A public limited company is called a Perseroan Terbuka (PT Tbk) in Indonesia. It’s a limited liability company with shares available for trading on the Indonesian Stock Exchange (IDX). Compared to a private limited company (PT), a PT Tbk has stricter regulations and greater public scrutiny.

What is a public limited Company (PLC) in Indonesia?

A public limited company (PLC) is a type of company that sells its shares to the public through the stock market. In simple terms, a PLC is a large company with strong capital and substantial resources.

This type of company allows many investors to own a small portion of its shares, allowing them to share in the profits and bear the risk of losses experienced by the company.

Read more: Key criteria when choosing a business consulting firm

What is the difference between PLC and Ltd in Indonesia?

PT Terbuka (PLC) and PT Tertutup (Ltd), known as a private limited company, have significant differences in terms of ownership and stock offerings, as explained in the following table:

| Aspects | PLC | Ltd |

| Legal Basis | Law No. 8/1985 on Capital Market (UUPM) | Law No. 40/2007 on Limited Liability Companies (UUPT) |

| Shareholders | Minimum 300 | Minimum 2 |

| Board of Directors | Minimum 2: allocation of tasks and authority determined by General Meeting of Shareholders (RUPS) | Minimum 1 |

| Capital | Minimum IDR 3 billion raised from public investors | Lower capital requirement: personal, family, or related sources |

| Shares | Listed on IDX; publicly traded | Unlisted; limited ownership |

| Reporting Obligations | Extensive reporting to the Financial Services Authority (OJK) | No mandatory reporting |

| General Meetings of Shareholders (RUPS) | Held at stock exchange; 14-day notice required | Held at company headquarters or primary business location |

What are the advantages and disadvantages of a public limited company?

When deciding on the appropriate corporate structure, one must consider the advantages and disadvantages of a public limited company.

Advantages

- Owners have limited liability for the company’s losses and debts.

- A separate legal entity protects owners from claims against the company.

- The company can raise a substantial amount of capital.

- The company tends to remain stable even if owners or directors leave.

- Directors and employees can buy shares and become company owners.

- Sources of profit include dividends and capital gains.

Disadvantages

- PLC can easily trigger conflicts of interest.

- Must pay significant administrative costs due to complex operations.

- Stock prices can fluctuate due to speculation.

- Decision-making can take longer due to having many owners.

- As a public company, PLC must disclose sensitive information, such as financial data.

- Owners cannot participate in the operational decisions of the company.

Can a Ltd be a PLC in Indonesia?

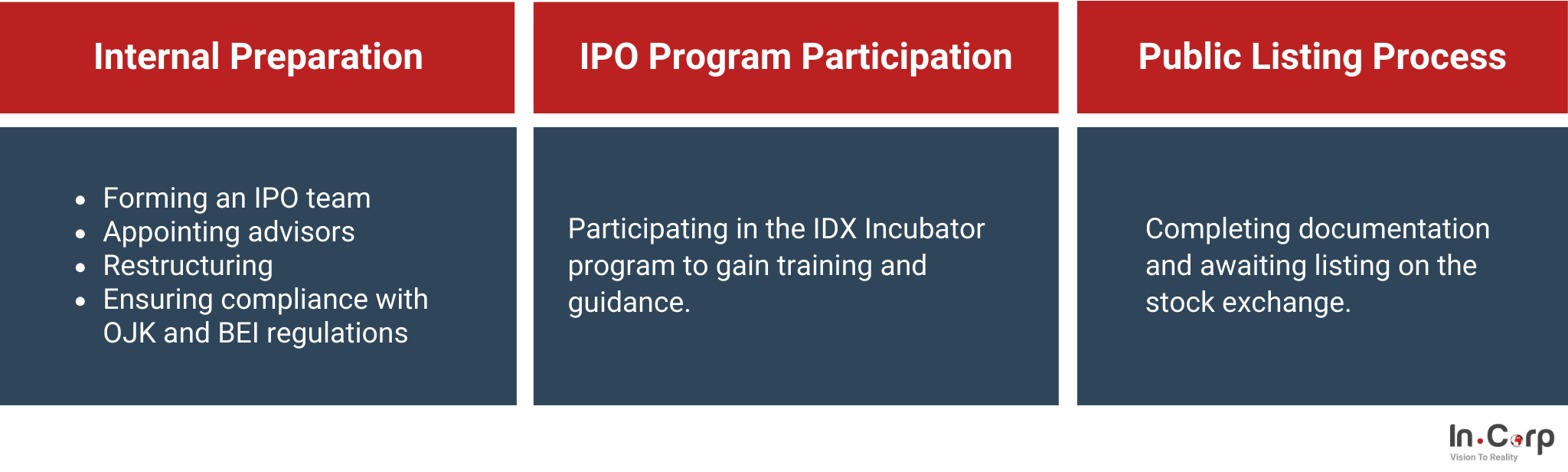

As outlined in the guidelines on the IDX website, Ltds seeking to transition into PLCs, the process encompasses:

1. Preparation phase

- Forming an internal IPO team.

- Appointing underwriters, supporting institutions, and professionals.

- Conducting internal restructuring and capital discussion.

- Meeting the requirements of the Indonesia Stock Exchange (BEI) and the Financial Services Authority (OJK).

- Defining the IPO structure.

- Holding an Extraordinary General Meeting of Shareholders (RUPSLB).

- Completing documentation according to OJK, BEI, and the Indonesia Central Securities Depository (KSEI) regulations.

2. Participation in the road to the IPO Program

This program, part of the IDX Incubator by BEI, facilitates the journey of startups and small- to medium-sized enterprises to becoming Public Companies.

Training covers IPO regulations, preparation for roadshows with investors, and understanding financial and legal aspects.

3. The process of becoming a Publicly Listed Company (Perusahaan Tbk)

After completing all the preparations and participating in the above program, the limited liability company seeking to go public on the stock exchange must wait approximately three days after completing all processes and preparations.

The benefits of becoming a public limited company in Indonesia

Achieving PLC status can offer several advantages:

1. Securing additional funding

Companies can obtain extra funding from public investors or institutions. Obtaining additional capital by becoming a public company is generally more cost-effective than seeking funds by applying for bank loans.

2. Facilitating company growth

With fresh funds from public investors, the company’s cash flow can be smoother, allowing it to use the accumulated money for various programs it desires.

3. Enhancing company image

By becoming a public company, the company’s image will also improve in the eyes of the public. A public company must have good information transparency for investors and the general public.

4. Possibility of divestment for founders

When a company becomes public, the founders can more easily divest their ownership by selling their shares to the public.

5. Benefits for employees

Employees also have the potential to receive bonuses through an Employee Stock Option Plan (ESOP).

Requirements to become a public limited company

If you’re interested in turning your company into a public limited company (PLC), it’s important to understand the requirements you need to meet. Here are the criteria that must be met to achieve this status.

| Requirements | Descriptions |

| OJK and BEI registration | The primary criteria for a PLC company is being registered with OJK and recognized by BEI as a company planning to conduct an initial public offering (IPO). |

| Clear company structure | A PLC company must meet Good Corporate Governance (GCG) criteria, including a clear company structure, legal entity status, independent commissioners, an audit committee and an internal audit unit, and a company secretary. |

| Appropriate capital structure | Possess capital proportional to the listing category (primary or development board) based on share offering size, shareholder number, and IPO price. |

| Profitability | If the PLC company has yet to profit, it will be listed on the development board. Conversely, if it has recorded a profit of a particular value within a specific timeframe, it will be listed on the main board. |

| Transparent financial reporting | A crucial requirement is that the company’s financial reports be transparent, accessible, and available on the official company website. |

| Tangible assets | Assets ownership is a vital accounting and financial aspect. Companies with at least IDR 5 billion assets are listed on the development board, and those with IDR 100 billion or more are on the main board. |

Establish your company with InCorp

Establishing a public limited company can benefit investors, employers, and employees. Whether you’re considering a Limited (Ltd) or a Public Limited Company (PLC), a legitimate company presence is a cornerstone for business success in Indonesia.

At InCorp Indonesia, we comprehend the complexities of establishing your company and stand ready to be your trusted partner. We offer company registration and business license services to smooth the transition and maximize your success.

Ready to take the first step? Contact our expert team today for a free consultation by clicking the button below.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.