing, assembling, or labeling inside the bonded zone. These tasks do not trigger taxes and help increase your product’s value before export.

Work with Experts

Partnering with customs consultants or logistics service providers can help with paperwork, licenses, inspections, and overall compliance. This effort will save your business time and avoid costly mistakes.

Train Staff and Maintain Compliance

Make sure your team knows how bonded zones work. Regular training helps avoid issues during inspections and keeps operations smooth. Additionally, stay informed about any changes in the rules to ensure your business remains compliant and maintains its benefits.

Unlock the power of bonded zones for your businesses in Indonesia

Indonesia’s bonded zones are your gateway to global trade opportunities. These zones offer advantages for manufacturers and importers who want to lower costs and simplify their operations.

Setting up in a bonded zone can feel complicated, but InCorp Indonesia (an Ascentium Company) is here to make it easy. We offer complete support to help your business maximize its bonded zone benefits.

- Company Setup: Our team handles your business registration and ensures you meet all legal requirements to facilitate your business launch.

- Import License: We help you comply with Indonesian laws and get your import license quickly so you can start bringing products without delays.

Ready to expand confidently? Contact us today, and let’s build your success in Indonesia’s bonded zones.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.