Real estate Indonesia stands out as one of Southeast Asia’s fastest-growing markets, presenting excellent opportunities for investors worldwide. With a large and diverse landscape, knowing where to focus your property investment is crucial.

This article will highlight Indonesia’s 10 best cities for real estate investment, key market insights, and essential investment strategies.

Indonesia’s real estate market outlook

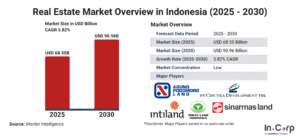

The market for real estate Indonesia projected to reach a value of USD 68.5 billion by 2025, with expectations to grow further to USD 90.6 billion by 2030, supported by a CAGR of 5.8%. Contributing nearly USD 31 billion to the nation’s GDP, this sector’s expansion is driven by rapid urbanization, a rising population, and supportive government initiatives.

The residential property segment holds around 53% of the market share as of 2024, boosted by the expanding middle class and the government’s FLPP program, targeting up to 15 million housing units nationwide. Alongside housing, office spaces, hospitality, and industrial properties also strengthen the growth of real estate Indonesia.

Why invest in Indonesia’s real estate?

What makes real estate Indonesia a perfect choice for your next investment? Here are the key reasons why prioritizing Indonesia’s property market could be profitable.

1. Growing Economy and High Housing Demand

Indonesia’s strong and stable economy supports continuous growth in the real estate sector. Its large population and expanding middle-class drive demand for better homes, apartments, and commercial spaces in major cities.

2. Affordable Property Prices

Property prices in Indonesia are relatively low compared to other Asian markets, but rental yields remain attractive. In many popular areas, investors can enjoy 6% to 12% rental returns, making it easier to generate consistent income.

3. Strategic Location

Positioned between two major oceans, Indonesia is a key hub for global trade routes. This advantage boosts business activities, tourism, and foreign interest, especially in big cities like Jakarta, Surabaya, and Bali.

4. Supportive Government Regulations

The Indonesian government continues to improve its investment climate through policies like the Omnibus Law and affordable housing programs (FLPP). These initiatives make buying easier for locals and show the government’s commitment to sector growth.

5. Strong Tourism

Indonesia is home to some of the world’s top tourist destinations, including Bali, Lombok, and Labuan Bajo. The growing number of visitors creates a strong demand for vacation homes, villas, and rental properties.

Read more: Indonesia’s Property Market Stay Resilient Amid Escalating Trade War

Future market trends and opportunities in real estate Indonesia

The future of real estate Indonesia is shaped by changing lifestyles, digital transformation, and infrastructure projects.

So, what does the future hold for real estate Indonesia?

Green and Sustainable Buildings

Sustainability is becoming more important in the Indonesian property market. Both buyers and investors are showing interest in eco-friendly buildings with energy-efficient designs.

Green certifications and innovative technologies are expected to become standard features, particularly in new commercial and residential developments.

Industrial and Logistic Real Estate

The rise of e-commerce and Indonesia’s strategic position in the global supply chain fuel the demand for warehouses, logistics hubs, and industrial parks. Areas near ports, airports, and key transportation routes are seeing increased investment in these sectors.

Property for Digital Nomads

The remote work trend has led to a surge in long-stay visitors, especially in destinations like Bali and Yogyakarta. Digital nomads and remote workers are looking for well-designed villas, apartments, and co-living spaces, creating new demand in the rental property market.

Real Estates Near Infrastructure Projects

Massive infrastructure projects, such as the Trans-Java toll roads, new airports, seaports, and railway lines are improving connectivity across Indonesia.

These developments open new investment areas outside the big cities, allowing investors to capitalize on future property value growth.

Guide to buying property in Indonesia as foreigners

Can foreigners buy properties in Indonesia? Yes, it is allowed, but specific rules and restrictions are in place. The most important rule here is foreigners cannot directly own freehold property (Hak Milik).

However, foreigners can still put their investment interest in the Indonesian real estate market through this specific property ownership, such as:

- Hak Pakai (Right to Use): Grants long-term usage rights for land or property, initially valid for 30 years with the option to extend twice for up to 80 years.

- Hak Guna Bangunan (Right to Build): This law allows the right to build and own structures on leased land. Its initial validity is 30 years, and possible extensions reach up to 80 years.

- Leasehold Agreement: This type of agreement involves long-term leasing arrangements directly with property owners, commonly starting at 25 years and with the potential for renewal or extension.

- Investment via PT PMA (Foreign-Owned Company): This option enables foreign investors to legally acquire property by establishing a foreign-owned company.

Newest Indonesia’s Real Estate Law for Foreign Investors

As of April 12, 2024, foreigners can now buy property with just a passport in certain circumstances, with minimum property value requirements and land size limitations.

According to the Decree of the Minister of Agrarian Affairs and Spatial Planning/Head of the National Land Agency Number 1241 Year 2022, the minimum housing price varies depending on the region as follows:

| Regions | Minimum Prices (IDR) |

| Java Island and Bali | 5 Billion |

| West Nusa Tenggara | 3 Billion |

| North Sumatera, East Kalimanta, South Sulawesi, and Riau Archipelago | 2 Billion |

| Other Regions/Provinces | 1 Billion |

Read more: How to buy property as a foreigner in Indonesia

10 best cities to start investing your property in Indonesia

Choosing the right city is crucial for success in real estate Indonesia. Here are the top locations:

1. Jakarta

As Indonesia’s capital and largest city, Jakarta remains a top choice for real estate investment. The city is the business hub for major corporations, government offices, and expat communities.

- Strong rental market, especially in Central and South Jakarta

- Major infrastructure boosting accessibility (MRT and toll roads)

- Stable demand from expats

2. Bali

Famous for its tourism industry, Bali is one of Indonesia’s hottest property markets, especially for vacation rentals, villas, and resorts for tourists and digital nomads.

- High occupancy rates for rentals

- Popular for tourists, digital nomads, and long-term visitors

- Strong demand in areas like Canggu, Seminyak, and Ubud

Read more: Five tips for choosing the right property agent in Bali

3. Surabaya

Surabaya, Indonesia’s second-largest city, is a key industrial and commercial hub in East Java. Its growing population and rising middle class make it an attractive location for residential and commercial real estate investments.

- Affordable property prices compared to Jakarta

- Rapid urban development and improved infrastructure

- High demand for housing and commercial spaces

4. Bandung

Bandung is a favorite among young professionals, students, and weekend tourists because of its cool climate and creative scene.

- Growing middle-class population

- Stable demand for condominiums, townhouses, and hospitality properties

- Well-connected via the Jakarta-Bandung high-speed rail

5. Medan

As the largest city in Sumatra, Medan plays a vital role in trade and industry. With strong business ties to Malaysia and Singapore, the city offers good opportunities for residential and commercial property.

- Significant industrial and trade activities

- Increasing demand for affordable and mid-range housing

- Growth in retail and office spaces

6. Makassar

Makassar is a rapidly developing city with growing economic importance. Its strategic coastal location makes it a key port city, boosting industrial, commercial, and hospitality sectors.

- High demand for residential and commercial properties

- Emerging tourism sector

- Government focus on Eastern Indonesia development

7. Yogyakarta

Yogyakarta, famous for its cultural heritage and universities, is attracting domestic and foreign investors. The city’s tourism appeal and student population support strong demand for rentals and hospitality properties.

- Growing tourism

- High rental demand from students and young professionals

- Opportunities in hotels, guesthouses, and apartments

8. Batam

Located near Singapore, Batam is a designated free trade zone that attracts foreign investment in manufacturing and logistics. This offers opportunities in industrial and residential real estate.

- Strong industrial base

- Rising demand for worker housing

- Strategic location next to Singapore and Malaysia

Read more: 7 advantages for renting Batam property for your manufacturing needs

9. Lombok

An emerging tourist destination is often called the “next Bali.” This city offers beachfront property and villa investment potential.

- Untapped tourism potential

- Mandalika SEZ boosting tourism infrastructure

- Increasing international exposure

10. Semarang

Semarang is known for its port facilities and role as a logistics center in Central Java. The city has a healthy mix of industrial, commercial, and residential real estate opportunities.

- Well-developed industrial zones and logistics centers

- Rising middle-class population driving housing demand

- Strong government support for infrastructure projects

Secure your property investment with confidence

Investing in real estate Indonesia requires understanding local laws and market dynamics. Partnering with experts ensures you avoid risks and maximize returns.

InCorp Indonesia (An Ascentium Company) provides trusted property and land ownership solutions in key investment spots, such as Jakarta, Surabaya, Bali, Semarang, and Batam. Our all-in-one support will ensure smooth and secure experience for your real estate investment in Indonesia.

Ready to get started? Fill out the form below and begin your hassle-free property journey with us today.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.