In today’s unpredictable business landscape, companies may struggle with credit recovery and debt discharge during challenges. Those challenges lead to the need for corporate recovery.

To support businesses and companies in Indonesia during this unfortunate time, InCorp Indonesia provides corporate bankruptcy and recovery or insolvency services that can assist in weathering the storm and help them survive during this.

Bankruptcy Filing: The Process

| No. | Procedures |

|---|---|

| 1 | File bankruptcy: It can be either self-filed or filed by creditors. |

| 2 | Wait approximately 30 days to see whether a bankruptcy filing is approved or rejected. |

| 3 | If the bankruptcy filing is approved, arrange a meeting with creditors for a peace proposal. |

| 4 | If approved, the next step is homologation or verification, followed by the bankruptcy being terminated or lifted. If rejected, the next step is asset designation, followed by asset distribution. |

Note: If a bankruptcy filing is rejected, there will be cassation and judicial review before going through the bankruptcy filing process all over again.

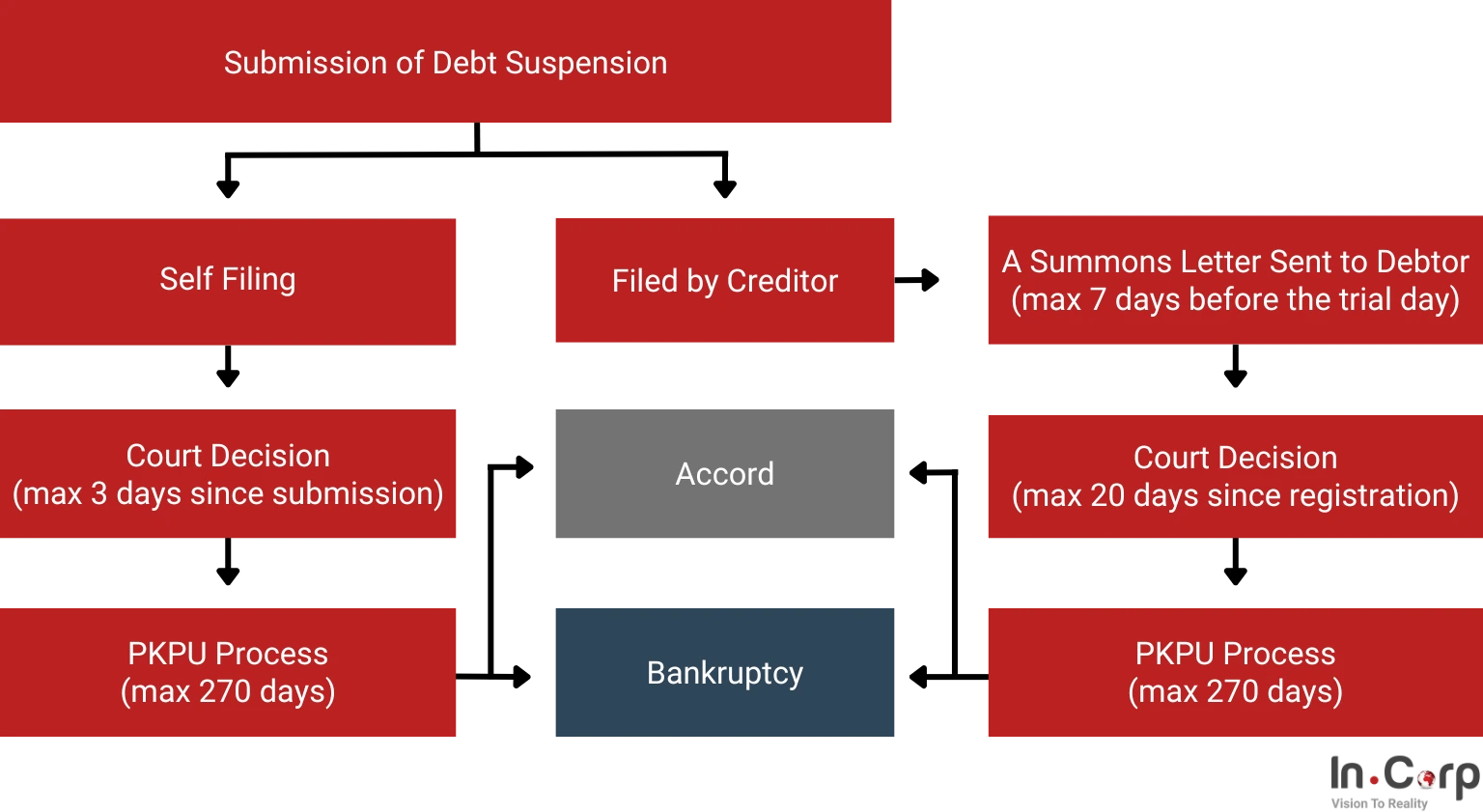

Debt Suspension (PKPU) Filing in Indonesia

The procedure for filing PKPU in Indonesia is as follows:

| Legal Steps | Procedures |

|---|---|

| File PKPU | It can be either self-filing or filing by the creditor. |

| For self-filing | Wait for a court decision within three days and complete the PKPU process (max. 270 days). If approved, an accord will be issued. If rejected, you will be declared bankrupt and arrange a meeting with creditors (see Procedure for Bankruptcy Filing – step 3). |

| For filing by creditors | Issue a summons letter to the debtor within seven days before the day of the trial, wait for a court decision within 20 days, and go through the PKPU process (max. 270 days). If approved, an accord will be issued. If rejected, you will be declared bankrupt and arrange a meeting with creditors (see Procedure for Bankruptcy Filing – step 3). |