Indonesia imports play a crucial role in economic development. The industry facilitates access to essential goods and fosters international trade for better and sustainable economic growth.

However, navigating the import process in Indonesia can be complicated. Investors need a thorough understanding of the applicable regulations and procedures before optimizing their business operations in the said circumstances.

Key regulations for importing to Indonesia

Indonesia’s new Omnibus Law marks a significant step towards business reform. Government Regulation No. 29 of 2021 grants the Ministry of Trade (MoT) the authority to streamline import-export activities by issuing approvals, verifications, obligations, and licenses.

The regulation also simplifies the process for importers and exporters to obtain business licenses. Now, only a Business Identification Number (NIB) is required through the Online Single Submission (OSS) system.

Previously, businesses had to navigate through different types of import licenses, but now the NIB covers all necessary authorizations, including API-U, API-P, and API-T licenses.

Types of prohibited and restricted goods

Some products are subject to import regulations based on the Restricted and Banned Goods List, also known as the “LARTAS list.”

Indonesia’s Ministry of Trade Regulations 18 (MoT Regulation 18/2021) provides an updated list of goods that cannot be imported to or exported from Indonesia.

The regulation introduces new categories of prohibited import goods, including:

- finished hand tools

- sugar

- ozone-depleting substances

- certain drugs and foods

- hazardous and toxic materials, among others

Categories of goods prohibited for export include:

- scrap metal

- cultural heritage goods

- subsidized fertilizers

- mining products

- forestry

- certain agriculture products

Read more: Navigating import duties and taxes in Indonesia

Documentation and licenses

Importing goods into Indonesia necessitates various licenses and permits to ensure compliance with the country’s regulations. Those are:

Importer Identification Number (API)

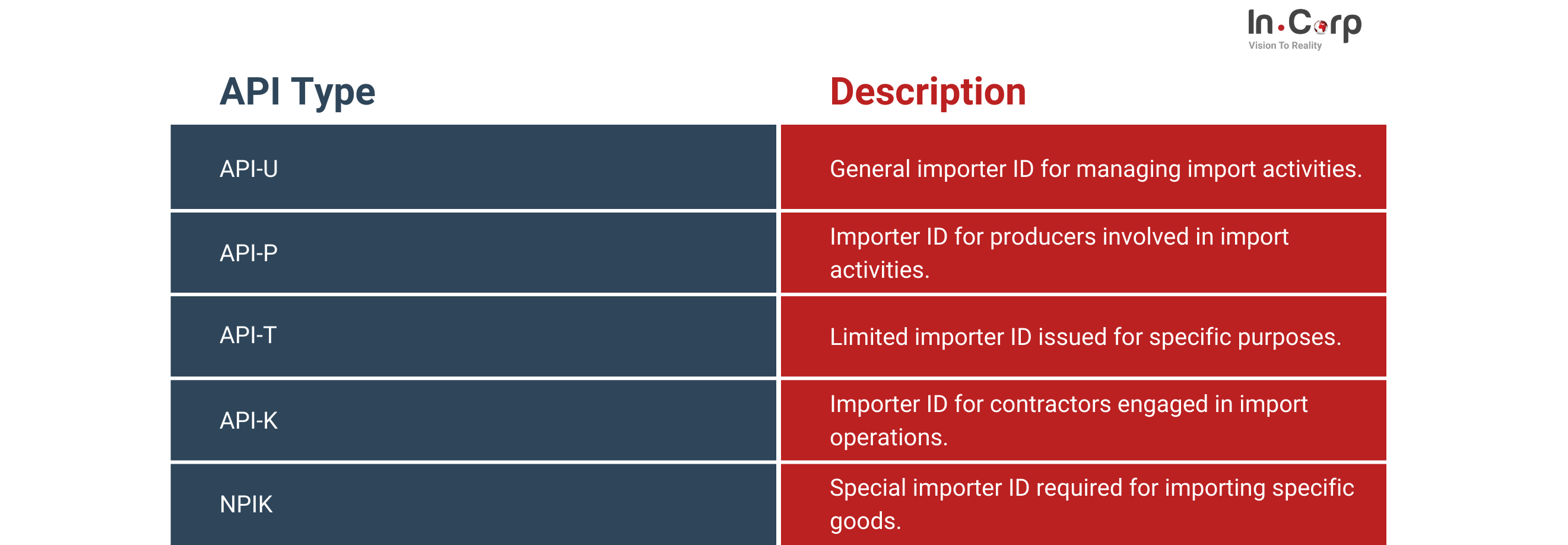

To facilitate the import process, you’ll need an API to manage a database of importers and supervise import activities. There are four distinct types of API:

- General Importer Identification Number (API-U)

- Importer Identification Number for Producers (API-P)

- Limited Importer Identification Number (API-T)

- Importer Identification Number for Contractors (API-K)

Special Importer Identification Number (NPIK)

The Special Importer Identification Number, or NPIK, is crucial for importing specific goods such as rice, corn, soybean, sugar, textiles, footwear, electronics, and toys. To obtain an NPIK, you first need an API (Importer Identification Number).

The process of importing goods into Indonesia

| Step | Description | Additional Notes |

| 1 | Determine your product and gather your paperwork |

purchase order, packaging list, commercial invoice, bill of lading, and any other licenses or permits as needed. |

| 2 | Acquire your NIB (Single Business Number) |

|

| 3 | Acquire your SIUP (Business Permit for Trade) |

|

| 4 | Acquire your NPWP (Taxpayer Identification Number) |

|

| 5 | Employ the services of a customs broker |

|

| 6 | Complete your import declaration |

|

| 7 | Pay your import taxes and duties |

|

| 8 | Complete customs clearance and receive your shipment |

|

| 9 | Adhere to post-importation obligations |

|

| 10 | Consider professional support if necessary |

|

Customs clearance and duties

Customer clearance is an administrative process for sending or releasing goods from a cargo area. Simply put, it’s the process of unloading goods related to customs or government administration. The steps include the following:

Pre-clearance (Initial stage)

Pre-clearance is the initial administrative process in customs clearance for goods. Two main aspects of importing goods are legality processes and import restrictions (LARTAS).

Clearance

The second stage is the clearance process, which consists of three main steps: customs notification, tax payment, and goods release.

Post-clearance

The final stage is post-clearance, which occurs after completing the first and second stages. It occurs before the release of goods.

Streamline your imports with InCorp Indonesia

Importing into Indonesia can be a simple maze. InCorp Indonesia takes the hassle out of the process with our comprehensive import solutions:

- Import licenses: We help you obtain the necessary permits to import your goods and avoid delays legally.

- Importer of record: We act as your official importer, ensuring compliance with local regulations and minimizing risk.

Ready to simplify your imports? Contact our experts today, and let’s discuss your needs.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.