Ensuring your business complies with tax obligations is vital, especially when filing the annual tax return. Consulting tax services is essential for navigating deadlines, complex requirements, and evolving regulations, helping companies file on time, reduce stress, and avoid penalties.

Corporate annual tax return submission: Deadline and key reports

Businesses in Indonesia must file their Corporate Income Tax Return (SPT Tahunan PPh Badan) no later than the end of the fourth month after the fiscal year ends, typically April 30th. Meeting this deadline is not negotiable. Failure to comply may result in sanctions, including fines and audits.

What Should Be Included?

To file annual tax returns, businesses are required to submit a complete document that reflects the company’s financial health and tax responsibilities. Key components include:

- Audited financial statements

- Details of revenue and expenses

- Tax payment slips (SSP)

- Withholding tax documents (PPh 21, PPh 23, etc.)

- Commercial and fiscal reconciliation reports

- Assets and liabilities listing

- Statement of losses carried forward

- Company profile and changes, if any

Consulting tax professionals ensures these documents are accurate, complete, and aligned with regulatory updates, helping your business feel supported and confident in compliance.

Read more: A 2025 guide to fill corporate annual tax return

Challenges of navigating Indonesia’s complex tax landscape

Indonesia’s tax environment is known for its complexity. From shifting regulations to digital systems like Coretax, businesses often struggle to keep up. Filing the annual SPT can quickly become a burden for companies without local tax expertise.

Adapting to the Coretax System

Businesses must now use Indonesia’s digital tax administration platform, Coretax. This system, while efficient, requires an in-depth learning process, especially for those unfamiliar with e-filing technicalities. This struggle can lead to future tax filing delays.

Frequent Tax Regulations Changes

Tax laws and reporting standards often evolve. Without expert guidance, businesses risk misinterpreting rules or submitting outdated or incorrect documentation.

Data Inconsistencies

Annual tax reporting requires alignment between financial statements and tax documents. Mismatched expenses, missing withholding tax slips, or unreconciled revenue are red flags for audits and penalties.

Time Constraints

Preparing and validating numerous financial documents requires time. Many SMEs and growing businesses lack dedicated tax teams, making the process time-consuming and vulnerable to human error.

Penalties for Late Filing

According to Indonesia’s tax regulation, late submission of the annual tax return can lead to severe consequences, including:

- Administrative fines

- A comprehensive tax audit

- Additional tax assessments

- Even legal sanctions in severe cases

These key challenges often lead to late tax submissions, risking penalties and business disruptions. Engaging consulting tax services ensures accurate, timely filings, helping companies avoid these risks and maintain smooth operations.

Read more: Navigating Indonesia’s new Core Tax System.

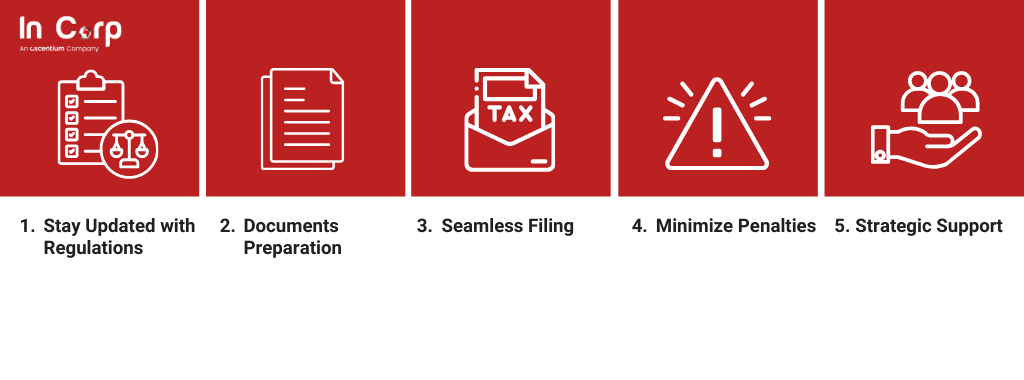

How consulting tax services ensure on-time reporting

Consulting tax services offer businesses the expertise needed to meet tax deadlines confidently. They ensure a smooth, timely, and stress-free reporting process by doing these:

1. Stay Updated with Regulation Changes

Tax consultants monitor and interpret the latest Indonesian tax laws and updates to systems like Coretax. This keeps your tax filing compliant and up to date.

2. Prepare and Review All Required Documents

From financial statements to withholding tax slips, consultants organize and validate all necessary paperwork early. This eliminates last-minute errors or missing files.

3. Ensure Seamless Coretax Filing

With hands-on experience using Indonesia’s e-filing platform, tax professionals manage uploads, fix entry errors, and ensure your submission is technically sound.

4. Minimize Risk of Penalties

Accurate, timely filing reduces the chance of audits, fines, or tax assessments. This will help protect your company’s finances and reputation.

5. Provide Strategic Support

Beyond filing, consulting tax experts may advise on ways to optimize tax efficiency and reduce future liabilities, supporting long-term business health.

[su_posts template=”su-posts-templates/embed-tax.php”]

Key advantages of on-time annual tax reporting

Filing your corporate tax return on time delivers significant benefits that go beyond just avoiding legal and financial penalties:

- On-time filing can boost business credibility with banks, investors, and government bodies

- Avoid last-minute disruptions and focus on core business activities to ensure smooth operations without tax delays.

- Accurate reporting supports accurate financial planning and opens opportunities for tax optimization.

- Staying compliant can simplify future tax submissions

Working with dedicated consulting tax professionals, like InCorp, helps large and small businesses overcome the complexities of annual tax filing. With expert support, companies can ensure on-time submissions, maximize tax benefits, and unlock more growth opportunities through compliance.

Mastering Corporate Taxation in Indonesia

Ensure a stress-free tax filing with InCorp

Filing corporate taxes in Indonesia can be complex, but you don’t have to do it alone. With expert support from InCorp Indonesia (an Ascentium Company), you can file on time, avoid penalties, and focus on growing your business.

Our specialized services include:

- Tax Consulting: Navigate complex regulations with ease. Our seasoned experts handle every aspect of your tax strategy, ensuring smoother audits and more intelligent planning.

- Tax Reporting: From preparation to compliance, we manage the entire tax reporting process, saving you time and minimizing risk.

Take the stress out of the tax season. Partner with us and get it done right.

Frequently Asked Questions

When is the deadline for filing the corporate annual tax return in Indonesia?

Companies must submit their Annual Corporate Income Tax Return (SPT Tahunan PPh Badan) by April 30, or no later than four months after the fiscal year ends.

What documents are required for annual corporate tax filing?

Audited financial statements, revenue and expense details, tax payment slips (SSP), withholding tax documents, reconciliation reports, and asset–liability listings.

What happens if a company files its annual tax return late?

Late filing may result in administrative fines, increased audit risk, and closer scrutiny from the tax authority.

How can tax consultants help with annual tax reporting?

Tax consultants prepare and review documents, ensure accurate Coretax filing, monitor regulatory updates, and help minimize errors and penalties.

Why is on-time annual tax reporting important for businesses?

Timely filing improves compliance, supports financial planning, strengthens credibility with stakeholders, and simplifies future tax submissions.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.