As the global trade scene changes, the United States has recently raised import tariffs on goods from several countries, aiming to protect its economy. While many nations see this as a threat, Indonesia is finding ways to benefit from the situation.

These US tariffs could open new doors for Indonesian businesses. With other countries facing higher export costs, Indonesia has a chance to step in and fill the gap. This article will explore how this challenge can become a massive opportunity for Indonesia’s trade growth.

What are the new US import tariffs?

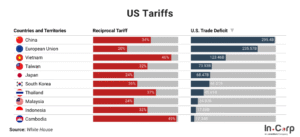

The United States has introduced new import tariffs targeting several countries as part of its trade policy changes. These tariffs are aimed at reducing the trade deficit and protecting local industries. As a result, imported goods from countries like China, Vietnam, and Indonesia now face higher fees when entering the US market.

Here’s a breakdown of the key changes:

- Import baseline tariffs

A flat 10% tariff now applies to almost all imports, including from trade surplus countries like Indonesia. - Reciprocal tariffs

Higher tariffs target 57 countries with trade deficits or unfair trade policies, such as China, Vietnam, and Indonesia. - De minimis rule removed

Goods under $800 from China and Hong Kong no longer enter duty-free. - Auto tariffs

A steep 25% tariff is now on cars, trucks, and auto parts.

Although Indonesia is not seen as a top trade rival like China, it has recently made the list for higher reciprocal tariffs of 32%. This mainly applies to goods like textiles, electronics, and rubber-based products.

Why the US implements the new import tariffs

The US government isn’t raising tariffs without a reason. These new policies are part of a larger economic and political strategy to protect national interests and reshape global trade.

Protect Local Industries

The US wants to shield domestic manufacturers from being undercut by cheaper foreign products.

Fix Trade Imbalances

Countries with large trade surpluses with the US, including China, Vietnam, and Indonesia are being asked to pay more when exporting to America.

Pressure for Fair Trade

The US sees these tariffs as tools to force fairer trade deals and discourage unfair practices like subsidies or currency manipulation.

Strengthen National Security

For sectors like steel, tech, and automotive, tariffs are seen to secure key supply chains from foreign control.

Political Leverage

Tariffs give the US bargaining power in trade talks, especially with strategically essential or competitive countries.

What influences the new 32% tariff decision in Indonesia?

While Indonesia wasn’t initially a primary focus of US trade tensions, it now faces a steep 32% import tariff on some goods. Several factors have influenced this decision, including:

Rising Trade Surplus

Indonesia’s exports to the US have grown significantly, especially in textiles, footwear, machinery, and electrical equipment. Since 2019, the country has consistently recorded a yearly trade surplus with the US, which has reached around US$16.8 billion by 2024. This has created a trade surplus that caught the US government’s attention.

Product Categories Overlap

Many of Indonesia’s exports, like rubber-based goods, furniture, and garments, are in the same category as goods from countries already facing tariffs, making it a target by association.

Non-tariffs barrier

The US also points to non-tariff barriers in Indonesia, such as local content rules, strict import licenses, and a 2024 policy on earnings repatriation worth more than US$ 250,000. Officials argue these measures limit market access and disrupt fair trade.

Indonesia’s Growing Global Role

With a growing manufacturing base and stronger exports, Indonesia is now seen as a rising trade competitor. As businesses shift operations from China due to high tariffs, Indonesia has emerged as a preferred alternative, boosting its global trade position.

Key sectors affected by US tariffs

The new US import tariffs don’t impact all industries equally. Specific sectors in Indonesia are feeling more pressure than others, especially those that have shown strong growth in exports to the US market.

Electronics & Electrical Equipment

Indonesia’s top export to the US is electronics, which generated around US$4.83 billion in 2024. However, key items like circuit boards, appliances, and components now face higher tariffs, which impact major production areas such as Batam and Java.

Footwear

Footwear, Indonesia’s second-largest export at US$2.64 billion, is now at risk. Higher costs may drive global buyers to move shoe and sandal production to cheaper alternatives like Vietnam or Bangladesh.

Textile & Apparel

Apparel is a key Indonesian export, worth over US$2 billion in 2024 for knitwear and non-knit apparel. The 32% tariff makes these labor-intensive goods less competitive, pushing US buyers to cut orders or demand lower prices, further affecting profits and employment.

Furniture & Wood Products

Since more than half of Indonesia’s furniture exports go to the US, higher tariffs could reduce the global competitiveness of its wood products.

Read more: The forecast of Indonesia’s export in 2024

How the rising tariffs benefit Indonesian businesses

While US tariffs pose short-term risks, they also open unexpected opportunities for Indonesia. With key competitors like China and Vietnam facing even higher tariffs or trade restrictions, Indonesia has a chance to strengthen its global trade position.

Here’s why the US import tariffs can benefit Indonesian business in the global trade landscape:

Indonesia as Supply Chain Hub

Indonesia has a strong chance to position itself as a regional supply chain hub, especially as US tariffs push companies to shift away from Vietnam, which now faces a 46% rate. This opens the door for Indonesia to attract redirected electronics, textiles, footwear, and furniture exports.

To seize this opportunity, the Indonesian government must improve licensing, upgrade infrastructure, and remove illegal fees to attract more investors.

New Export Opportunities

With US importers moving away from high-cost Chinese goods, Indonesia is becoming a preferred supplier, especially in labor-intensive sectors like furniture, textiles, and electronics. This shift offers a valuable chance to expand exports and reduce reliance on regional markets by tapping into a wider global audience.

Increased Foreign Direct Investment

Rising global trade tensions have led multinational companies to adopt “China Plus One” strategies, shifting operations to countries like Indonesia. With its large market and improving infrastructure, Indonesia is attracting investment in electronics, EVs, and batteries. This trend brings in capital, jobs, and technology, boosting local industry growth.

Enhanced Regional Trade Partnership

With global trade becoming more uncertain, Indonesia is focusing on regional partnerships. Joining deals like the Regional Comprehensive Economic Partnership (RCEP) and strengthening ties with ASEAN helps the country rely less on the US and China while giving local businesses better access to nearby markets and lower trade costs.

Rising Demand for Local Brand

As global prices rise, more Indonesian consumers choose local products, creating growth opportunities for domestic brands. To keep up with demand, local businesses are boosting quality, using sustainable materials, and improving branding to appeal to a wider range of buyers.

Read more: New Strategies for Accelerating Export Growth in Indonesia

Seize Indonesia’s trade opportunities with InCorp

The rise in US tariffs is more than a challenge, it’s a strategic opportunity for Indonesia to boost its trade. With the proper focus on infrastructure and business support, Indonesia has the potential to position itself as a central hub in global supply chains.

InCorp Indonesia (an Ascentium Company) offers end-to-end export solutions to help businesses tap into this opportunity. Our expert knowledge and seamless process ensure your smooth export journey so you can focus on scaling your business.

Ready to grow? Fill out the form below and take your first step into Indonesia’s expanding trade market today.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.