Indonesia export commodities, including palm oil, metals, and manufactured goods, are influenced by evolving policies that can affect market access and compliance, making it essential for exporters and investors to stay informed about policy impacts on these key sectors.

As Indonesia’s export structure evolves, with new sectors such as EV batteries and green tech, readers should feel encouraged about the long-term growth prospects.

Overview of Indonesia’s export economy

Statistics Indonesia (BPS) reports that Indonesia’s export performance grew steadily during January–September 2025, reaching USD 209.80 billion, an increase from the previous year. Non-oil and gas exports contributed USD 199.77 billion, while oil and gas shipments declined.

Three key Indonesia export commodities contributed significantly to non-oil and gas performance:

- Iron and steel

- Coal

- Palm oil (CPO) and its derivatives

China, the United States, and India remained Indonesia’s largest destinations. Exports to China were dominated by iron and steel; the U.S. showed strong demand for machinery and electrical equipment; and India remained an essential market for mineral fuels.

Manufacturing-led exports continued to grow, supported by palm oil, metals, jewelry, chemicals, semiconductors, and electronic components. Agriculture also strengthened, while the mining sector continued to decline.

Top Indonesia export commodities

Data from BPS shows that energy products, palm-based commodities, metals, manufactured goods, and rubber-related items make up Indonesia’s export mix in 2026. These sectors represent both oil and gas and non-oil and gas exports.

Oil and gas products, mineral fuels, and coal

Oil and gas remain part of Indonesia’s export structure, including crude oil, refined products, and natural gas. Mineral fuels, particularly coal, continue to form a central export pillar and support key markets such as India.

Palm oil, vegetable oils, and related derivatives

Palm oil and its derivatives remain one of Indonesia’s strongest non-oil and gas export performers. This includes both crude and processed products used in food production, as well as chemicals and industrial applications.

Iron and steel, nickel, and other metal-based products

Metals play a prominent role in Indonesia’s exports. Iron and steel remain among the top contributors, supported by strong demand from China. Nickel and nickel-based goods, reflecting Indonesia’s downstream development, support stainless steel and battery-related industries.

Machinery, electrical equipment, jewellery, vehicles, and chemical products

Manufacturing exports cover a wide range of goods, including machinery, electrical equipment, jewelry, metals, automotive products, and industrial chemicals. Electronic components and semiconductors also contribute to growth in this category.

Rubber, footwear, and processed industrial goods

Rubber and rubber-based goods support the international automotive and industrial sectors. Footwear remains a steady contributor, backed by established production hubs. Other processed industrial products continue to support Indonesia’s long-standing export base.

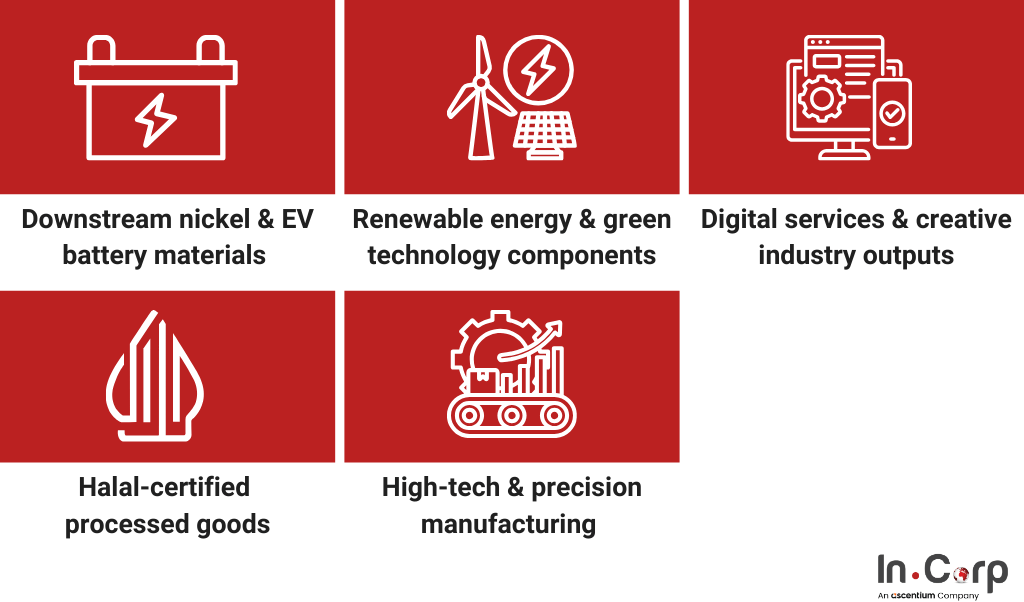

Emerging Indonesia export commodities

As Indonesia’s export structure shifts towards downstream industries, digital capabilities, and green technology, investors and policymakers should consider these emerging sectors for future growth and strategic positioning.

Downstream nickel and EV battery materials

Government policies are directing Indonesia toward producing higher-value nickel derivatives, such as intermediate battery materials, rather than exporting raw ore. This positions the country as a strategic supplier for the global EV industry.

Renewable energy and green technology components

Indonesia is gradually building capacity to supply solar, energy storage, and supporting materials for renewable energy systems.

Digital services and creative industry outputs

Sectors such as software, animation, and gaming are expanding and beginning to establish export potential, supported by Indonesia’s rapidly growing digital workforce.

Halal-certified processed goods

Indonesia is investing in developing the halal industry, opening export opportunities for halal-certified food, cosmetics, and pharmaceutical products.

High-tech and precision manufacturing

Electronic modules, smart-device components, and specialized machinery items are gaining traction as new industrial zones adopt automation and advanced manufacturing processes.

Indonesia’s list of export-banned commodities

Recent policy changes introduced through MOT Reg. 9/2025, implemented by MOF Decree No. 6/KM.4/2025, updated the list of commodities that are restricted or prohibited from export.

These measures aim to promote sustainable resource use, helping readers feel reassured about Indonesia’s environmental commitments and regulatory stability.

Export-banned and export-restricted commodities

The updated decree regulates the following commodity groups:

Swallow’s nest, rice, animals and animal products, natural plants and wildlife, fish (CITES and non-CITES species), wood, rough diamonds, tin, scrap, mining industry sample products, precursors and pharmaceuticals, fertilizers, other fuels, oil and gas, mining products, coal, coal products, sea sand from marine sedimentation, and kratom.

These Indonesia export commodities remain under strict supervision across Free Trade Zones, bonded areas, and the Exclusive Economic Zone.

Key updates in the new decree

The latest decree also introduced adjustments to several categories:

- Refinements to natural plants and wildlife, providing more precise definitions and forms.

- Expansion of the restricted list for fish and marine species, adding several eel and ray species.

- Changes in mining products, including new prohibitions (such as titanium slag), a full ban on iron ore, and lifted restrictions for laterite, copper, lead, and zinc concentrates.

These revisions indicate Indonesia’s continued focus on downstream processing, biodiversity protection, and alignment of export rules with global standards.

Clear Paths to Product Registration in Indonesia

Navigate Indonesia’s export landscape with InCorp

Indonesia is updating its export regulations to create a more sustainable and structured environment.

As Indonesia updates its export regulations, businesses should feel reassured that expert guidance can help them stay compliant and seize new opportunities.

- Export licensing: Ensure proper documentation and approvals based on commodity type

- Customs compliance and audit preparation: Operate smoothly within Free Trade Zones and bonded zone areas

- Operational compliance support: HS code mapping, product categorization, and controlled-goods evaluation

Complete the form below to comply with regulatory changes, meet industry standards, and effectively engage in Indonesia’s growing export ecosystem.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.