Indonesia updated its customs declaration rules with PMK No. 25 Year 2025, which took effect on June 27, 2025. These changes simplify the process of importing personal and household goods when relocating to Indonesia.

This section will explore what key changes distinguish the new regulations and who benefits from them.

Indonesia’s customs declaration rules: Key updates

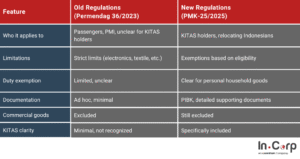

Previously, Permendag 36/2023 imposed restrictive limits on electronics, clothing, and books. Many returning citizens, expatriates, and KITAS holders found the exemptions unclear or unenforceable.

With PMK 25/2025, the government offers a transparent, fair, legal process that provides duty and tax exemptions. Below are the key changes in detail compared to the previous rules:

Read more: Navigating the landscape of Indonesian imports.

Who can use the new customs declaration rules?

The new regulation helps these groups:

- Indonesians who lived abroad for at least 12 months

- Government officials, diplomats, and military (TNI/POLRI) returning from official duty

- Foreign nationals with a valid KITAS for work or study for at least 12 months

- Foreign diplomats under official agreements

What items are covered?

Individuals can only bring specific qualifying items when relocating to Indonesia under PMK 25/2025. Below is a clear comparison of what you can and cannot declare:

| Item Category | Allowed | Not Allowed |

| Furniture | Used household furniture | – |

| Clothing & Personal Wear | Daily clothes, shoes, accessories | – |

| Books & Printed Materials | Personal collections, study materials | – |

| Kitchenware & Household Tools | Non-commercial kitchen items | – |

| Electronics | TVs, laptops, small gadgets | Bulk electronics or excessive items for resale |

| Motor Vehicles & Spare Parts | – | All types of vehicles and their parts |

| Alcohol & Tobacco | – | Excise goods not allowed under this scheme. |

| Commercial or Business Goods | – | Items for sale or in large quantities |

Read more: Navigating import duties and taxes in Indonesia.

Required documents and step-by-step process

Under the new regulations, eligible individuals must complete a formal customs clearance process through the PIBK (Pemberitahuan Barang Import Khusus) system. Here is the breakdown of what documents are required:

What Documents Do You Need?

To submit a valid customs declaration, you must prepare the following:

- Relocation Certificate

- Valid Passport and Visa

- KITAS/Work or Study Permit for foreign nationals

- Proof of over 12 months of overseas stay, such as boarding passes, visas, or travel history logs.

- Domicile Letter or Indonesian address

- Packing list or inventory consists of details of goods being imported

Step-by-step Customs Process

- Arrival Window: Goods must arrive 90 days before or after your arrival in Indonesia.

- Electronic Filing: Submit your declaration through the PIBK system, available online via SKP.

- Submit Required Documents: Upload the above documents to the online system.

- Verification by Customs: Customs will review your documents and inspect your goods. If everything is approved, you will receive the SPPB (Surat Persetujuan Pengeluaran Barang).

- Release of Goods: Once SPPB is issued, your goods can be released duty-free and tax-free, subject to regulations.

Read more: 3 tips to avoid having goods stuck at Indonesian customs.

Streamline your customs declaration process with InCorp

Importing personal or household goods into Indonesia with strict documentation requirements and customs inspections can be challenging. You do not have to worry with InCorp Indonesia (an Ascentium Company).

We handle the customs declaration process so your relocation or business can move forward without delays. Here is how we can help:

- Importer of Record: We act as your legal representative, managing all customs clearance procedures and ensuring full compliance with PMK No. 25/2025.

- Import Permit: Our experts simplify securing import licenses and handle all documentation to prevent costly delays.

Contact us today and get your goods cleared efficiently and stress-free.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.