Navigating Indonesian customs can be smooth for those who prepare, but unexpected delays can disrupt your business and cause frustration. This guide delves into the key strategies to prevent your goods from getting stuck at Indonesian customs.

What are Indonesian customs?

The Indonesian government entrusts the Directorate General of Customs and Excise to manage the nation’s import and export activities. This agency meticulously ensures adherence to customs regulations, levies, duties, and taxes and diligently safeguards against prohibited goods entering the country.

Indonesian customs regulations

Indonesia follows a self-assessment system for customs duties. Travelers and businesses declare their goods and calculate the payable duties based on the declared value and harmonized system (HS) code (a standardized product classification system).

Here are some key aspects of Indonesian customs regulations:

| Custom regulations | Descriptions |

|---|---|

| Electronic Customs Declaration (e-CD) | Travelers can declare their belongings electronically before arrival using the e-CD system (ecd.beacukai.go.id). |

| Duty-free allowances | Travelers are granted duty-free allowances for personal belongings within a set value limit. Exceeding the limit may incur duties. |

| Import permits | Certain goods require prior import permits from relevant government agencies. |

Why do your goods get stuck at Indonesian customs?

Several reasons your goods might get stuck at Indonesian customs, ranging in severity. These delays could stem from incomplete or inaccurate documentation, discrepancies in declared values, or the presence of restricted or prohibited items.

Inexperienced consignee

The consignee you use in Indonesia may need an import license or the necessary supporting documents. Some specific goods require additional paperwork beyond just the import license.

Irresponsible forwarder

The forwarder handling your imported goods in Indonesia may need to inform you about the customs documents required. This oversight can cause your goods to get stuck in Indonesia.

Red channel inspection

Pemeriksaan Jalur Merah (PJM) is Indonesia’s red channel inspection. It involves a physical check of selected imported goods and document verification. Many end-to-end import or export providers previously used door-to-door services to avoid paying customs duties and taxes.

However, as of July 2017, the Indonesian government enforced a new regulation to eliminate this type of service. This enforcement has resulted in many imported goods being stuck in customs due to unpaid taxes and incomplete documents.

Read more: Navigating the landscape of Indonesian imports

List that you should declare as part of customs clearance

During the customs clearance process, it is essential to declare the following items to comply with the regulations and ensure a smooth entry into the country:

- Cash exceeding USD 10,000 or equivalent

- New or expensive electronic items (laptops, cameras)

- Jewelry exceeding a reasonable amount for personal use

- Duty-paid gifts exceeding the duty-free allowance

How to prevent goods from getting stuck at Indonesian customs

To prevent your goods from getting stuck at Indonesian customs, you can follow the below tips:

1. Prepare the packing list and commercial invoice

Ensure your packing list and commercial invoice accurately reflect your shipment. Indonesian customs officers rely on these documents to calculate taxes and duties. Any inaccuracies can result in incorrect tax calculations.

2. Establish a company and obtain import licenses

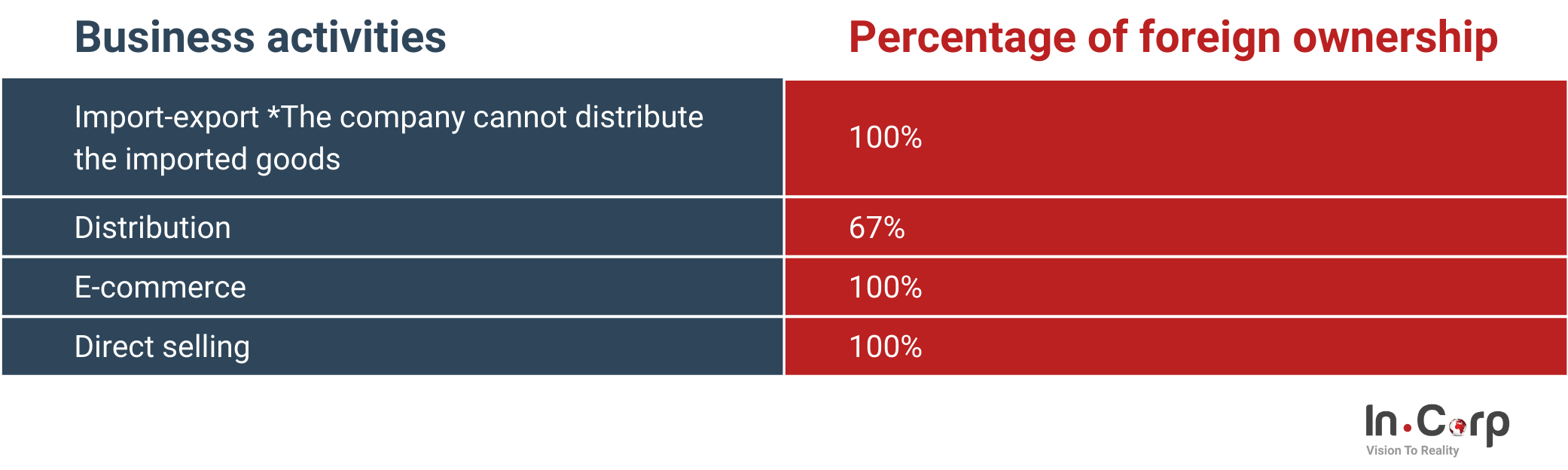

Establishing an import company in Indonesia can benefit those considering regular import activities. Here are some types of businesses open to foreign ownership that can apply for import licenses:

3. Appoint a consignee or importer of record in Indonesia

Only Indonesian companies with relevant import licenses and customs identification numbers can clear goods through customs. These are necessary for customs authorities to be able to retain or re-export your goods.

If your company lacks these credentials, you can appoint a consignee to handle the importation on your behalf using their documents.

How long does it take for goods to get stuck at Indonesian customs?

The duration that goods may spend at Indonesian customs can be varied, influenced by various factors such as the nature of the imported goods, the accuracy and precision of import documentation, and the necessity for physical inspections.

The customs clearance process typically ranges from several days to a few weeks. During this time, several factors can contribute to delays.

- Incomplete or inaccurate documentation: The most common reason for delays is missing or incorrect information about the goods, importer, or country of origin.

- Additional permits required: Certain goods, such as cosmetics, pharmaceuticals, and IT equipment, need additional permits from the Indonesian government before being imported.

- Physical inspection: Customs officials may select goods for physical inspection to verify documentation accuracy or check for contraband. This process can take several days or even weeks.

How do you check goods held by customs after being imported from abroad?

Here’s a guide on how to check if your goods are being held at Indonesian customs. Follow these steps to track your international package and understand its status.

- Open your web browser.

- Go to www.beacukai.go.id/barangkiriman.

- Enter the tracking number of your international package.

- The complete information about your package, including its location and any outstanding charges, will be displayed.

- If the status shows “data not found,” it means the package has not yet arrived in Indonesia, has not been reported to customs by the shipping service, or does not exist (potentially indicating fraud).

- Confirm with your shipping service.

Customs advises that if any customs officer asks you to transfer money to a personal account, you should ignore it as it might be a scam pretending to be from customs.

What should you do if your goods are stuck at Indonesian customs?

If customs hold your goods due to discrepancies or missing information, here are three possible solutions to get your goods out of customs.

Obtain the goods through an auction

If a shipment remains unclaimed or needs more information on exporting, the customs office may auction it off. In such cases, the goods will be sold to the highest bidder. This process allows the customs office to clear space and recover potential losses from unclaimed or unexported shipments.

Coordination between the consignee and customs authorities for clearance

One solution is to have a consignee handle your shipment. Your consignee must coordinate with customs on your behalf and manage any relevant taxes, fines, and fees.

Export the shipment

In certain situations, customs authorities in Indonesia may refuse entry to the goods. If this happens, you will be required to export the shipment, enabling you to maintain ownership of the goods. Subsequently, you can make another attempt to import them into Indonesia with the help of a record importer.

Avoid customs delays and focus on your business with InCorp

Importing goods to Indonesia can be complex, with strict regulations and potential delays at customs. InCorp takes the worry out of the process, ensuring your imports flow smoothly.

- Importer of record: We act as your legal representative, handling all customs clearance procedures and ensuring compliance.

- Import license assistance: Our team simplifies obtaining necessary import licenses and meticulously prepares and manages all import documentation to avoid delays.

Click the button below to navigate the complexities of Indonesian customs and ensure your imports arrive safely and efficiently.

Get in touch with us.

What you'll get

A prompt response to your inquiry

Knowledge for doing business from local experts

Ongoing support for your business

Disclaimer

The information is provided by PT. Cekindo Business International (“InCorp Indonesia/ we”) for general purpose only and we make no representations or warranties of any kind.

We do not act as an authorized government or non-government provider for official documents and services, which is issued by the Government of the Republic of Indonesia or its appointed officials. We do not promote any official government document or services of the Government of the Republic of Indonesia, including but not limited to, business identifiers, health and welfare assistance programs and benefits, unclaimed tax rebate, electronic travel visa and authorization, passports in this website.