An HRIS liberates businesses from the burden of manual payroll and employee data management. As companies expand, manual processes often lead to errors, delays, and security risks. With HRIS, these challenges are overcome, and businesses can operate more efficiently.

Different laws in each region, manual data entry, and disconnected systems make payroll more complex and prone to mistakes. Plus, handling sensitive employee data without proper safeguards puts organizations at risk.

As teams scale, these problems multiply. That’s why HRIS systems are here to automate payroll and protect employee information at every level.

What is an HRIS, and how does it work?

An HRIS (Human Resource Information System) is a digital platform that helps companies manage employee information, automate HR tasks, and streamline payroll processes. It is a central hub for all HR data, making tracking, updating, and protecting easier.

Here’s how an HRIS system works:

- Securely stores employee data: It keeps records like personal details, salaries, tax information, and bank accounts in one protected system.

- Automates repetitive tasks: Routine HR activities such as attendance tracking, leave requests, and payroll calculations are automated to save time and reduce human error.

- Connects different departments: HR, finance, and management can access the same data, ensuring transparency and real-time updates across the company.

- Improves compliance: The system helps companies stay updated with labor laws and tax regulations, reducing the risk of penalties.

- Generates reports easily: HRIS apps can quickly produce payroll summaries, employee data reports, and compliance documents, which help decision-making and audits.

In short, a modern HRIS app simplifies HR and payroll faster and more securely, especially for companies in fast-growing markets.

How HRIS reduces payroll errors and safeguards employee data

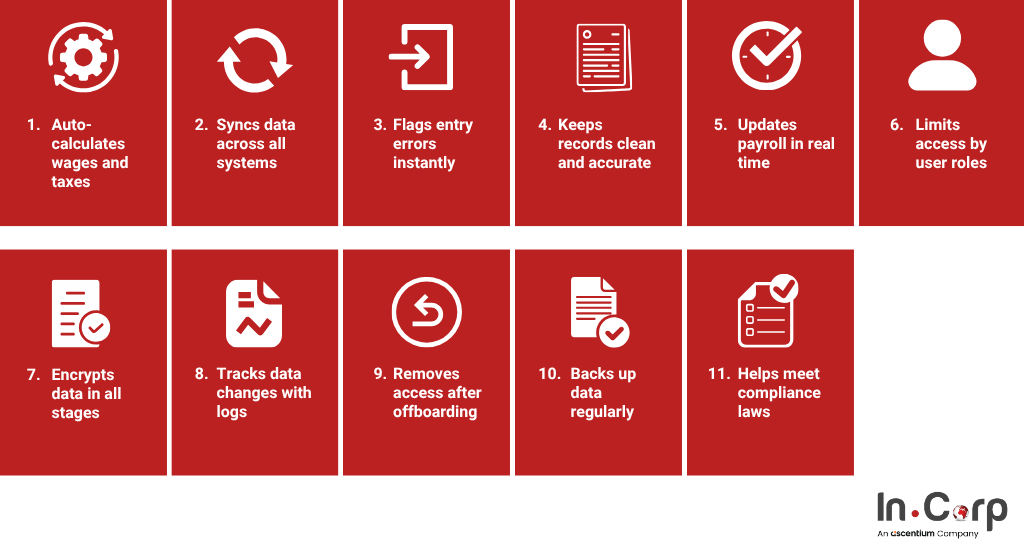

An HRIS is important in reducing payroll mistakes and protecting sensitive employee data, especially in fast-growing businesses. Below are key ways it does this:

Reducing payroll errors

Modern HRIS systems help minimize manual mistakes and ensure accurate payroll processing at every level, such as:

- Automated calculations: The system automatically processes wages, taxes, deductions, overtime, and benefits, reducing the chance of human error.

- Data consistency across systems: Integrated HRIS and payroll platforms ensure updates made in one area are reflected everywhere, avoiding mismatched or duplicated data.

- Validation rules and checks: Built-in controls catch input mistakes before payroll is finalized, such as flagging overtime limits or deduction errors.

- Clean data hygiene and regular audits: Accurate and updated records within the HRIS ensure payroll pulls from the correct information. Routine audits help spot issues early.

With HRIS, businesses are in control of their payroll processes. Any changes in salary, bonuses, or leave are instantly reflected in payroll calculations, empowering businesses to make real-time updates and corrections, reducing the risk of outdated payments.

Read more: How ERP systems enhance compliance and competitiveness in Indonesia

Safeguarding employee data

Human Resource Information System platforms are designed to provide businesses with peace of mind. They protect sensitive employee information through advanced security and compliance features, ensuring data is secure and companies can confidently operate.

- Role-based access control (RBAC): Only authorized users can view or edit sensitive data, ensuring strict control over who sees what.

- Encryption in storage and transit: Data like salaries, tax IDs, and bank details are encrypted to protect against cyber threats and unauthorized access.

- Audit trails and logging: Every action within the system is tracked, providing visibility into who accessed or changed employee records.

- Controlled offboarding and access revocation: To prevent data leaks, HRIS can automatically revoke system access when someone leaves the company.

- Regular backups and disaster recovery: Most systems keep secure backups and allow data restoration after technical failures or cyberattacks.

- Compliance and regulatory monitoring: Many HRIS platforms help ensure compliance with data privacy laws and labor regulations, protecting the company from penalties.

Integrating HRIS benefits in Indonesia

Indonesia’s complex regulatory and tax environment presents significant challenges for payroll management. Companies must navigate BPJS contributions, PPh 21 tax, minimum wage regulations, and social security requirements, which can differ by region. This complexity underscores the need for effective solutions like HRIS and payroll outsourcing services.

To effectively address these challenges, many businesses in Indonesia now combine a dependable Human Resource Information System with payroll outsourcing services, ensuring accuracy and efficiency in their payroll processes.

Why combine HRIS with payroll outsourcing in Indonesia

Using an HRIS alone improves accuracy, but pairing it with a trusted local payroll provider strengthens compliance and operational efficiency.

- Local compliance certainty: Payroll vendors understand Indonesian tax laws, labor regulations, and submission timelines, ensuring your HRIS stays compliant.

- More capacity, less overhead: Outsourcing frees your internal teams from time-consuming payroll tasks so they can focus on growth and people strategy.

- Secure and shared responsibility: Trusted vendors offer strong data protection measures and work closely with your HRIS to protect employee data.

- Scalability and cost efficiency: As your team grows, the combined HRIS and provider setup can handle added complexity without needing more internal hires.

Payroll Outsourcing in Indonesia: Building Continuity Through Compliance

Smarter payroll and safer data with InCorp

Growing businesses face pressure to manage payroll accurately and protect employee data, especially in complex markets like Indonesia. Manual processes no longer scale, and a well-implemented HRIS system becomes essential.

For businesses operating in Indonesia, partnering with InCorp (an Ascentium Company) can significantly improve compliance and operational efficiency by:

- Reduce payroll errors through automation and real-time data syncing.

- Ensure compliance with local tax and labor laws.

- Secure sensitive employee information with encryption and access controls.

- Streamline HR tasks like scheduling, benefits, and leave management.

- Gain better insights through instant reporting and analytics.

Whether managing a local team or expanding across regions, investing in the right Human Resource Information System can help you save time, reduce risk, and build employee trust. Fill out the form below to access scalable HR solutions and future-ready payroll tools.

Frequently Asked Questions

What is an HRIS, and how does it work?

An HRIS (Human Resource Information System) is a digital platform that automates HR and payroll tasks, securely stores employee data, and keeps all HR information in one system for easy access and compliance.

How does HRIS help reduce payroll errors?

HRIS automates salary, tax, and benefit calculations, ensures consistent data across systems, and uses built-in validation to catch errors before payroll is finalized.

How does HRIS protect employee data?

It uses encryption, role-based access control, audit trails, and automatic access revocation to keep sensitive employee information secure from unauthorized access.

Why is HRIS important for businesses in Indonesia?

Indonesia’s complex tax and labor regulations make payroll management challenging. HRIS helps companies comply with BPJS, PPh 21, and minimum wage laws while improving accuracy and efficiency.

Why combine HRIS with payroll outsourcing?

Combining HRIS with a trusted local payroll provider ensures full compliance, secure data handling, and cost-efficient scaling while freeing your internal team to focus on growth.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.