Indonesia’s tax enforcement has become much stricter with the adoption of Coretax, tighter cross-agency data monitoring, and increased issuance of SP2DK. As a result, even minor inconsistencies in reporting can draw scrutiny and lead to allegations of tax evasion, whether intentional or not.

Understanding what qualifies as tax evasion under Indonesian law and how it differs from legal tax planning is essential for businesses seeking to remain compliant. Clarifying these distinctions helps companies develop compliant strategies, avoid unintentional violations, protect their reputations, and avoid disputes with the tax authority.

Tax evasion regulations in Indonesia

To foster confidence in compliance efforts, companies need to understand both Indonesia’s local rules and the international standards that apply to multinational groups, helping them feel assured in their adherence to regulations.

Indonesian regulations

These are the main rules that define tax evasion and guide daily compliance:

- UU KUP: Explains what tax evasion is and the penalties.

- UU HPP: Strengthens tax monitoring and enforcement.

- PMK 213/2016: Transfer pricing documentation requirements.

- PMK 151/2021: Rules on e-Faktur and VAT invoice validity.

- PPh 21, 23, 26: Withholding tax obligations.

- VAT rules: Proper VAT calculation and reporting.

International anti-avoidance regulations

These help prevent profit shifting and aggressive tax planning:

- Thin capitalisation: Limits interest deductions on related-party loans.

- CFC rules: Tax certain offshore income.

- Hybrid mismatch rules: Prevent double deductions or tax advantages across borders.

- Substance over form: Structures must reflect real economic activity.

- Global Minimum Tax (2025): Large multinationals must pay at least a 15% effective tax rate.

Understanding both sets of rules helps companies reduce the risk of tax evasion allegations and maintain a strong compliance position in Indonesia.

Why companies get flagged for tax evasion

Businesses in Indonesia can be flagged for potential tax evasion if their reported data shows irregularities or inconsistencies that draw the tax authority’s attention. By integrating banking data, e-Faktur, third-party transactions, and historical filings, Coretax can detect these inconsistencies faster. The most common triggers include:

- Inconsistent financial and tax reporting, such as revenue or cost figures that do not match submitted returns.

- Unusual profit margins compared to industry benchmarks, especially if margins are too low or show sudden fluctuations.

- Repeated loss positions, which may indicate intentional profit shifting or misreporting.

- Irregular related-party transactions, especially without proper transfer pricing documentation.

- Sudden drop in revenue or tax paid, unrelated to market performance.

- Suspicious withholding tax patterns, such as recurring zero WHT despite active vendor transactions.

- Mismatch between e-Faktur and VAT returns, which the system automatically flags.

Read more: An overview of pre-tax litigation in Indonesia

How Coretax detects risks

- Cross-checking bank statements, e-Faktur, and third-party reports.

- Identifying discrepancies between VAT, corporate income tax, and withholding tax filings.

- Monitoring transaction patterns that deviate significantly from previous years.

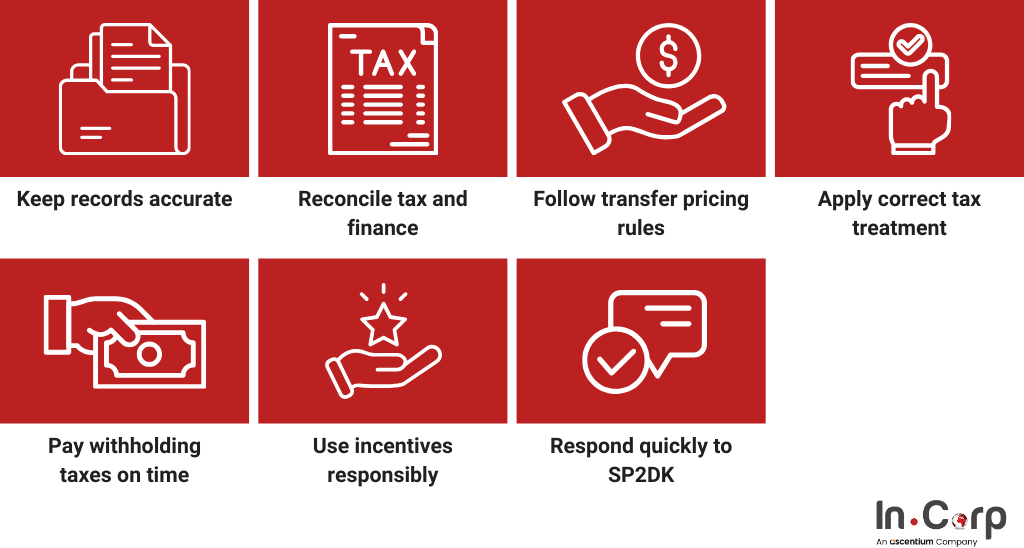

Key strategies to avoid tax evasion allegations in Indonesia

To reduce the risk of tax evasion accusations, companies must adopt proactive compliance practices that ensure transparency, accuracy, and consistency across all financial and tax functions. The following strategies are among the most effective approaches used by compliant businesses in Indonesia:

- Maintain accurate, timely financial records with complete supporting documentation.

- Reconcile financial data with tax filings regularly to ensure consistency.

- Comply with transfer pricing rules and prepare TP Documentation as required under PMK 213/2016.

- Apply the correct tax treatment for income, expenses, and cross-border transactions.

- Withhold and pay PPh 21, 23, and 26 accurately and on schedule.

- Use tax incentives properly and maintain proof of eligibility and utilisation.

- Respond promptly and clearly to SP2DK or audit requests with proper documentation.

Risks of being accused of tax evasion

Being accused of tax evasion can have serious consequences for any business in Indonesia. The potential risks include:

- Financial penalties, including administrative fines.

- Interest and back taxes that accumulate over time.

- Criminal charges under the UU KUP depend on the severity of the violation.

- Damage to business reputation, especially with clients and partners.

- Operational disruption during audits or investigations.

- Impact on banking, investment, and licensing, as institutions may reassess the company’s risk profile.

How professional advice helps reduce tax evasion risks

Numerous companies collaborate with external tax advisors to enhance compliance and prevent situations that might be seen as tax evasion. These advisors offer guidance, structured reviews, and documentation support to minimize risks. This is why companies choose to engage external advisors:

- To ensure tax reporting is accurate and consistent.

- To avoid mistakes that may lead to questions from the tax authority.

- To prepare for potential audits or SP2DK inquiries.

Key areas of support include:

- Tax health check to identify discrepancies early.

- Monthly tax compliance support for VAT and withholding taxes.

- Transfer pricing documentation preparation under PMK 213/2016.

- SP2DK handling with proper explanations and supporting files.

- Representation during audits for structured communication with the tax office.

Mastering Corporate Taxation in Indonesia

Avoid tax evasion allegations with InCorp

With stricter enforcement by tax authorities and increased data monitoring, companies must ensure transparency and accuracy in every transaction across financial and tax systems. Proactive compliance is essential for minimizing risks and maintaining business continuity.

InCorp Indonesia (an Ascentium Company) can support you with structured, accurate, and risk-focused tax advisory, such as:

- Monthly tax compliance: Ensure your VAT, withholding taxes, and filings stay accurate and on time.

- Transfer pricing support: Prepare TP Documentation and keep your intercompany pricing in line with PMK 213/2016.

- SP2DK assistance: Respond clearly and effectively to inquiries from the tax authority.

Fill out the form below to ensure your reporting stays compliant with Indonesian regulations.

Frequently Asked Questions

What is tax evasion under Indonesian law?

Tax evasion refers to intentionally or negligently misreporting income, expenses, or taxes that result in unpaid tax, which can lead to penalties or criminal charges.

Why are companies more easily flagged for tax evasion now?

Indonesia uses Coretax and cross-agency data matching, making it easier to detect inconsistencies between financial reports, VAT, withholding tax, and banking data.

What common issues trigger tax evasion reviews?

Common triggers include mismatched tax filings, unusual profit margins, repeated losses, missing transfer pricing documents, and VAT invoice discrepancies.

How can businesses reduce the risk of tax evasion allegations?

By keeping accurate records, reconciling tax and financial data regularly, complying with transfer pricing rules, and responding properly to SP2DK requests.

How can professional tax advisors help?

Tax advisors help review compliance, prepare documentation, handle audits or SP2DK inquiries, and ensure tax reporting follows Indonesian regulations.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.