Indonesia’s food sector offers a compelling investment opportunity, especially in the processed food segment. This area is set for substantial growth, fueled by a burgeoning middle class with increasing disposable income and a rising demand for convenient and flavorful food options.

These trends create an ideal environment for businesses looking to capitalize on Indonesia’s dynamic consumer market. Let’s find interesting aspects for you to capitalize on.

What defines a processed food category

Processed food or ready-to-eat food has been altered from its natural state. This means products under the ready-to-eat food category involve cutting, washing, heating, pasteurizing, canning, cooking, freezing, drying, dehydrating, mixing, or packaging. It can also add preservatives, nutrients, flavors, salts, sugars, or fats.

The difference between processed and unprocessed food

The main difference between processed and unprocessed foods is how much they’ve been altered from their natural state. Unprocessed foods are natural and whole without altering their original state. This includes many items, such as:

- Fruits (apples, berries, oranges)

- Vegetables (broccoli, carrots, spinach)

- Whole grains (brown rice, quinoa, oats)

- Lean meats and poultry (chicken breast, fish, beans)

These foods are typically packed with nutrients like fiber, vitamins, minerals, and healthy fats. On the other hand, ready-to-eat food has been modified in some way. This can range from simple things like washing and chopping vegetables to more extensive nutritional content changes.

4 types of processed foods in the market

The United Nations utilizes a food grouping system called the NOVA classification, which divides foods into four categories:

| Type | Description |

|---|---|

| Unprocessed or Minimally Processed Foods | This includes fresh blueberries, roasted nuts, or chopped vegetables, which have undergone minimal changes. |

| Processed Culinary Ingredients | These natural ingredients have been slightly altered, such as pressed, refined, milled, or dried. They are processed for use in cooking and are not intended to be eaten on their own. |

| Processed Foods | This group includes canned fish, syrup fruits, bottled vegetables, cheese, and fresh bread, with added salt, oil, sugar, or other ingredients from groups one or two. |

| Ultra-Processed Food and Drink Products | These foods result from extensive manufacturing processes, including sugars, oils, fats, salts, etc. They are designed for immediate consumption with minimal preparation, such as soft drinks, packaged snacks, and ready-made frozen meals. |

Processed food industry trends in Indonesia

The processed food industry contributed to the national gross domestic product (GDP) within the food and beverage sector, totaling USD 849.39 billion last year.

Research released by SGE titled “Food Sector in Indonesia Imported Processed Food Market” in January 2024 indicates that the convenience needs of modern urban society drive the trend of increasing consumption of this ready-to-eat food.

City dwellers’ fast-paced and often hurried lifestyles demand practical, ready-to-eat foods that can be consumed quickly. Ready-to-eat foods effectively meet this need.

Read more: The halal industry: trends and prospects in Indonesia

Why invest in Indonesia’s processed food market?

Indonesia is a significant market for ready-to-eat food, with intense competition among many players. In 2022, the country had 7,498 medium to large-scale food and beverage manufacturing companies.

Furthermore, 530 licensed importers, ranging from local and national to multinational companies, are active in the processed food industry.

Promising sub-sectors within the processed food industry

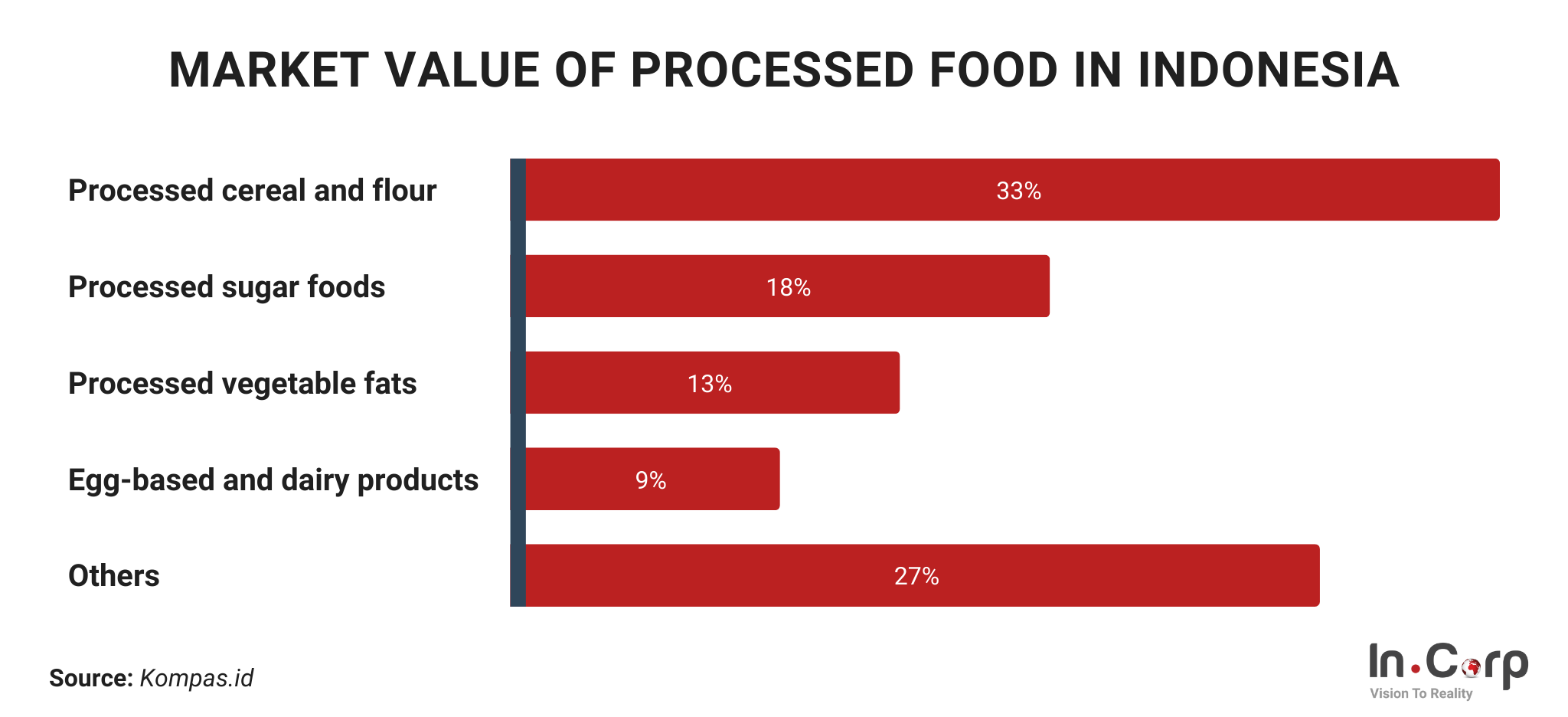

The market value of processed foods in Indonesia reached USD 17.9 billion (IDR 286.40 trillion) in 2023. The processed cereal and flour market was the most consumed, contributing 33% of the total processed food market value.

Moreover, processed sugar foods contributed 18%, processed vegetable fats 13%, and egg-based and dairy products 9% of the total market value. Other ready-to-eat foods (processed meat, beverages, cocoa, coffee, tea, spices, vegetables, fruits, tubers, nuts, and processed fish) contributed 27% of the total market value for processed foods.

Top processed food companies in Indonesia

There are various types of processed food companies in Indonesia. However, some companies have risen by demonstrating their expertise in producing a wide range of ready-to-eat food products.

These leading companies cater to the Indonesian market’s diverse culinary preferences and dietary requirements.

Indofood CBP Sukses Makmur

Indofood is the largest FMCG company in Indonesia. It specializes in various food and beverage products, such as instant noodles, snacks, dairy items, and drinks. Its flagship brand, Indomie, is the leading instant noodle brand in the country.

Wings Group

Wings Group produces and distributes various food and beverage items, including instant noodles, snacks, and sauces. Its leading brand, Mie Sedaap, is Indonesia’s second most popular instant noodle brand.

Mayora Indah

Mayora Indah manufactures and distributes various food and confectionery products, such as biscuits, wafers, cakes, and chocolate. Kopiko, its flagship brand, is Indonesia’s most popular coffee candy.

Frisian Flag Indonesia

Frisian Flag Indonesia, a subsidiary of the Dutch dairy company FrieslandCampina, offers a variety of dairy products, including milk, yogurt, cheese, and ice cream. The company’s flagship brand, Frisian Flag, is Indonesia’s most popular milk brand.

Kraft Heinz Indonesia

Kraft Heinz Indonesia, a subsidiary of the American multinational Kraft Heinz, is known for its diverse food and beverage products, including ketchup, mayonnaise, cheese, and snacks.

The challenges in Indonesia’s processed food sector

The ready-to-eat food industry in Indonesia also faces several challenges. One major challenge is maintaining food safety and quality standards. As the industry grows, it is crucial to ensure that food production processes comply with strict regulations to protect consumer health and maintain trust.

Another challenge is the need for innovation and differentiation. With increasing competition, companies must continuously develop new and unique products to capture market share.

Indonesia’s ready-to-eat food industry has a promising future with significant growth potential. However, businesses must address these challenges and seize opportunities arising from changes in the consumer landscape.

Capitalize on Indonesia’s processed food market with InCorp

Indonesia’s increasing demand for high-quality processed food presents an attractive market opportunity for investors and businesses. If you want to take advantage of the ready-to-eat food industry in Indonesia, InCorp can guide you through establishing and flourishing in this dynamic sector.

Our experts deeply understand Indonesia’s regulatory landscape, specifically in the ready-to-eat food industry. We offer comprehensive services made to streamline your business setup and ensure seamless compliance:

Click the button below to unlock the full potential of the processed food market in Indonesia and maximize your opportunities in this dynamic market.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.