Navigating your corporate annual tax return in Indonesia can feel daunting. Whether you are a local or foreign company, filing your annual tax return is critical and requires a more profound understanding to ensure compliance. This guide will walk you through the essentials of yearly tax returns for companies and how to ensure a smooth reporting process.

Understanding corporate annual tax return

A corporate annual tax return in Indonesia is a comprehensive report submitted by companies to the Directorate General of Taxes (DGT) Online system. This report is submitted using Form SPT Tahunan Badan (Form 1771), detailing all taxable income, deductions, and final tax liability.

Filing this return is mandatory for all legal business entities operating in Indonesia, including:

- Limited Liability Companies (PT)

- Limited Partnership (CV)

- Foundations and Institutions

- Foreign-owned companies (PMA)

- Permanent Establishments (BUT)

Types of corporate taxes

Businesses must report multiple categories of corporate tax in their annual return, including:

- Corporate Income Tax (CIT): Based on net profit after deducting allowable business expenses.

- Withholding Taxes: Includes PPh 21, 23, 26, 4(2), and 15, collected and paid by companies on behalf of third parties.

- Value-Added Tax (VAT): If the company is a PKP (Taxable Entrepreneur), monthly VAT must be reconciled and reported annually.

- Final Taxes: Certain types of income may be subject to final tax and need to be reported separately.

It is critical to reconcile monthly tax payments and reports with the annual return to avoid audits or penalties.

Why should businesses report corporate tax?

Filing corporate annual tax returns is a necessity that can impact your business operations and growth opportunities. Here’s why businesses should not miss this obligation:

1. Legal Obligation with Financial Consequences

Submitting a corporate annual tax return in Indonesia is a legal obligation. Every business entity must file its annual SPT, regardless of whether it operated profitably during the year. Failing to report, underreporting, or late submissions can lead to:

- Administrative sanctions

- Financial penalties

- Tax audits

- Legal prosecution in severe cases

2. Enhancing Corporate Credibility

A consistently filed annual tax return helps establish transparency and trust with investors, banks, partners, and regulatory authorities. It signals that your company operates ethically and in compliance with Indonesian laws.

3. Securing Business Opportunities

Many government and private tenders, funding rounds, or investment proposals require proof of tax compliance. Your annual return becomes a critical supporting document when applying for:

- Business loans

- Tax clearance certificates

- Immigration permits for foreign directors or staff

In short, your company has more to gain from proper filing than skipping it. Ensuring accurate annual reporting now saves major headaches and financial losses.

How to fill out a corporate annual tax return

Filing your corporate annual tax return in Indonesia becomes easier when you follow a structured process. Here’s what you need to know in 2025:

Requirements Before Filing

Make sure to have the following ready:

- NPWP (Tax ID Number)

- EFIN (Electronic Filing Identification Number)

- Annual financial statements

- Monthly tax payment and withholding records

- VAT and tax invoice recaps (if applicable)

- Access to the DJP Online system

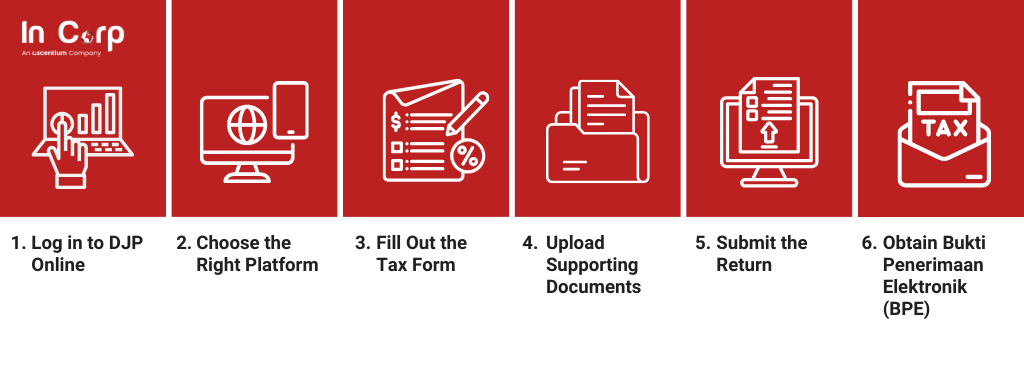

Step-by-Step Guide

Once you have prepared all the documents, you need to file Form 1771 to submit your annual tax return. Here’s the complete guide for you:

1. Log in to DJP Online

Go to the DGT Online System and log in using your company’s NPWP and EFIN to access the corporate tax services.

2. Choose the Right Platform

Select whether to use the e-SPT desktop application or the online Form 1771. Both options allow you to file, but the web version is more convenient for most companies.

3. Fill Out the Tax Form

Enter your company’s financial data, including total income, deductible expenses, net profit, and any tax credits. Ensure the data aligns with your financial statements.

4. Upload Supporting Documents

Attach documents such as:

- Annual financial statements

- Tax payment slips (SSP)

- Recaps of tax withholdings (PPh 21, 23, VAT, etc.)

These support your declarations and prevent delays or audits. After that, you need to double-check all entries to avoid any inconsistencies that lead to a tax review or correction request.

5. Submit the Return

Submit the completed Form 1771 and documents through the DJP Online platform. Wait for system confirmation to ensure the submission is successful.

6. Save the Receipt

Download and securely store the Bukti Penerimaan Elektronik (BPE). This document is your official proof of timely and complete submission.

Read more: Navigating Indonesia’s new Core Tax System.

Deadlines and penalties of non-compliance

The deadline for the upcoming annual tax return filing is April 30th of the following year and applies to all corporate taxpayers, regardless of revenue or profit status. Extensions can be granted, but only in specific cases are requests formally submitted before the deadline. It’s crucial to remember that timely filing is not just a requirement, but a key factor in avoiding penalties and maintaining your company’s financial health.

This deadline is strict. Failing to submit your annual tax return on time can result in fines, audits, and even legal consequences from the DGT, such as:

- IDR 1,000,000 fines for late SPT Tahunan submission

- Interest penalties up to 2% per month on the outstanding tax due for late payments

- Additional sanctions in case of incorrect or false reporting, including tax assessments, tax audits or investigations, and legal actions

To ensure timely and accurate filing, it’s highly recommended to partner with a trusted tax agent, such as InCorp. Their local expertise will help first-time businesses navigate Indonesia’s complex tax landscape, providing the reassurance and support you need throughout the process.

Read more: 2025 update to Indonesia’s tax audit procedures

Mastering Corporate Taxation in Indonesia

Simplify your corporate tax filing

Filing your corporate annual tax return doesn’t have to be stressful or time-consuming. InCorp Indonesia (an Ascentium Company) offers reliable tax reporting services to help you file your yearly tax return accurately and on time.

With local experts handling the process, you can:

- Avoid penalties

- Reduce administrative errors

- Save time

- Stay fully compliant

Don’t let tax filing slow your business down. Contact us today and let us handle your tax filing.

Frequently Asked Questions

Which businesses must file a corporate annual tax return in Indonesia?

All legal business entities—including PT, CV, foundations, PMA companies, and BUT—are required to file an annual corporate tax return.

What taxes must be reported in the annual corporate tax return?

Companies must report Corporate Income Tax (CIT), withholding taxes (PPh 21, 23, 26, 4(2), 15), VAT (for PKP businesses), and any applicable final taxes.

What documents are needed before filing the annual tax return?

You must prepare your NPWP, EFIN, annual financial statements, monthly tax payment records, VAT recaps (if PKP), and access to DJP Online.

How do I file the corporate annual tax return (Form 1771)?

Log in to DJP Online, choose e-SPT or online Form 1771, fill in financial data, upload supporting documents, submit the form, and save the BPE receipt as proof.

What happens if a company misses the filing deadline?

Late filing may result in an IDR 1,000,000 fine, interest penalties of 2% per month, and potential audits or legal actions from the tax office.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.