Import duties in Indonesia can quietly raise landed costs due to inefficiencies in classification, valuation methods, or missed regulatory advantages. For established importers, the main challenge is managing costs rather than understanding the system. Focusing on strategic classification and proper documentation can lead to significant savings.

Indonesia’s customs framework provides opportunities to optimize legal costs. This article outlines practical strategies to help importers make smarter decisions and reduce expenses.

Understanding import duties in Indonesia

Imported goods in Indonesia are subject to multiple layers of taxation. Understanding how these charges work and where they can be managed provides opportunities for cost control.

- Import duty (Bea masuk): Applied based on the product’s HS code and CIF value (Cost, Insurance, and Freight). Rates vary and are set under PMK No. 4/2025, which also introduced simplified tariffs for selected consignments.

- Value-added tax (PPN): Most imported goods are subject to 12% VAT, calculated on the customs value plus applicable duties.

- Income tax (PPh Article 22): Withholding tax applied at 2.5% for registered importers and 7.5% for non-registered ones. Reduced or zero rates may apply in some sectors (e.g., agriculture).

- Personal and small consignment of imports: Imports valued at USD 500 or less FOB (Free on Board) per person are exempt from duties and taxes. Shipments above this threshold are subject to standard taxation unless exempted.

While these taxes can substantially increase the cost of importing, they also create opportunities for savings through correct classification, strategic documentation, and efficient import structuring.

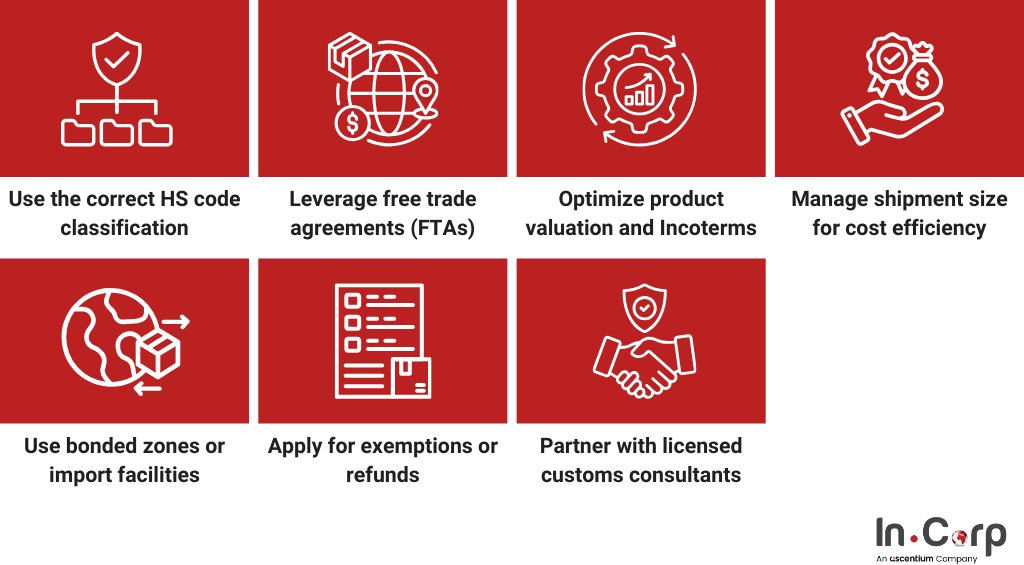

7 legal strategies to reduce import duties in Indonesia

Indonesia’s import framework leaves room for legal cost reductions when approached with strategy and attention to detail. Here are seven practical ways to reduce import duties in Indonesia while remaining entirely within the law.

Use the correct HS code classification

Accurate product classification determines duty rates and eligibility for FTA (Free Trade Area) benefits.

- Misclassification often results in higher tariffs or delays.

- PMK No. 62/2025 updates the HS classification structure under the BTKI (Buku Tarif Kepabeanan Indonesia).

- Use the latest BTKI and seek advanced classification if needed.

Leverage free trade agreements (FTAs)

FTAs allow preferential tariffs on qualifying goods imported from member countries.

- Reduced or zero duties where applicable.

- Submit a valid Certificate of Origin at the time of clearance.

- Coordinate early with suppliers to ensure documentation accuracy.

Optimize product valuation and Incoterms

Tax liabilities are based on the declared CIF value. Overstated freight or insurance increases VAT, duties, and income tax. Here are some management strategies:

- Use Incoterms (International Commercial Terms) that define cost responsibilities clearly (e.g., FOB vs. CIF)

- Audit cost components to ensure only dutiable items are included

Manage shipment size for cost efficiency

Structuring shipments to match operational needs can influence tariff application.

- Smaller consignments may qualify for simplified treatment.

- Customs may scrutinize shipments that appear to have been intentionally divided. Make sure your scheduling reflects actual inventory levels or genuine production requirements.

Use bonded zones or import facilities

Bonded facilities permit the deferral or exemption of duties on goods intended for processing or re-export. Taxes are only applied when goods enter the domestic market. This setup is ideal for manufacturers, logistics centers, and exporters.

Apply for exemptions or refunds

Eligible businesses may apply for tax exemptions or refunds on specific types of imports, such as production machinery, R&D materials, and capital goods. These facilities are especially relevant during the investment or expansion phase of operations.

Partner with licensed customs consultants

Professional support ensures compliance and reduces the risk of unnecessary costs. Advisors can identify regulatory benefits and help prevent misclassification or valuation errors. This leads to fewer mistakes, better documentation, and more consistent savings.

Common challenges and mistakes that increase import costs in Indonesia

Importing into Indonesia involves more than just managing logistics. There are several aspects to consider, including licensing, documentation, and valuation. Minor missteps in these areas can lead to delays, unexpected costs, or overpayment of taxes.

Below are some key challenges and common mistakes that importers should be aware of:

- Unclear import licensing: Using the wrong type (API-U or API-P) can lead to delays or penalties.

- Incorrect HS codes: Misclassification often results in higher duties or the loss of FTA benefits.

- Missed FTA claims: Lacking valid Certificates of Origin means losing out on reduced tariffs.

- Document inconsistencies: Mismatched invoices or missing permits trigger customs delays.

- Overstated customs value: Including non-dutiable costs can lead to a higher tax liability.

- Unused bonded facilities: Eligible businesses often overlook tax-saving bonded zones.

- Unexpected fees: Demurrage, storage, or reinspection costs add up quickly.

- Lack of regulatory oversight: Infrequent reviews increase the risk of recurring compliance issues.

Clear Paths to Product Registration in Indonesia

Maximize import duty efficiency and compliance with InCorp

Reducing import duties in Indonesia is about making more thoughtful and well-informed decisions. Every detail plays a role in lowering costs and improving compliance.

To streamline and enhance import processes, collaborating with a reliable, experienced partner can truly transform operations. InCorp Indonesia (an Ascentium Company) offers tailored solutions to help businesses simplify and optimize import process.

- Accurate HS code classification and valuation support.

- Guidance on licensing, documentation, and FTA application.

- Help you access bonded zones and tax exemptions.

- Stay ahead of customs and trade policy changes.

- On-the-ground support for importers entering the Indonesian market.

Ready to improve the import strategy? Fill out the form below to unlock the potential and success in your importing process.

Frequently Asked Questions

Is Import Approval required for all imported goods?

No. Import Approval (PI) is only required for specific regulated or restricted goods listed under certain HS Codes. Common categories include electronics, health products, machinery, and raw materials.

Can a foreign company apply for Import Approval without a local entity?

No. Only companies registered in Indonesia with a valid NIB/API can apply for PI. However, foreign businesses can import legally using an Importer of Record (IOR) service.

How long does it take to obtain Import Approval?

It typically takes 5–15 business days after submission, depending on the commodity type, document completeness, and ministry response time.

Does Import Approval cover multiple shipments or just one?

It depends on the type of PI issued. Some are shipment-specific, while others can be valid for multiple shipments within the approval’s validity period.

Can Import Approval be amended or transferred?

No. PI is non-transferable and cannot be amended after issuance. If there are changes in quantity, HS Code, or supplier, a new application is required.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.