Opening a bank account in Indonesia can be challenging for foreigners because banks and branches apply different requirements, document checks, and internal policies. These challenges become even more complex when opening a corporate bank account, as banks conduct deeper reviews for companies with foreign shareholders or overseas directors.

At the same time, having an Indonesian bank account is essential for handling operational expenses, receiving capital injections, paying vendors, and managing business transactions.

This guide explains how foreigners and foreign-owned companies can open a bank account in Indonesia, what documents are commonly required, and how to avoid delays during the process.

Can a foreigner open a bank account in Indonesia?

Many foreigners are unsure of how to open a bank account in Indonesia because banks follow different internal rules. Some branches accept only KITAS holders, while others allow business visa holders with additional verification.

In general, foreigners can open an Indonesia bank account, but approval depends on immigration status and the bank’s risk assessment. Most banks follow this approach:

- KITAS or KITAP holders are usually approved with standard documents

- Business visa holders may be accepted with supporting documents

- Tourist visa holders are accepted by only selected branches, and with limited features

Understanding your visa category helps you choose the right bank and avoid unsuccessful applications, giving you confidence in your options.

Read more: Work KITAS Indonesia: An Ultimate Guide for Foreign Workers

Requirements to open a bank account in Indonesia

Foreigners often face delays because each bank requests different documents. Preparing the typical requirements in advance helps avoid repeated branch visits.

Under Indonesian banking regulations, especially Bank Indonesia Regulation No. 3/10/PBI/2001 on Know Your Customer Principles and OJK Regulation No. 12/POJK.01/2017 on Anti–Money Laundering and Counter-Terrorism Financing, banks are required to verify the identity, immigration status, and beneficial ownership of every applicant.

This is why foreigners and foreign-owned companies are often asked for more supporting documents. Standard documents for personal accounts:

- Valid passport

- Valid visa (KITAS or KITAP preferred)

- Indonesian phone number

- Proof of local address

- Minimum initial deposit

Additional documents that some banks may request:

- NPWP if available

- Sponsorship or employer letter

- Work contract

For corporate bank accounts, banks usually review:

- Company registration documents

- Authorized signatory details

- Ownership structure

- Business activity and intended account usage

Preparing these documents in advance increases your chances of approval.

Step-by-step process to open a bank account in Indonesia

Foreign applicants often expect a simple registration, but banks apply various verification and compliance steps that differ across branches. A guided process helps you avoid submission errors and unnecessary delays. The general flow includes:

- Choosing a bank that accepts your visa type

- Preparing key documents based on the bank’s compliance policy

- Completing identity and immigration checks

- Finalizing account activation at the branch

Since each bank interprets the rules differently, following the correct sequence is essential. InCorp can support you through the entire process, making it easier to open your Indonesian bank account smoothly and without unnecessary delays.

Can you open a bank account in Indonesia without a KITAS?

While many banks prefer KITAS or KITAP holders, it is still possible to open a bank account without one. Approval depends on the bank’s internal policy, your visa type, and the supporting documents you can provide.

Business visa holders and non-residents may still be accepted, but typically through selected branches and with extra checks. These variations often leave foreigners unsure of where to apply. With proper guidance, you can identify banks more likely to accept your application and prepare the necessary documents.

How to open a corporate bank account in Indonesia

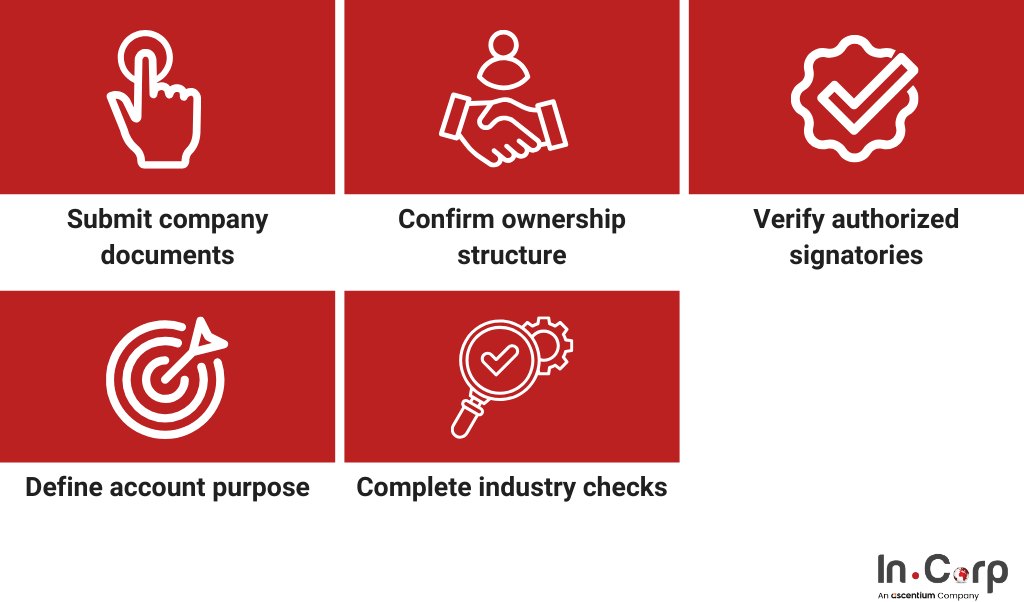

Opening a corporate bank account in Indonesia can be challenging for companies with foreign shareholders because banks apply stricter compliance checks. Many businesses face delays due to document gaps, different interpretations of regulations, and additional verification for overseas directors or UBOs. Common areas reviewed by banks include:

- Company registration documents

- Structure of foreign ownership

- Authorized signatories and their identification

- Business activity and intended account usage

- Additional compliance checks for specific industries

Typical challenges companies encounter:

- Different requirements across banks and even across branches

- Multiple follow-ups before the account is approved

- Additional verification when foreign directors are involved

Choosing the right bank and preparing compliant documents helps reduce delays during the corporate bank account opening process.

Tips to make the process smoother for opening a bank account

Many delays occur because applicants visit a branch without knowing the bank’s specific requirements. Preparing strategically can speed up both personal and corporate account applications. Here are some ways to make the process seamless:

- Confirm whether the bank accepts your visa type before visiting.

- Prepare both printed and digital copies of your documents.

- Use an Indonesian phone number to avoid activation issues.

- Bring supporting documents, such as a sponsorship letter if available.

- Choose branches that have experience handling foreign applicants.

Taking these steps reduces the chance of rejection or repeated visits. For a more seamless experience, InCorp can guide you through the process and coordinate with the bank to achieve a faster outcome.

Guide to Doing Business in Jakarta

Open a bank account more easily with InCorp’s assistance

Opening a bank account in Indonesia can be challenging because banks apply different requirements and internal checks. These challenges become more complex when opening a corporate bank account, as banks review a company’s structure, ownership, and intended transactions more carefully.

With proper preparation and guidance, the process becomes much easier and helps you avoid repeated visits or rejected applications.

InCorp Indonesia (an Ascentium Company) can assist your corporate bank account setup by:

- Recommending suitable banks and preparing the required corporate documents

- Coordinating with bank officers to streamline compliance and verification

- Assisting authorized signatories so your corporate account is opened quickly and ready for use

Complete the form below to receive assistance and recommendations for bank accounts during your business setup in Indonesia.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.