Choosing the right business consulting firm is challenging. The top firms have specific specializations and criteria that set them apart. With many firms competing for market dominance, it can take time to identify the best ones. This article highlights the key characteristics of top consulting firms to help you make an informed decision.

What makes a top consulting firm?

The consulting field is expansive and dynamic, and due to the sheer number of firms, it can be challenging to determine which are the best. Nevertheless, what are the criteria for identifying a top consulting firm?

A company’s reputation and success are influenced by several factors, some of the most significant of which include:

1. Prestige

The most prestigious consulting firms are typically well-known and respected. They often have a long history of success and a blue-chip client base.

2. Revenue

Top consulting firms are also typically the most profitable. They generate high revenues from their clients, allowing them to invest in their people, infrastructure, and brand.

3. Culture

The best consulting firms have a strong culture that attracts and retains top talent. A focus on teamwork, collaboration, and excellence often characterizes this culture.

4. Industry expertise

Top consulting firms have deep expertise in various industries. This allows them to provide their clients with the best advice and guidance.

5. Client satisfaction

Ultimately, satisfaction is the best measure of a consulting firm’s success. Top firms consistently deliver results for their clients, which helps to build long-term relationships.

Read more: Guide to choosing a company registration consultant in Indonesia

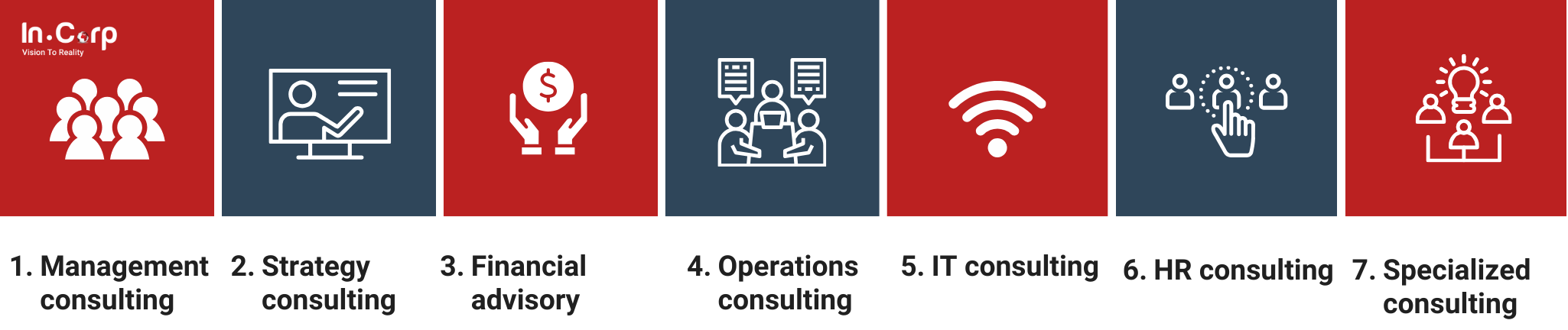

Types of top consulting firms

The consulting industry presents a dynamic and lucrative landscape for ambitious professionals. However, with many firm types competing for your talent, discerning the right fit can take time and effort.

1. Management consulting

In management consulting firms, industry leaders address high-level strategic imperatives. They guide CEOs and senior executives on crucial matters such as restructuring, market-entry, and Mergers and acquisitions (M&A).

2. Strategic consulting

Often closely aligned with management consulting, these firms offer unparalleled strategic expertise.

Their focus involves assisting clients in shaping long-term visions, identifying competitive advantages, and developing successful strategic plans.

Strategy consulting projects encompass:

- Evaluating the viability of entering a new geographic market.

- Assessing the potential profitability of introducing new products or service lines.

- Conducting due diligence for merger and acquisition decisions.

3. Financial advisory

Serving as custodians of financial well-being for businesses, financial advisory firms bring specialized expertise in accounting advisory, risk management, transaction services, and corporate finance.

4. Operations consulting

Efficiency and optimization form the core focus of operations consulting firms. They assist clients in streamlining operations, refining processes, and boosting productivity.

Operations consulting projects involve:

- Maximizing value extraction from facilities, plants, or mines.

- Enhancing quality and minimizing scrap in factories or service organizations.

- Optimizing efficiencies within the supply chain or a specific division.

5. IT consulting

IT consulting has become integral, with technology playing a pivotal role in business. These firms guide clients through digital transformations, develop technology strategies, oversee IT infrastructure, and implement systems.

6. Human capital consulting

Recognizing the pivotal role of the human element in business success, human capital consulting firms concentrate on talent management, organizational development, performance improvement, and HR processes.

The field comprises eight core disciplines:

- Compensation & Benefits

- Organizational Change

- HR Function

- Talent Management

- Learning & Development

- Human Capital Strategy

- HR Technology

7. Specialized consulting

Going beyond broad categories, specialized consulting firms offer deep-domain knowledge and tailored solutions. Whether in healthcare, energy, sustainability, or specific industries, these firms provide focused expertise.

How can InCorp Indonesia be your top consulting firm?

Indonesia has a thriving economy and immense potential. However, foreign investors may need help navigating the country’s complex regulations and cultural nuances. InCorp Indonesia can be the optimal choice among consulting firms for those looking to venture into the Indonesian market.

1. Deep market expertise

With a decade of experience, InCorp Indonesia deeply understands the local business scene. Our skilled team offers precise guidance and tailored solutions to meet your needs.

2. Comprehensive services

InCorp Indonesia offers a comprehensive suite of services under one roof. From company registration and legal compliance to tax advisory and HR solutions, we seamlessly manage every aspect of your Indonesian business setup.

3. Streamlined processes

InCorp Indonesia values efficiency and transparency. We’ve built strong ties with local authorities for quick permit processing.

Our streamlined approach reduces bureaucracy, letting you concentrate on your core business goals.

4. Client-centric approach

InCorp Indonesia understands that every business is unique. We prioritize personalized attention and take the time to understand your specific goals, challenges, and risk tolerance.

5. Unwavering support

InCorp Indonesia goes beyond mere transactional services. We offer continued support and guidance throughout your Indonesian journey.

6. Beyond consulting

InCorp Indonesia’s commitment extends beyond just consulting services. We offer a more comprehensive range of expertise, including:

- Market research and analysis

- Recruitment and HR services

- Accounting and bookkeeping

- Post-establishment support

Embark on your Indonesian journey with confidence

Choosing InCorp Indonesia as your consulting partner is choosing a trusted advisor and long-term partner for your Indonesian success story. We are committed to helping you navigate the challenges, unlock opportunities, and build a thriving business in this vibrant market.

Click the button below and let our expertise guide you toward success.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.