Indonesia is one of the world’s largest coffee producers, known for its high-quality beans and unique flavors. The country’s coffee industry has experienced remarkable growth driven by increasing market demand. In this article, we will explore the outlook of Indonesia’s coffee market, covering its current state, opportunities, and future trends for businesses.

Indonesia’s current coffee market size

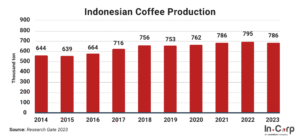

Indonesia’s coffee industry has experienced significant growth in recent years. By 2023, coffee production reached 786,000 tons, with market revenue expected to hit USD 25.9 billion by 2030, growing at a CAGR of 6.3%.

In 2023, Indonesia contributed 3.5% to the global coffee market, with this share expected to rise as worldwide demand continues to grow. Roasted beans primarily drive the industry, while ready-to-drink coffee is projected to be the fastest-growing segment in the coming years.

Why Indonesia’s coffee market is thriving

Indonesia’s coffee industry is expanding rapidly, driven by local demand, global interest, and shifting consumer preferences. Several key factors contribute to this growth:

1. Rising domestic coffee consumption

Coffee consumption in Indonesia has surged, with urbanization playing a key role in shaping new habits. Coffee shops have become social hubs in cities, making coffee a daily essential for many Indonesians.

The rise of the middle class has also influenced purchasing behavior, as consumers with greater spending power are willing to invest in premium and specialty coffee. Notably, coffee consumption in Indonesia reached 79%, continuing to grow even after the COVID-19 pandemic.

2. Rising demand for specialty coffee & local brands

More Indonesians are shifting from instant coffee to premium, single-origin, and artisanal brews. Local varieties like Gayo, Toraja, and Mandailing are gaining popularity at home and abroad. This trend has fueled the growth of specialty cafés, independent roasters, and organic coffee production, increasing demand for high-quality local beans.

3. Coffee shop expansion

The café culture in Indonesia is booming, with independent coffee shops and international chains expanding rapidly. Coffee shops have also become workspaces for young professionals and freelancers, boosting coffee consumption.

4. Rapid growth of ready-to-drink coffee

The ready-to-drink (RTD) coffee market is growing faster than any other segment. Consumers are seeking convenience without sacrificing quality, leading to increased demand for bottled and canned cold brews. As a result, brands are investing in premium RTD coffee, and convenience stores are expanding their product selections to meet this demand.

Indonesia’s coffee export market outlook

Indonesia is a leading global coffee exporter, with around 60% of its coffee production sent to international markets. In 2024, the country’s coffee exports were valued at approximately USD 1.6 billion, primarily consisting of unroasted, non-caffeinated Robusta and Arabica beans.

With rising production, Indonesia’s coffee exports are projected to grow from 4.3 million to 6 million bags between 2024 and 2025. The country’s major export destinations include the United States, Malaysia, Thailand, Vietnam, Egypt, India, and Japan.

Read more: Indonesia’s top import-export business ideas.

Business opportunities in the coffee industry in Indonesia

Indonesia’s growing coffee industry offers promising opportunities for businesses and investors. Key areas to explore include:

Coffee Farming and Plantations

Indonesia is ideal for coffee cultivation. Investing in coffee farms can be profitable with rich soil and a suitable climate, especially with government support for small farmers and sustainable production.

Coffee Processing and Export

As a major coffee exporter, Indonesia presents bean processing, packaging, and international trade opportunities. Businesses that focus on high-quality and specialty coffee can tap into global markets.

Café and Coffee Shop Chains

The growing café culture in Indonesia has fueled the rise of local coffee brands. Business owners can tap into this trend by opening coffee shops, franchise outlets, or mobile coffee kiosks to meet the increasing demand.

E-Commerce Coffee Businesses

Online coffee sales are expanding, making it easier for brands to sell beans, brewing equipment, and ready-to-brew products. The rise of home brewing and coffee subscriptions offers further business potential.

Read more: Your Guide to Opening a Coffee Shop in Bali.

Future trends in Indonesia’s coffee industry

The specialty coffee market is growing, allowing Indonesia to showcase its unique coffee varieties. Premium beans are gaining popularity, creating opportunities for businesses to focus on high-quality and artisanal coffee. As demand for distinct flavors rises, Indonesia can expand its share in the global market.

Technology is improving coffee production, processing, and distribution, making the industry more efficient. Innovations like precision farming and blockchain help maintain quality and traceability. Meanwhile, coffee tourism is rising, with visitors exploring coffee farms and learning about the production process, benefiting local businesses and regional economies.

Seize Indonesia’s coffee business growth with InCorp

Entering Indonesia’s coffee industry is exciting, but navigating local regulations can be challenging. InCorp Indonesia (An Ascentium Company) simplifies the process, allowing you to focus on your business growth.

- Company Registration: Get your coffee business legally set up with expert assistance, ensuring full compliance.

- Business Licensing: Secure the necessary permits for coffee shops, roasting facilities, or export businesses.

- Export Assistance: Expand globally with support in trade regulations, documentation, and smooth shipping.

Fill out the form below and launch your coffee business effortlessly in Indonesia’s thriving market.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.