Investment opportunities in Indonesia are expanding at a pace that’s hard to ignore. With one of Southeast Asia’s fastest-growing economies and a wealth of untapped markets, Indonesia presents an attractive landscape for foreign investors seeking long-term growth. However, opportunity often comes with complexity.

This article will examine investors’ challenges when doing business in Indonesia and the support and solutions necessary for success in this dynamic market.

6 best investment opportunities in Indonesia

Indonesia’s economy is full of potential, and several sectors are desirable for investors looking for strong returns. Here’s a quick guide to the top areas worth exploring in the growing landscape of investment opportunities in Indonesia. These sectors offer both stability and long-term growth potential for foreign and local investors.

Mining & downstream processing

Indonesia is moving beyond raw mineral exports by pushing for domestic processing. This shift creates long-term investment potential in value-added operations.

- Nickel and bauxite reserves fuel EV battery production

- Major investments in metal smelting zones like Morowali Industrial Park

Renewable energy

Indonesia’s geography makes it ideal for geothermal and hydro projects, and global climate finance is driving development.

- Over 28,000 MW in untapped geothermal potential

- World Bank and private investors are backing clean energy builds

Digital economy & e-commerce

A digitally connected population creates high demand for online services, making this sector one of Indonesia’s fastest-growing.

- High internet and smartphone penetration rates

- Expanding markets for online retail, digital banking, and logistics

Manufacturing & industrial expansion

Indonesia remains a regional production hub, but its focus is shifting toward higher-value manufacturing in electronics, automotives, and food processing sectors.

- Export-oriented policies support industrial growth

- Access to a large, cost-competitive labor force

Infrastructure & construction

Large-scale development plans are improving national connectivity and attracting local and foreign investors.

- Major infrastructure rollouts (ports, roads, MRT)

- Public-private projects in urban and semi-rural areas

Tourism & food and beverage

Indonesia’s unique destinations and culinary scene drive investment in travel and downstream F&B products for export.

- Increased tourist arrivals in Bali, Lombok, and beyond

- Demand for packaged and branded local food products is rising

Read more: Exploring investment potential in Indonesia

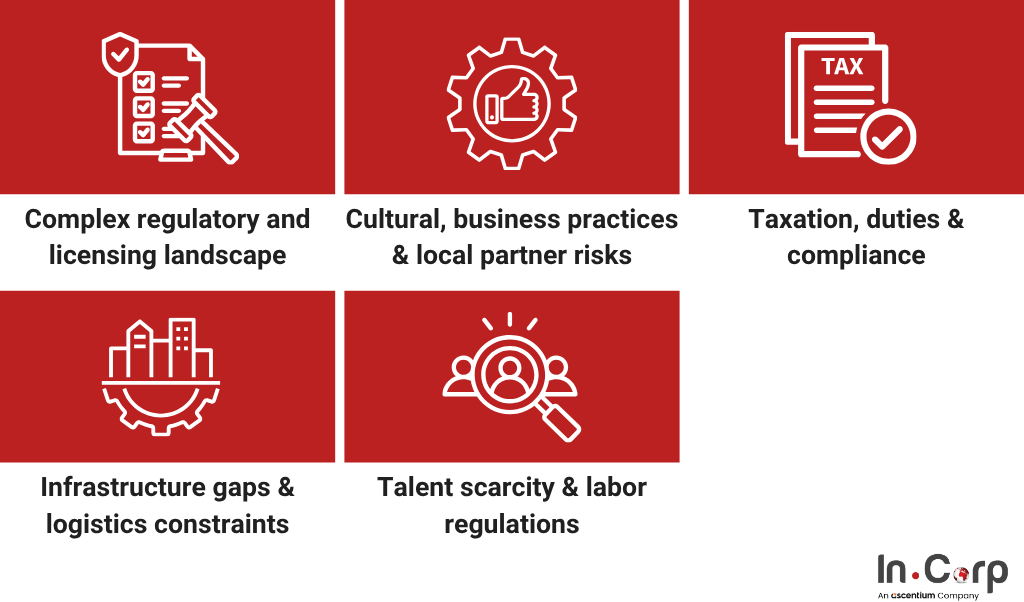

5 challenges when investing in Indonesia

While investment opportunities in Indonesia are growing, entering the market still involves overcoming real challenges. Understanding these hurdles can help you plan more strategically and reduce risk.

Complex regulatory and licensing landscape

Indonesia’s legal system includes overlapping national and regional authorities, which creates bureaucratic hurdles for foreign investors.

- Multiple layers of government approvals

- Inconsistent implementation of rules delays business setup

- The OSS system still has gaps and inconsistencies

Cultural, business practices & local partner risks

Doing business in Indonesia often relies on informal relationships and local norms, which can be unfamiliar to foreign companies.

- Language and business etiquette vary significantly by region

- Business decisions often rely on local networks and trust

- High risk of disputes without proper due diligence on local partners

Taxation, duties & compliance

Indonesia’s tax system is evolving, and while reforms are ongoing, navigating them remains complex.

- Regulations frequently change and may apply retroactively

- Conflicting import tariffs raise operating costs

- Delays in tax refunds and unclear audit processes

Infrastructure gaps & logistics constraints

Geographic fragmentation across thousands of islands poses a significant challenge for efficient operations and distribution.

- Many industrial zones outside major cities lack reliable transport links

- Port congestion and limited cold chain options impact supply chains

- Fuel price volatility has pushed logistics costs higher

Talent scarcity & labor regulations

Although Indonesia has a large workforce, the supply of skilled professionals in key sectors remains limited.

- Shortage of skilled professionals in key industries

- Complex labor laws make hiring and termination difficult

- New labor policies increase severance costs for employers

Guide to Doing Business in Jakarta

How to address investment challenges in Indonesia

Investing in a new country can be tricky, but with the proper support, it becomes much easier. At InCorp Indonesia (an Ascentium Company), we provide comprehensive services to help foreign investors confidently set up and succeed in Indonesia.

Regulatory & licensing support

We help you with government rules and speed up the business setup process.

- Handle all required permits at the national and regional levels

- Ensure your business meets all legal requirements

- Navigate the OSS system to avoid costly delays

Cultural & local business advisory

Understanding local customs is key to building successful partnerships. We help you:

- Assist in selecting the right local partners and structures

- Help bridge communication and cultural gaps

- Offer insights into local decision-making practices

Tax & compliance services

Tax laws in Indonesia can be complex, but we make them manageable. We can:

- Keep you updated on the latest tax changes

- Help you structure your business to reduce tax risks

- Manage filings, audits, and VAT requirements

Infrastructure & operational setup

Choosing the correct location and partners is essential for smooth operations. Here’s how we can help you with:

- Recommend areas that fit your industry and logistics needs

- Connect you with trusted suppliers and contractors

- Assist with securing property or production space

HR, payroll & labor law assistance

Hiring and managing staff in Indonesia requires local know-how. We help you:

- Recruit both local and expat employees

- Ensure compliance with updated labor laws

- Handle payroll, onboarding, and termination procedures

Partnering with InCorp Indonesia means you’ll have expert help every step of the way, making your investment opportunities in Indonesia more secure and prosperous.

Ready to begin? Fill out the form below to simplify your entry into one of Asia’s most promising markets.

Frequently Asked Questions

What are the best sectors to invest in Indonesia?

Top sectors include mining & processing, renewable energy, digital economy, manufacturing, infrastructure, and tourism & F&B.

What makes Indonesia attractive for foreign investors?

Indonesia has one of Southeast Asia’s fastest-growing economies, untapped markets, a large labor force, and strong government support for investment.

What are the main challenges of investing in Indonesia?

Key challenges include complex regulations, cultural differences, evolving tax rules, infrastructure gaps, and limited skilled talent.

How can investors reduce risks when entering Indonesia?

Work with local experts for licensing, compliance, tax, HR, and cultural guidance to avoid delays and costly mistakes.

Can InCorp Indonesia help with foreign investment?

Yes. InCorp provides end-to-end support in licensing, tax, HR, compliance, and local business advisory to make investing easier and safer.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.